My husband and I met as broke college students, took a personal finance class together, and used that professor’s advice to reach millionaire status in ten years – and it’s the same advice JL Collins gives in The Simple Path to Wealth.

Want to work on your millionaire status?

I broke down our strategy and built a FREE step-by-step Money Fit Challenge.

The people following it have been able to:

- Pay down debt

- Spend less

- Increase their savings (and investing) 📈

- Improve their credit score

- Get on track for retirement

- Start hitting their financial goals. 🙌

Join us!

Improve your BUDGETING & INVESTING! Join the FREE #MoneyFitChallenge

Newlywed and Living on Love

My husband and I were married young and financially-speaking, we were living on love. To attempt to make ends meet while getting our master’s degrees, I had two part-time jobs and my husband had three. To save money while doing summer internships, we slept on an air mattress and always packed our lunches. Our side tables were boxes covered with sheets. But it paid off. By about a month after graduation, we paid off our student loans and were debt-free.

But we didn’t stop there. We didn’t upgrade our lifestyle as so many college grads are tempted to do. After graduation, we followed the advice of our finance professor who advised:

“For the first ten years out of college, live like no one will, and then you’ll be able to live the rest of your lives like no one can.”

The start of our millionaire journey

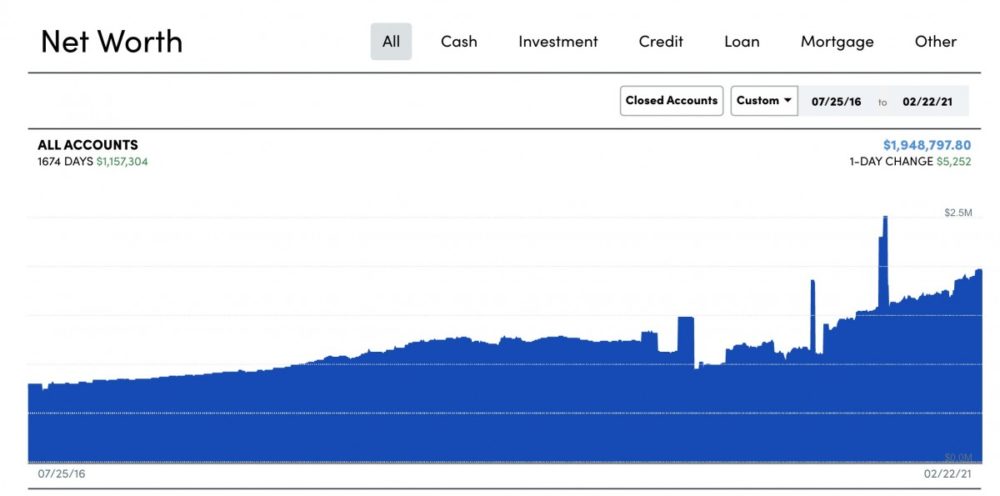

We continued to live lean, but with a purpose: we piled everything possible into tax-advantaged investment accounts (401k and Roth IRA). Because of compound interest, the more we could save upfront, the more that money could grow. We held little budget meetings every Sunday at first (and later monthly) that helped us stay on track. Having a time set aside to discuss finances created a safe space so that no one felt attacked or picked on when we had to adapt our strategy (aka admit that one or both of us was overspending). This year (2019) marks ten years since we graduated from college and our professor was right. We reached that “millionaire” milestone and are on track for a generous early retirement.

Thanks to our professor’s advice, we became millionaires in our 30s.

3 Simple Keys to Becoming a Millionaire

Here are the top three simple things that helped us reach millionaire status in our 30s.

