FatFire is a growing movement — here’s how this couple will retire in their 30s. Planning for retirement is essential for everyone. Luckily, the earlier you start planning and saving, the better your outcomes can be.

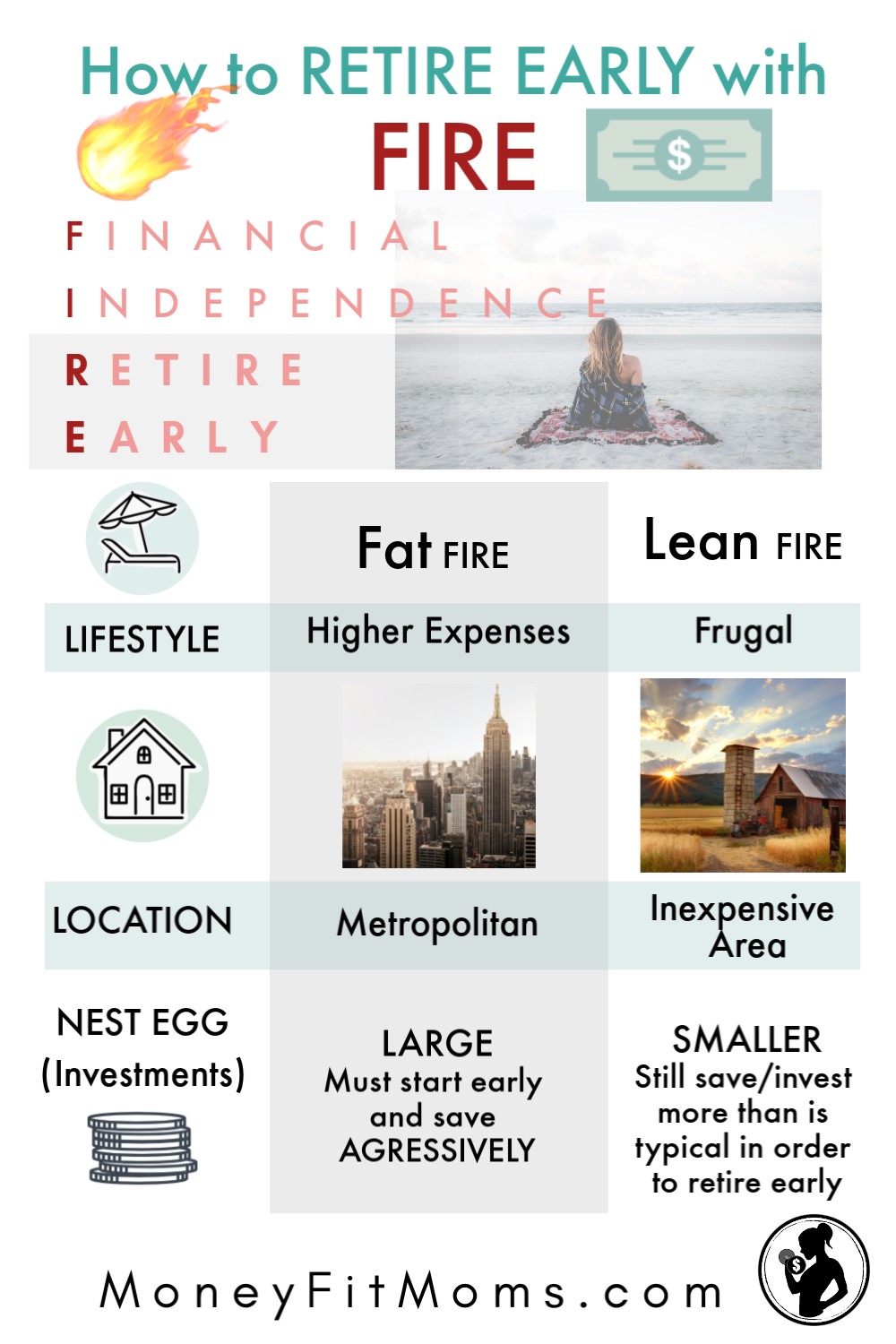

Today I have an awesome GUEST POST: a couple that can easily retire in their 30s. Whether you decide to build a Lean FIRE or a Fat FIRE, both offer financial independence and early retirement.