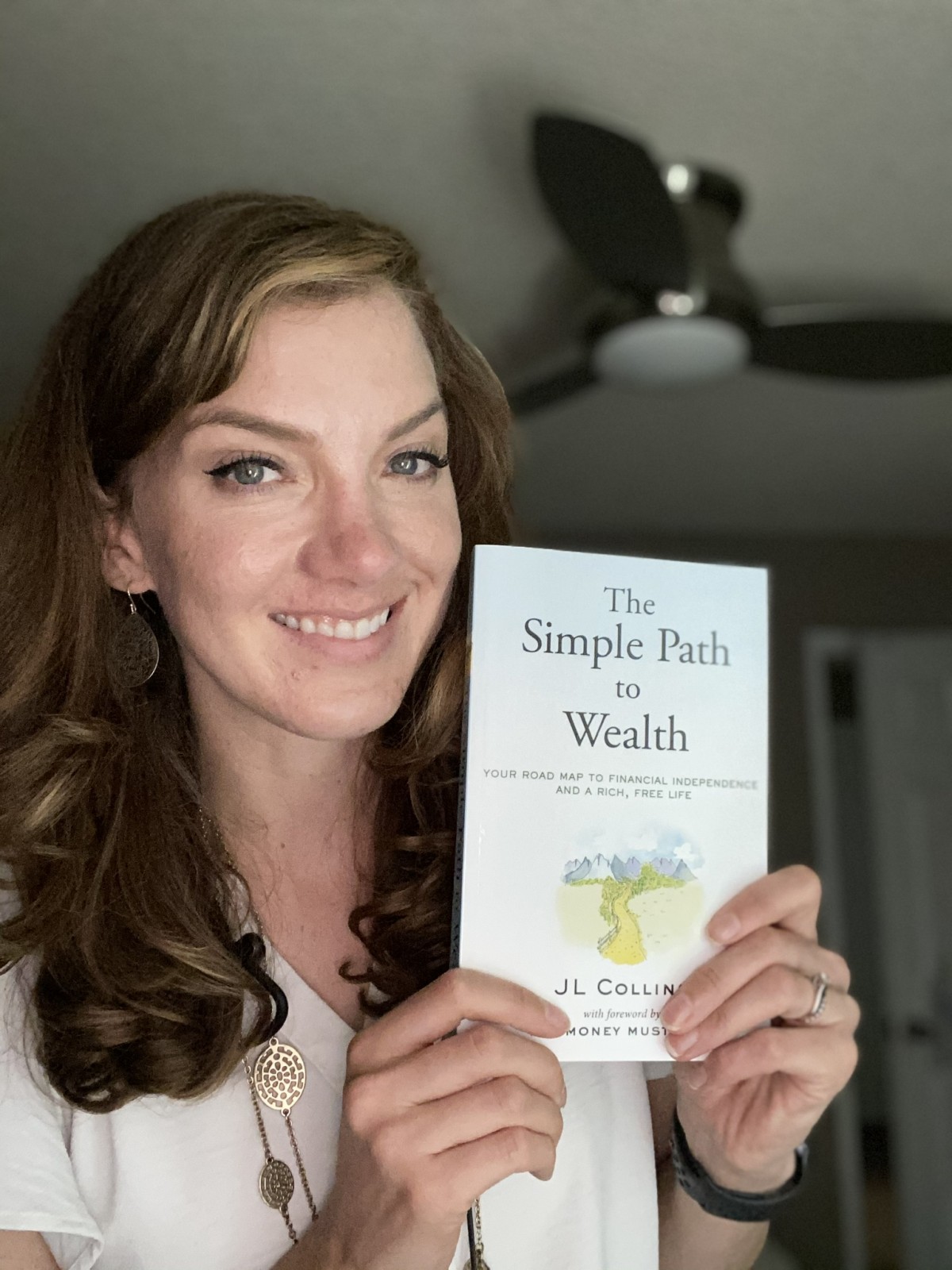

Just starting your journey now? It’s not too late to start your journey in financial freedom. The keys are still the same. They are, in fact, the same three key takeaways that the author JL Collins mentions in his book (that I highly recommend): The Simple Path to Wealth.

MILLIONAIRE KEY #1: Spend less than you earn–Set your Saving Rate HIGH

Upgrade your Savings Rate–not your lifestyle

We set our savings goals high. If we only tried to save the “leftover” money, we would not have saved anything. We set a goal to save 100% of my income towards our first home and 15% of my husband’s salary for retirement. We didn’t quite hit that 15% goal at first, but we were hardcore budgeters, so we scrimped and saved every way we could. When our income went up, we resisted the urge to upgrade our lifestyle and instead continued to increase our savings rate.