Lean FIRE versus FatFire

In the personal finance world, FIRE stands for Financially Independent, Retire Early. A Lean FIRE is for people that choose to reach early retirement and live a minimalist, frugal lifestyle in a low-cost area. Consequently, their expenses are lower, so their retirement nest egg can be significantly smaller. Budgeting is a great way to figure out how much you typically spend in a month (YNAB is my favorite budgeting tool).

What is FatFIRE?

FatFIRE is having a high-expense retirement. You build a higher investment and asset accumulation, generating a larger income stream to support your lifestyle.

Why We’re Building a FatFIRE

For many reasons, my husband and I have decided to opt for a FAT Fire retirement. I’m a minimalist in many ways and I know how to happily live on a shoestring budget. My husband and I lived lean during college and for the first ten years after college to begin building our retirement stash quickly–which we did! We became Everyday Millionaires by living lean while our income was still relatively low.

That being said, our low-expense days are behind us. We live in a nice home to accommodate our active and going-to-be-ginormous three boys. We also live in an expensive area. I love where we live. Our area is warm, close to both beaches and a major metropolitan area with great food, culture, and theater/musical scene. We’ve made a lot of great friends and I don’t want to feel like I have to leave this area in order to retire. I also love to travel and I don’t want to spend a lot of time and energy figuring out how to travel on the cheap.

We’re slower to build our FatFIRE, so I brought in a Guest Contributor

My husband and I are currently on track for Fat FIRE (if we left California, we could retire today), but we’re currently aiming for age 43 (for him) / 40 (for me). My husband enjoys his work and he wants to continue to build our net worth and therefore how much we can spend in retirement. But good news–I personally know a Money Fit Mom reader who is on track for a true Fat FIRE by age 38. How in the world are they accomplishing this? Read on to find out.

Keep in mind that they live in what is considered a more expensive area of the country (Los Angeles), so if you live in a lower-cost area, you could achieve the same results with less income (and lower expenses).

-Lisa

This post is anonymous for privacy reasons, but I know this Money Fit Mom personally and can vouch for the accuracy of her post.

FatFIRE by 38 (Guest Post Written by a Money Fit Mom)

My husband and I plan on retiring in two years (we’ll both be 38 years old). By then our net worth will be $2.5 million and we plan on spending around $100k per year. My husband has planned on early retirement since he was in his mid 20’s and first heard about it from reading Mr. Money Mustache. I didn’t start officially working towards it until 5 years ago (when we were married). By nature, we’re both somewhat frugal, but I think that is only part of the equation. We also realize that we’ve been a part of the longest bull market in history and we both have fairly generous income. In addition, making a lot of careful financial decisions plays a large role.

Pre-Marriage Financial History

We both are college graduates and came out of college with little student loans.

College and Savings–My Husband

My husband went to college in Australia where it is much cheaper ($5k per year for 3 years back then) and where the government-issued loans are indexed to inflation and paid back through an income tax levy of 1%-4.5% of your income once your income exceeds a threshold (currently $45k per year). He finished college in 3 years and started working as a computer programmer for the Australian government at 20 years old. His initial salary was $45k per year and by the time he left almost 4 years later, that had grown to $70k.

My husband then immigrated to the US (green card lottery) in 2008 and worked as an IT contractor for $50/hr. This was around $100k per year and yet he shared an apartment with someone at work and was able to live off about $1250 / month. Rent was $450/month, and the remaining $800 was for groceries and miscellaneous expenses. He bought a used Ford Focus for $5k cash in 2009 after taking the bus for a year; we finally retired that vehicle in 2019 and sold it for $1500. He saved most of his paycheck, first maxing out his 401k and then putting the rest into index funds. By the time we married, he had been working a total of 6 years in the US and saved $300k in post-tax Vanguard funds ($220k invested and $80k in returns).