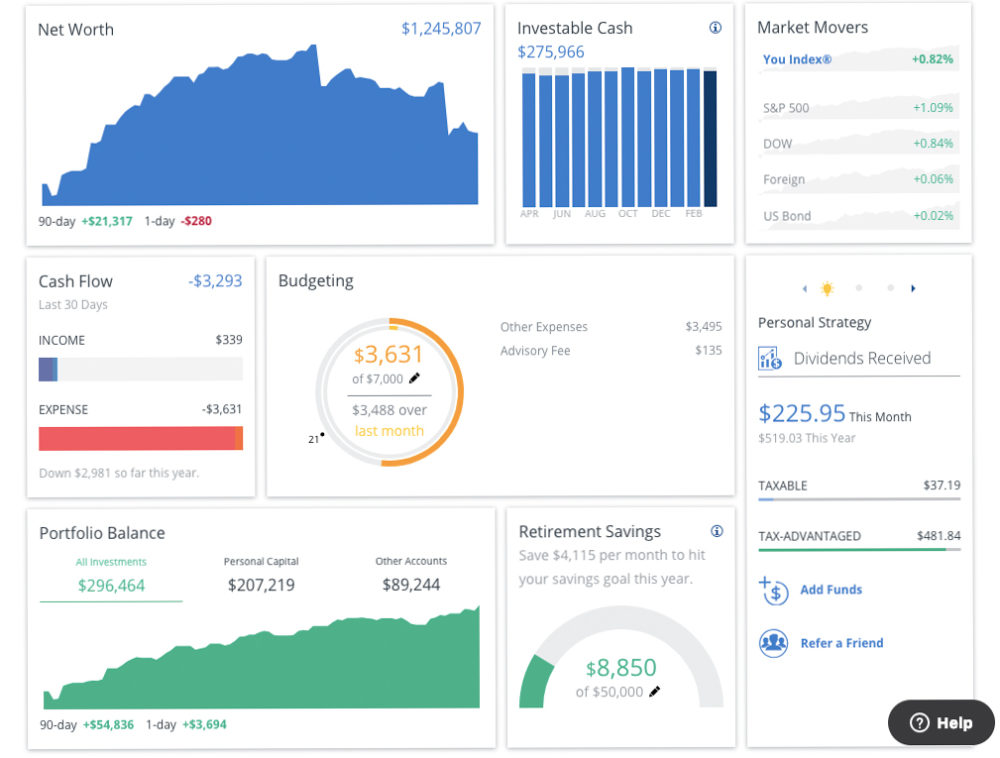

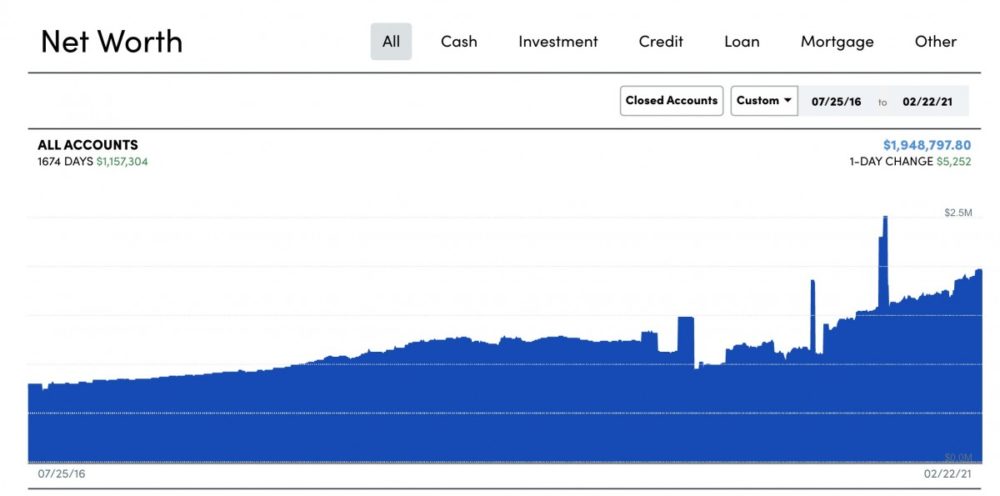

Why you should start tracking your NET WORTH

A great to both decrease your spending, avoid debt, and increase your savings and investing is to track your net worth. To track our net worth, we’ve been using Empower since 2014. It’s FREE and tracking your net worth with it is the BEST way to start SAVING & INVESTING MORE!

Calculate your NET WORTH. Get your FREE, secure Financial Dashboard (Affiliate Link)

Here’s the video I created about how to track your net worth.

Prioritize Giving

Despite the struggle of living in the expensive California Bay Area on part of one salary, we still donated at least 10% of our income to charity. At some point during college, I learned that people tend to be as generous with their first dollar as they are with their last, so we prioritize giving. I realized we needed to live with gratitude and contentment for what we did have and empathy for those suffering from difficult life situations. Without those things, I knew no matter how much we had, it would never feel like enough.