Me

I worked substantially throughout my undergraduate years (40-50 hrs/wk). Afterward, I went to graduate school and didn’t finish till I was 26 years old, and had $20k in student loans. I didn’t earn as much as my husband at first, but within 4 years out of college, I was making over $100k/yr. When we got married, I had around $80k in savings. Combining our incomes and moving into one household drastically increased the amount we could save. By the time we married (2014), our combined income was around $250k/yr and we were able to live off less than one of our paychecks, completely saving the second paycheck. We used an auto investment capability in Vanguard and bought index funds automatically every two weeks (VOO, VDC, and more recently VGT).

Real Estate purchases (our home and two income properties)

In 2015, we bought a short-sale, fixer-upper house in Los Angeles, putting 20% down from our savings and put another $100k into fixing it up. In 2016, we decided to buy an investment property. After looking around for a year, we purchased a quadruplex for $800k. It had positive cash flow, was in good condition, and required little work. The following year, we bought a second quadruplex, but for $850k. It was not in good condition and was negative cash flow. We thought it was in better condition than we later discovered. We did substantial renovations on it for the past two years. This is the third year we’ve had the second quadruplex and finally expect it to have a positive cash flow. Both investment properties were purchased with a 25% down payment, which secured us the best interest rates.

Why we are FatFIRE vs. Lean FIRE

I hear about early retirement and how some people scrimp and save like crazy, then live very frugally. That is not us at all. In general, we are not huge spenders and do not have extraordinary needs, but, we don’t budget and we buy whatever we feel we want/need. We do meticulously track our spending and have it fully broken apart each year into categories through Mint, so we know exactly where all of our money is being spent. We did want a new car last year, when we were expecting our 3rd child, so we did some research and decided upon a used Prius V. It is fairly spacious and gets great gas mileage. It was $10k, with 100k miles, but it should last another 100k. We now have a 2006 Prius with over 200k miles which my husband commutes in and the new-to-us Prius V as the family car.

Travel: Frequent International and Domestic Trips

We both love to travel, so we do two big trips each year, plus a couple of smaller trips (like flying to another state for an extended weekend to stay with family). Our big trips are usually international. For the last two years, we went to Japan, Spain, Portugal, and Australia. We took the kids with us (we had two at the time 2 and 3 yrs old) on every trip except the Japan one. Our oldest daughter is 4 years old and has been on 17 vacations with us, including 5 international vacations.

When we retire, we don’t plan on slowing down with our travel and instead plan on ramping it up. We’ll be able to get much better deals on flights since we won’t be bound by work schedules. We often see deals with round-trip tickets to Norway, Sweden, Paris, the Philippines, or many other cities for $399 or less. We also want to look into house swaps and potentially live in places for a month or so at a time.

Income Projections to Support Early Retirement

Our investment properties are projected to bring in $30k/yr by 2023 and increase around 12%/year (rent only goes up by 4%, but mortgage and other expenses are either flat, or go up by much less, so the net income goes up by much more than rent). Until 65, we plan on living off our stocks and rental properties and if needed, some of our 401k funds using the Roth conversion ladder. By the time we’re 50 years old, our rental properties should fully support us.

Will Early Retirement Be Boring?

People often ask if we’ll be bored in retirement, but we both have lots of hobbies/interests. My husband does want to keep his computer skills current, so he plans on taking contracts occasionally, so if needed, he can easily rejoin the workforce.

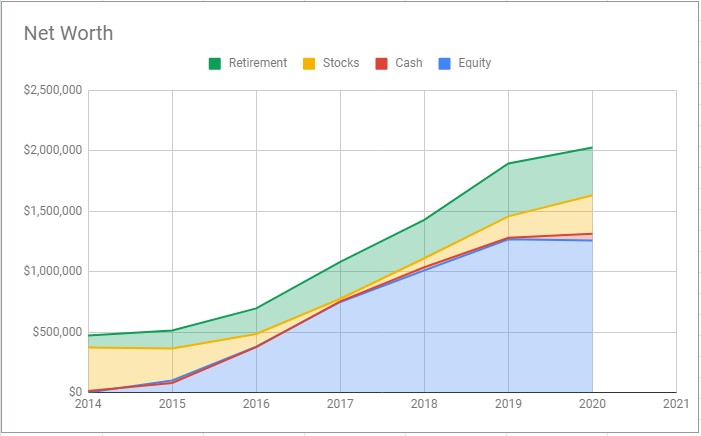

Net Worth Over Time

Graph of our net worth over time (2014 is when we married and combined our finances):

Cash Flow/Savings Data from Past 5 Years

Table of our cash flow over the past 5 years, showing our income and where we spend it all. At the bottom, there is a summary of how much we save each year, and how much our stocks and properties change each year.

| Cash Flow | 2015 | 2016 | 2017 | 2018 | 2019 |

| Husband Gross Income | $130,000 | $132,469 | $143,922 | $141,664 | $158,078 |

| Wife Gross Income | $112,704 | $110,678 | $146,428 | $161,649 | $139,478 |

| Rental Property I | $710 | $9,975 | $19,528 | $23,629 | |

| Rental Property II | -$6,955 | -$25,043 | -$36,604 | ||

| Money towards 401k | $36,000 | $36,000 | $33,800 | $32,369 | $30,026 |

| Total Taxes Paid | $50,000 | $35,000 | $56,662 | $68,402 | $59,511 |

| Housing (mortgage+taxes+insurance) | $20,988 | $22,794 | $25,068 | $27,650 | $27,942 |

| Home Improvement | $83,630 | $50,935 | $6,920 | $3,456 | $1,120 |

| Groceries | $4,596 | $4,998 | $4,654 | $4,132 | $4,066 |

| Restaurants | $2,379 | $1,763 | $1,993 | $3,038 | $2,514 |

| Gifts | $2,661 | $1,646 | $496 | $626 | $1,111 |

| Clothing | $971 | $642 | $3,427 | $1,367 | -$518 |

| Charity | $5,228 | $4,962 | $4,451 | $5,455 | $2,580 |

| Home Supplies | $2,267 | $3,016 | $2,318 | $2,173 | $1,278 |

| Kids (supplies, hobbies, toys, etc.) | $2,092 | $5,762 | $2,339 | $2,091 | $1,733 |

| Nanny/Babysitting | $1,499 | $12,036 | $16,536 | $13,414 | $12,490 |

| Pets (including pet sitting income) | $771 | $3,250 | $2,783 | $504 | -$647 |

| Vacation | $8,414 | $6,625 | $1,650 | $4,446 | $8,639 |

| Auto Insurance | $841 | $1,624 | $1,507 | $1,250 | $1,985 |

| Utilities | $2,282 | $4,116 | $3,206 | $3,146 | $2,853 |

| Doctor | $2,961 | $3,091 | $1,930 | $2,199 | $4,209 |

| Education | $11,005 | $1,500 | $1,200 | $335 | $0 |

| Entertainment | $1,734 | $582 | $1,038 | $876 | $964 |

| Electronics/Hobbies/Sporting goods | $3,525 | $1,708 | $3,161 | $3,277 | $1,521 |

| Auto Gas | $707 | $780 | $1,185 | $1,161 | $1,109 |

| Auto costs (purchases, repairs, registration) | $354 | $818 | $11,739 | ||

| Money Saved from Income (including 401K) | $34,152 | $77,028 | $150,491 | $147,982 | $138,384 |

| Earnings from Stocks/Mutual Funds | $12,240 | $74,194 | $80,415 | -$27,059 | $102,004 |

| Real Estate Growth (not realized gains) | $57,003 | $133,490 | $228,022 | $216,174 |