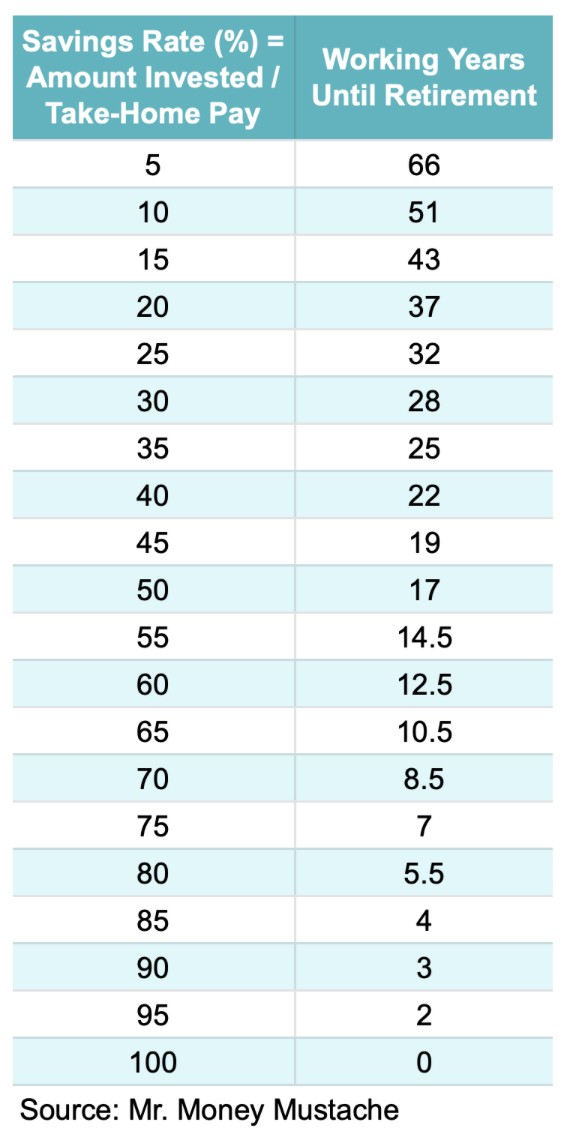

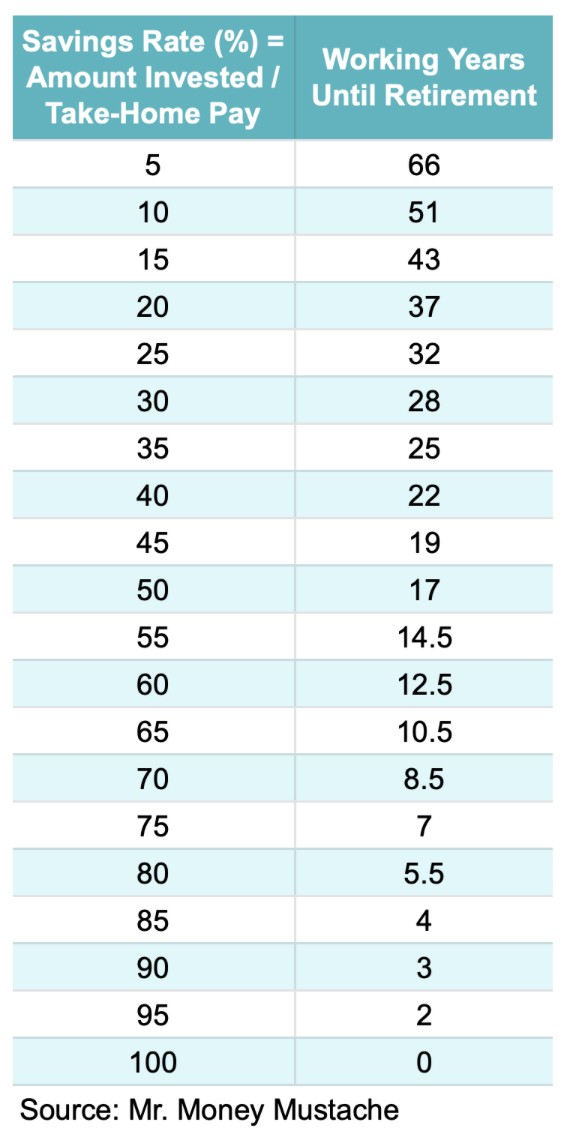

HOW MUCH should you be SAVING for “Retirement” aka Financial Independence?

Saving at LEAST 15% toward retirement should be the minimum. If you want to retire early or you’re getting a late start, you will need to have a much HIGHER Savings Rate.

FIRE = Financial Independence Retire Early

I’ve learned that retirement has almost NOTHING to do with age and everything to do with your ability to save up for financial independence. Once you’ve saved up enough for your financial independence, working is optional (although you may choose to keep working or some other passion project).

People who are part of the FIRE movement often try to save 50% or more of their income.

If you want to learn more about retirement and FIRE, check out my posts:

How to Get Your Retirement On Track In 3 Easy Steps

or

How to Retire in Your 30s–Fat FIRE Style

Track your saving

Setting your savings rate and sticking to it is the most important thing to financial independence. But budgeting what’s leftover for spending can be helpful for wealth creation, quality of life, AND your relationship. Creating and reviewing a budget regularly helps couples stay on the same page and settle money issues in constructive and respectful ways. (Top 7 Steps for Money and Marriage Harmony)

The budget becomes the neutral party or financial counselor of sorts to help you manage your different priorities.

“FUN” Money

For couples managing their finances together, I also recommend setting aside an amount–no matter how small–that each partner is allowed to spend without accountability to the other. When we were broke and in college, I think we literally each got $5 a month or so. Eventually, that amount has grown, but it has saved a LOT of money fights.

My Favorite Budgeting Software

Honestly, I’m not a budget tool snob. The best budgeting tool is the ONE YOU’LL USE — whatever that is. I think a spreadsheet or notebook works fine. But since you asked . . . I’ve used a lot of tools–e.g. Mint, EveryDollar, and Quicken. The budgeting tool I recommend is YNAB (You Need A Budget)–affiliate link. In my experience, nothing beats YNAB’s ability to plan for future large purchases (e.g. new car, vacation, home). YNAB also has great customer service (a real human response to all your questions via email and will continue to follow-up until you’re satisfied), so you won’t be on your own. Also, if you’re trying to pay down debt, you can join one of their Facebook communities to help you stay motivated and on track.

MILLIONAIRE KEY #2. Live on Less and INVEST the rest

You don’t need to be a stock market or finance guru to be a savvy investor. Investing can be set up to autopay to “set it and forget it.” In The Simple Path to Wealth, JL Collins recommends Low-Cost Index Funds. He recommends:

- Vanguard’s VTSAX – The Total US Stock Market

- Vanguard’s VBTLX – The Total Bond Market Index Fund. This is to hedge your volatility, so the amount depends on both your age and your tolerance for risk. The majority of the growth will happen in VTSAX, though, so you don’t want too much of this. Even at retirement age, JL Collins himself only has 23% in bonds (VBTLX). Granted, he has a pretty high tolerance for risk, especially because his net worth is so high.

If investing makes you uneasy or stressed, once again, I HIGHLY recommend this 5-star rated book.

If you’re going to read ONE book about money, this is the one I recommend.

Budgeting will only get you so far. INVESTING WISELY IS KEY TO BUILDING WEALTH. It is crucial so if you don’t feel comfortable doing it, you need to get comfortable. Or at least be willing to do it anyway.

Our Investment Strategy

We built wealth using a similar strategy as JL Collins–using index funds to get in the stock market in diversified ways.

- We piled money into tax-advantaged accounts (401k and Roth IRA).

In the book Everyday Millionaires, the survey found:

- 79% of millionaires built wealth using a company plan (e.g. 401k)

- 74% built wealth outside of a company plan (e.g. IRAs – Individual Retirement Accounts, business, and real estate equity)

Meaning: Smart people take advantage of both company plans and every opportunity to maximize their investments.

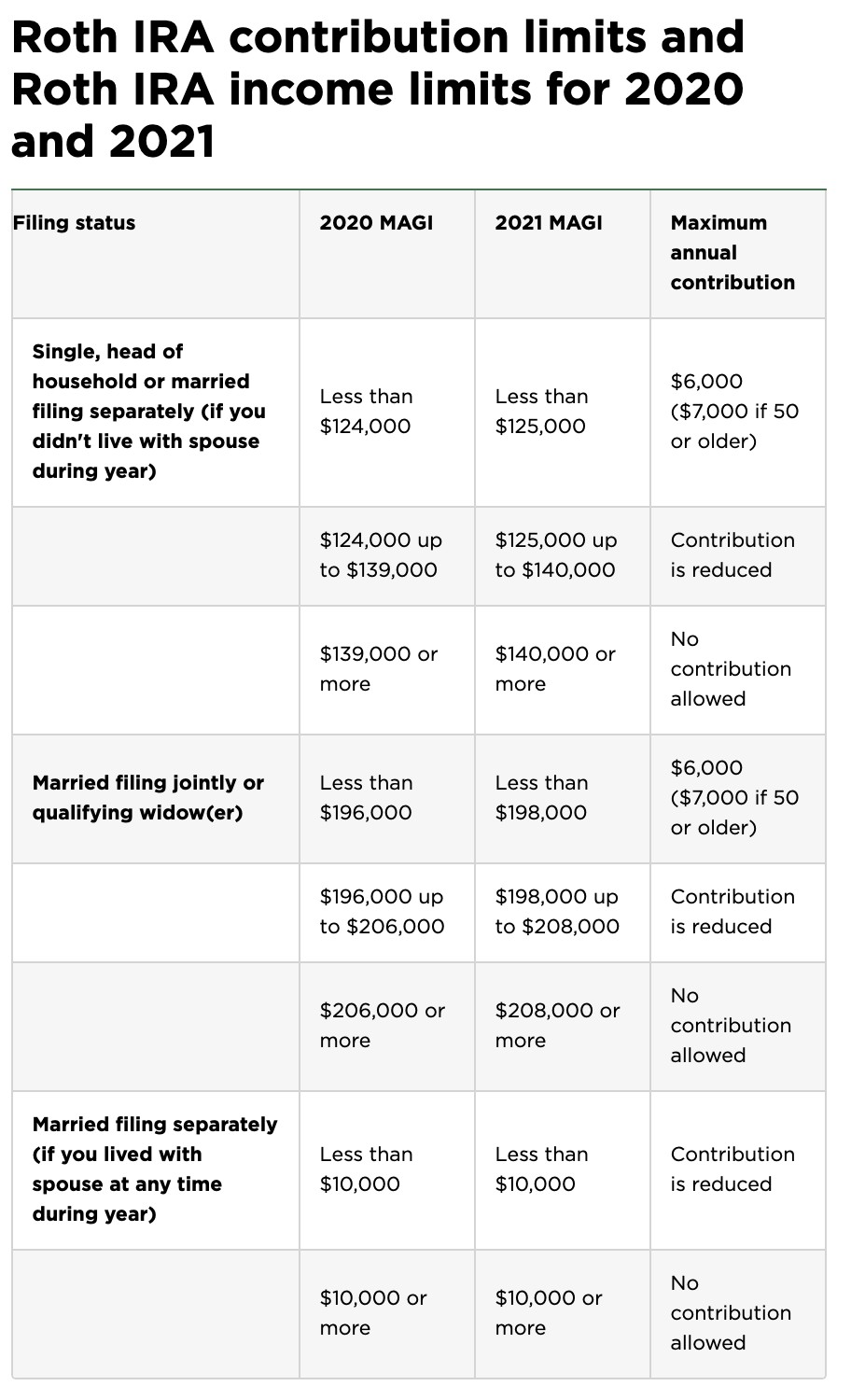

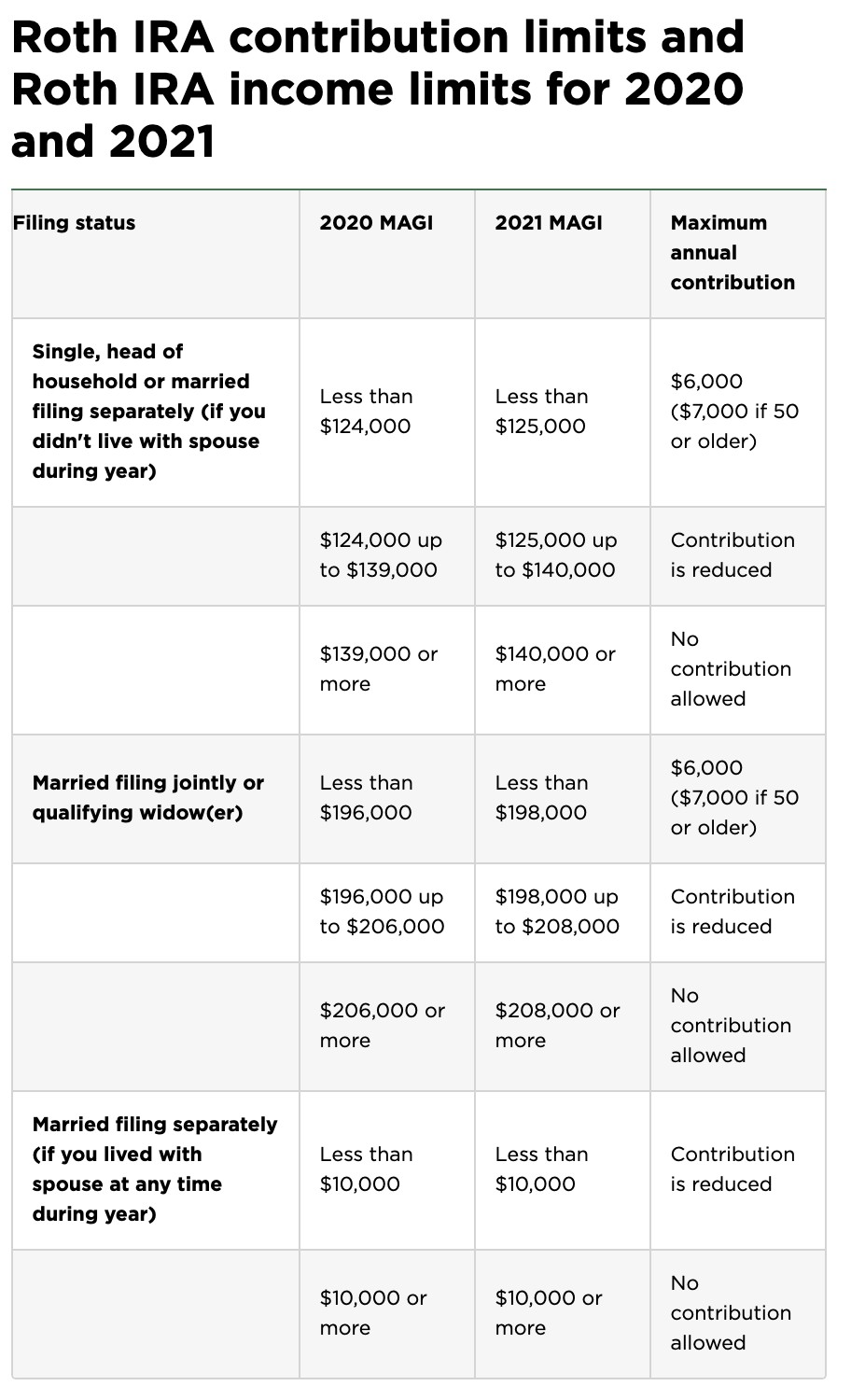

Roth IRA Income and Contribution Limits

Roth IRAs do have income limits, so if you are over those limits, you have the research what is informally known as “backdoor Roths.”