Examples of how we save money to build our FatFIRE

Savings on Pet’s Diet: $1,459/year

I feed a raw diet to my 60 lb dog (please do not debate the validity of diet. You can go to Raw Feeding on Facebook to discuss it.). Normally, people spend around $150-$200/month to feed their equivalent sized dogs a premade raw diet bought from stores or online. We spent $200 to buy a deep freezer, which runs on $40/yr of electricity. I check the weekly ads and when human-grade meat drops to a 4-6 month low, I buy 50-100 lbs of meat. It takes about 2-3 hrs of prep every 6 months and costs $23/month to feed our girl a high quality, fully balanced, raw diet. That is a savings of $1,459/yr (that includes the cost of the freezer assuming it lasts around 8 years).

Chipotle Savings: $137/year

My husband likes to go to Chipotle with his coworkers a couple of times/wk for lunch. He buys gift cards to Chipotle online at a 15% discount. He buys around $18 worth of food from Chipotle every week, and with the gift cards, he saves around $135/yr.

Pet Sitting Costs: Offset + $400/year INCOME

Pet sitters are expensive and we pay nearly $1,000/year (about $30/night and we’re on vacation around 30 days/yr). To try offsetting this cost, we decided to start pet-sitting on Rover.com. We charge $40/night and are very picky about the dogs. After a year, we found 3 dogs that we’re willing to watch (low maintenance, low shedders, very nice/friendly). This past year, we’ve watched those dogs 45 days and brought in $1,800. We tried to just offset the cost of the pet-sitting for our dog but ended up earning extra money which offsets all of our pet costs and still brings in an extra $400.

Travel Savings

My husband and I love vacations, so we pick a destination, then start watching flights around 8 months beforehand. We buy flights 4-6 months in advance. Airbnb which works better than hotels with children— it gives them room to run around, but they are also affordable and yet quite nice. We also use credit card miles as much as possible to buy flights.

Car Maintenance

I no longer do car oil changes myself, because they are so cheap (we use coupons 100% of the time for oil changes). I do a lot of other auto work myself. Generally, if I can do the mechanical project in less than an hour, then I do it myself, such as brake pads/rotors, spark plugs, transmission fluid, etc. (brake pads take less than 30 minutes to change and this saves around $200 in labor) If it is going to be longer than an hour, but still result in significant savings, then I might tackle it myself, as long as it is still within my capabilities.

My Time is Valuable

Recently, I saw a post on a frugal Reddit group about sewing make-up wipes rather than just buying them. I hardly wear make-up (only a few times per year), but if I did wear make-up regularly, I would probably not sew wipes, unless I really enjoyed the process of sewing them. I feel like my time is valuable and usually give it a cost. If I’m not saving more money than the cost of my time, I would much rather just pay for it.

We wanted a toddler-sized bunk bed for our two older kids. I couldn’t find any online (due to safety issues they are not manufactured), so I built it. It cost around $130, so not super cheap and took about 15 hrs of mine and my husband’s time (he did the staining and finishing). So the total price is not really worth our time and money, had we been able to find one for a few hundred dollars. But, I really enjoy building things and was able to come up with a very sturdy and beautiful finished product.

Thank you to this amazing Money Fit Mom for writing this incredible guest post!

Lisa again here.

A few things that stood out the most of me from this Money Fit Mom’s Fat FIRE Journey:

- Smart Education Investments: Both husband and wife pursued higher education WITH MINIMAL STUDENT LOAN DEBT to increase their earning potential.

- Big Savings Margin: They always lived in significantly less than they earned. Before they were married, the husband lived with a roommate and drove an old car, so he was able to pursue his larger goal of retiring early.

- Automated Investment Contributions to Slay Goals: They were able to save/invest aggressively because they automated their investment contributions to happen every two weeks.

- Simple Investing: They didn’t spend forever stressing over the timing of the market or the perfect stock portfolio. They went with low-cost investments: index funds from Vanguard.