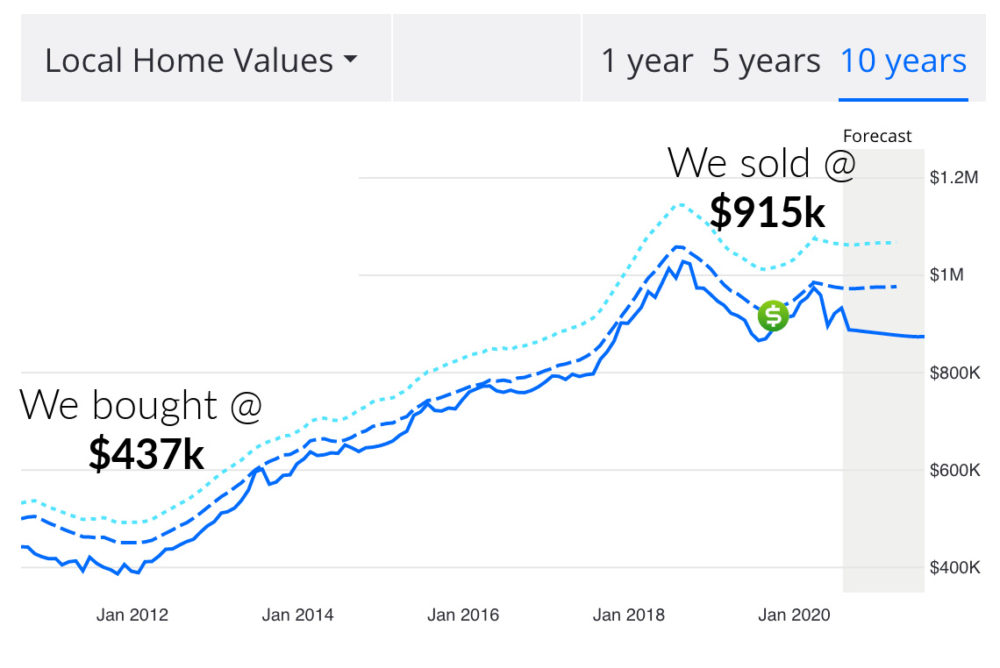

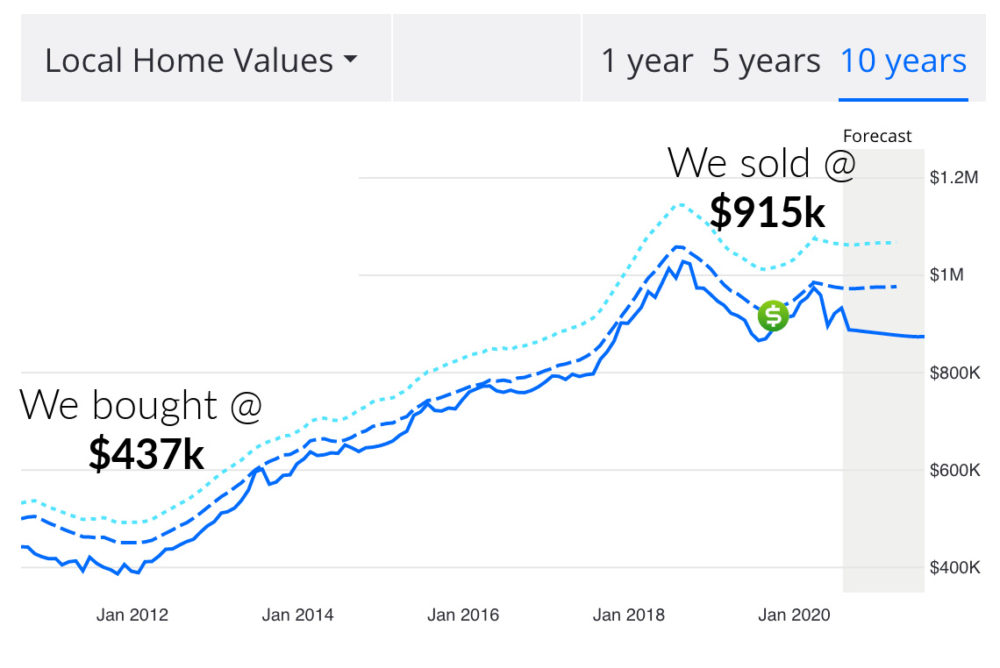

Real Estate–Another millionaire wealth-building tool for millionaire

Although homeownership is not for everybody (some people move a lot for employment or lifestyle reasons), it can be a great tool to stabilize and lower your housing expense. So if you’re staying in one place, buying a reasonable and affordable home can also be a boon to your net wealth.

We were able to buy a home in the expensive Bay Area because we listened to the people around us who told us the market was low and this was our best chance to buy. They were right.

How to Know How Much House You Can Afford

Check out this post (including this house affordability calculator) to find out more, but the basic rule of thumb is your housing expense should cost no more than 25% of your Take-Home Pay. Included in housing costs is:

- Mortgage Payment

- Property Taxes

- Homeowner’s Insurance

- HOA fees

- PMI – Private Mortgage Insurance – Applicable if you paid less than 20% down

MILLIONAIRE KEY #3. Avoid debt

This sounds obvious, but once again, financing expensive items like cars, electronics, and home renovations have become the American way. There is another way! We set aside money for large upcoming expenses. And we didn’t buy things until we’d save up enough. Or we bought a less expensive version that we could buy using savings.

Brainstorm Items to Save for at your Monthly Budget Meeting

Brainstorming for large upcoming purchases is probably the most important part of our Monthly Budget Meetings. We sit and brainstorm absolutely any expenses we can anticipate, whether it’s next month or ten years from now. We’re almost always saving for our next car and our next home renovation. In the meantime, we drive old cars (my van is almost 20 years old) and we live in a less-than-picturesque house (we still have popcorn ceilings) because we’ve learned not to take on debt for those things–as much as we’d love to have them. We’re saving up and we’ll upgrade eventually. In the meantime, we’re on track for early retirement and we’re content to make do with what we have.

If you want a reminder to hold your monthly budget meeting, sign up for my weekly Money Fit tips.

Improve your BUDGETING & INVESTING!

Examples of large irregular expenses:

- Property Taxes (If not rolled into your mortgage expense, set aside an amount monthly)

- Insurance Payments (e.g. car insurance, life insurance, etc.)

- Home repairs

- Medical expenses (e.g. If you’re planning on having another child)

- Veterinarian expenses

- Dental work and braces

- A new car (or preferably gently-used-and-therefore-less-expensive car)

- Car repairs (I recommend including a monthly average for car maintenance and repairs)

- Kids extracurricular programs (sports, dance, camps, etc.)

- Annual memberships (e.g. Costco, gym, pool, etc.)

- School Tuition or other educational expenses

- Electronics (laptops, phones, and tablet don’t last forever–start saving now or be frustrated later)

- Upcoming events and/or travel

- Gifts (e.g. Christmas gifts, if you’re not already including this in your monthly budget amount)

- Clothing (e.g. Back to school or winter coats)

- Income tax for supplemental or self-employment income (i.e. money you received without having tax withheld)

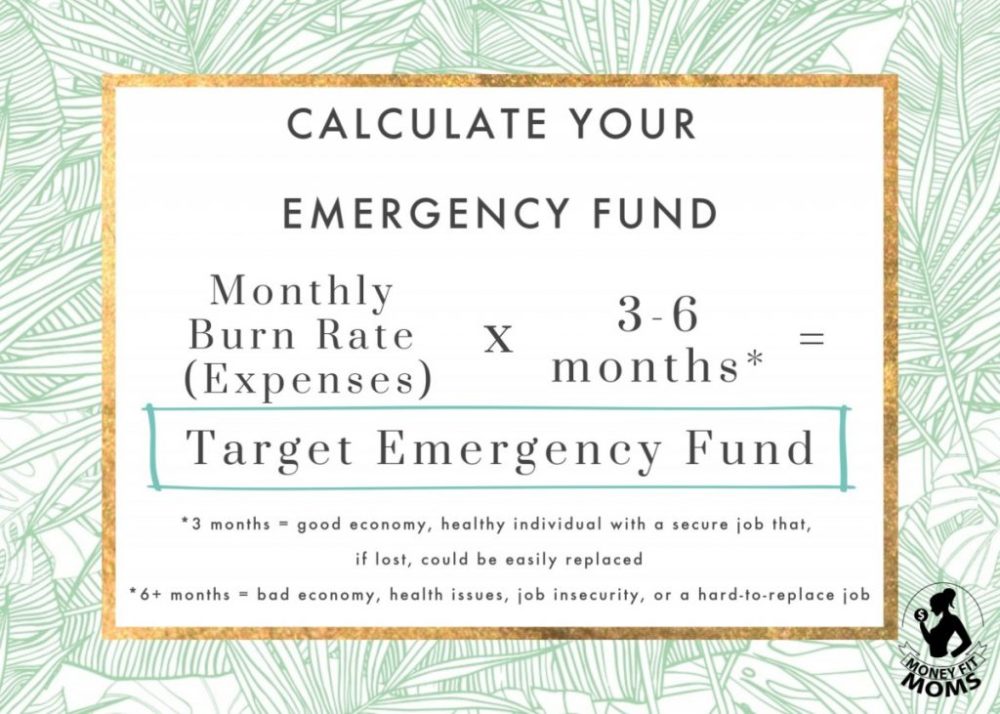

Avoid Debt with a 3-6 Month Emergency Fund

Building an emergency fund was a big part of staying debt-free. We had two expensive medical events that cleared out our emergency fund two separate times. An emergency fund costs you money (as cash depreciates over time), but think of an emergency fund as INSURANCE.

Emergency Funds save you from financing life’s emergencies with DEBT.

How large should your emergency fund be?

- Monthly burn rate (how much you spend in a month) x 3-6 months

If you’re not sure whether you should have 3 months or 6 months, read more about emergency funds here.

We bought cars with cash

So weird in today’s society, but we save up before buying a car. I still remember when my husband came home from buying the first car we purchased together. The car salesman acted as if no one had ever paid with savings before. Not financing with a car loan is weird! The truth is financing in how most car manufacturers make money. As much as I like supporting businesses, this is one area where I stuck it to the man. We paid for the car in full, didn’t have a car loan, and didn’t pay any interest.

SNL Skit (If you handle a little comedy on the sensitive topic of debt)

This SNL skit “Don’t Buy Stuff” is legendary in the personal finance world.

Best Budgeting Tool

If you’re struggling to set money aside for large purchases with your current budgeting tool, I once again recommend YNAB (You Need a Budget). NOTHING is better than YNAB for setting and hitting savings goals.

Summary: The 3 Simple Keys to Becoming a Millionaire

In summary, to build your net wealth to millionaire status, you’ll need to:

- Live on less than you earn and set a high savings rate so you can . . .

- Invest the rest

- Avoid Debt

- Pay for large items with savings rather than debt

- Emergency Fund: Keep 3-6 months expenses in cash so you don’t turn to use debt during hard times

Track Your Net Worth

The easy way we track net wealth is with a one-click secure login we created with Empower. They securely put all your various bank and retirement accounts into on easy-to-follow dashboard. We do use their wealth management services now, but for years, we just used their free tools. They also have an awesome Free Retirement Planner (affiliate link).

Calculate your NET WORTH. Get your FREE, secure Financial Dashboard (Affiliate Link)

Good luck on your millionaire journey!

I wish everyone the best of luck on their financial journey! Not because becoming a millionaire will make you happier, but because it will allow you to time and freedom to make the world a better place and pursue your dreams.

Empower Personal Wealth, LLC (“EPW”) compensates Money Fit LLC for new leads. Money Fit LLC is not an investment client of Empower Advisory Group, LLC.