Money and marriage can be two of the most wonderful and stressful things — combine them and you’re either soaring or sinking.

Here are 7 steps to help prevent money fights and bring harmony to your money and marriage.

STEP 1: Both partners need knowledge of and access to all financial accounts

Often when I start financial coaching with a client, they have to track down all their financial accounts, how to access them, and what the balances are. This is not uncommon, but it’s always a little jarring when the coachee is married and they meet resistance from their partner. Sometimes knowledge of and access to financial accounts are used as a weapon. But if finances are combined, both partners should have equal access.

If you are denying your partner access to your financial accounts, I suggest taking the rest of the steps below to see if it can resolve financial difficulties. If not, I would consider seeing a financial coach or relationship counselor.

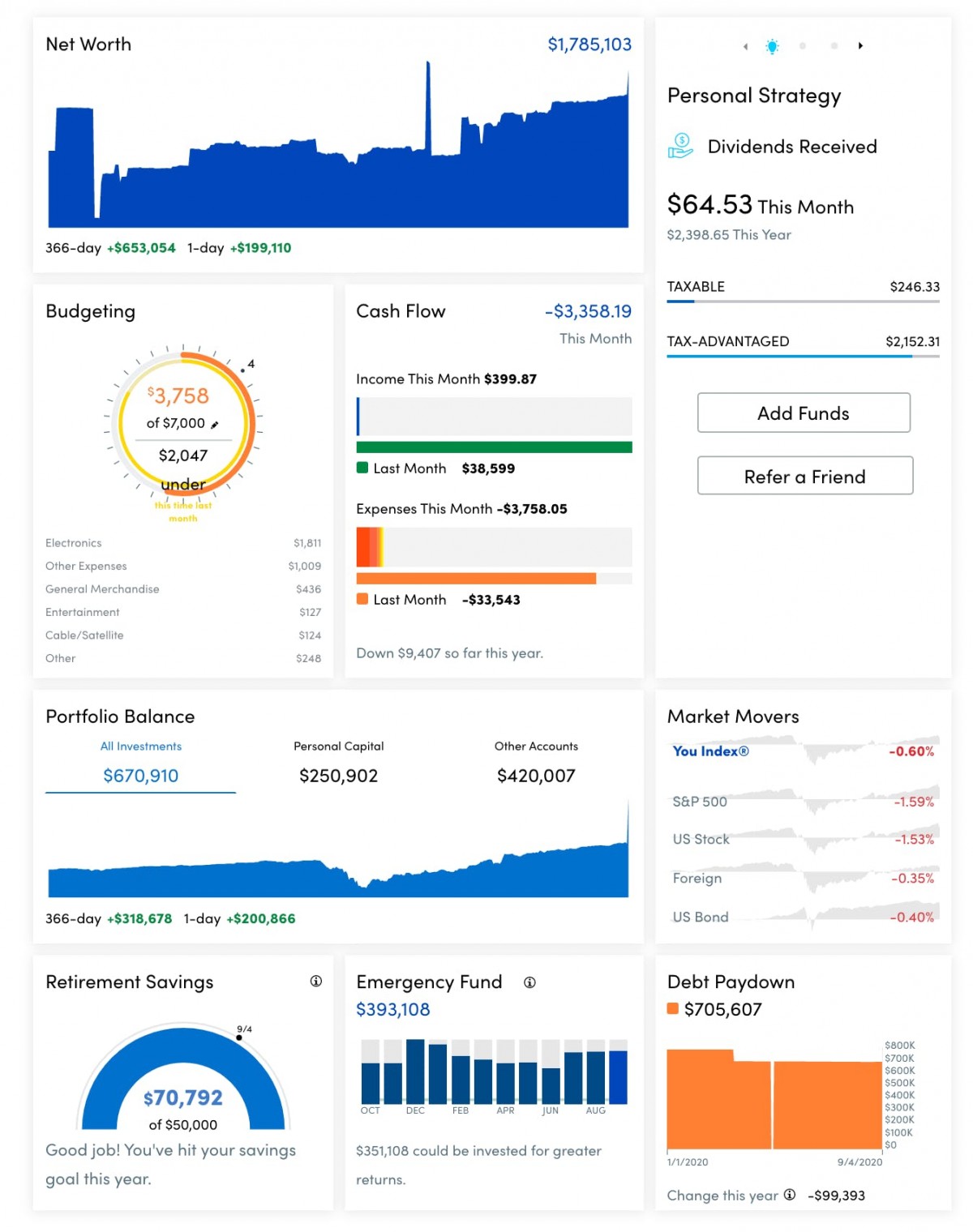

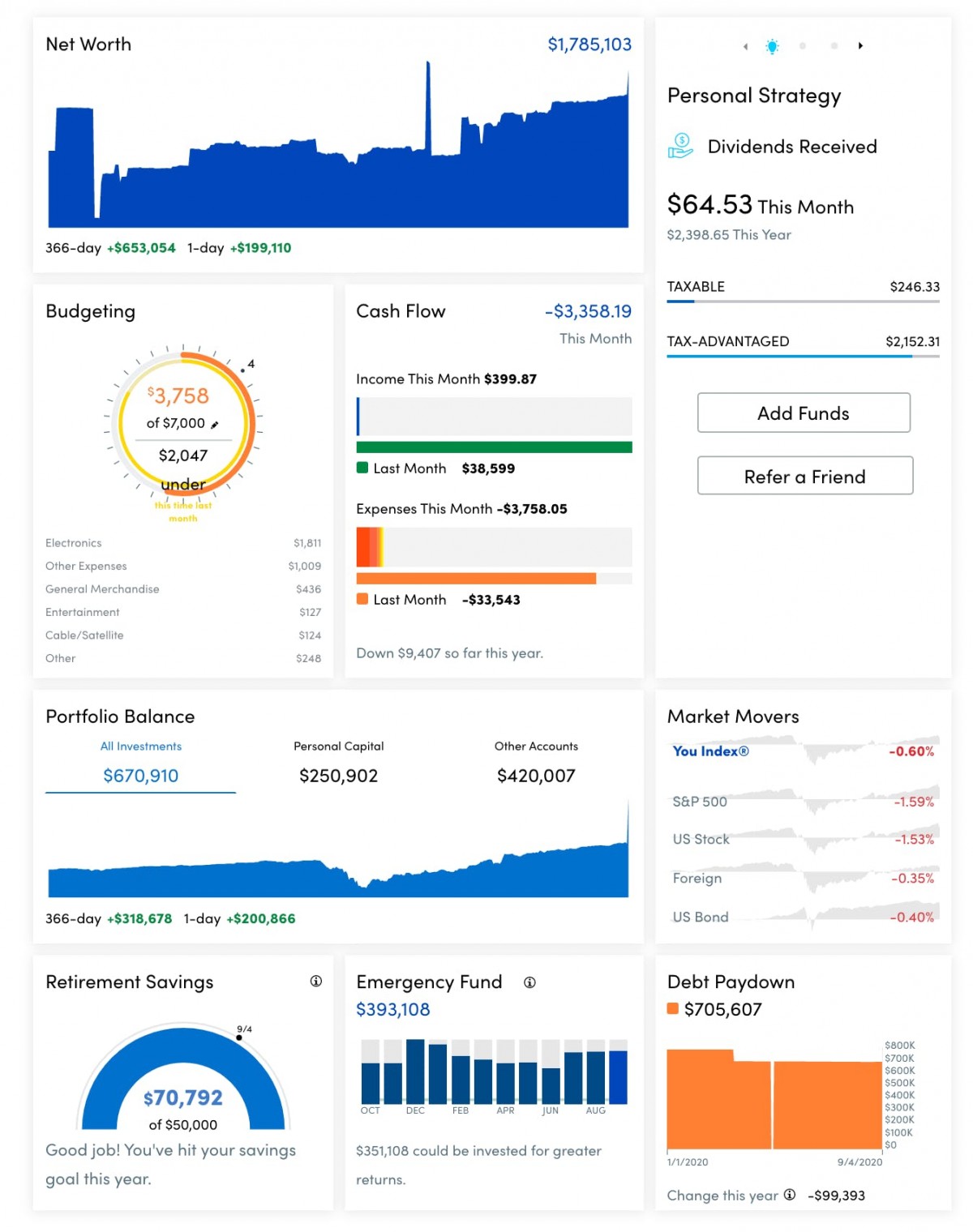

The easiest way to see ALL your accounts in one click — Empower

Sometimes chasing down all your different accounts is a hassle. Budgeting software can often help you see all your banking (checking, savings, credit cards) in one place, but if you want to have a FREE Net Worth Dashboard for ALL your accounts (investment, 529 plans, mortgage loans, etc.), I highly recommend getting a Empower account. We’ve been using them securely since 2016.

To read more about my love for Empower and their free tools, check out How to Get Your Retirement Planning on Track in 3 Easy Steps.

Calculate your NET WORTH. Get your FREE, secure Financial Dashboard (Affiliate Link)

STEP 2: Appreciate differences in personalities (Spenders vs. “Savers)

Spending and saving is a spectrum and as individuals, you and your partner are always going to be in slightly or very different places — which can actually be a GOOD thing.

I’m the saver and my husband’s the spender. Rather than pointing fingers and blaming, we balance each other out. Without my drive for reaching financial goals, we probably would not have become millionaires in our early 30s. Without my husband’s appreciation for enjoying and spending some of our money, our side tables would still be unstable cardboard boxes covered with sheets (yes, that happened). Learn to appreciate what your partner’s differences bring to the table and use the other steps below to find that balance between reaching financial goals and enjoying spending.

STEP 3: Set BIG financial goals together

I put ” BIG financial goals” before budgeting for a reason. It’s a LOT easier and more exciting to budget when you can REMEMBER YOUR “WHY,” whether your reason for staying on budget is:

- Early retirement

- Buying a home, or

- A trip to Paris

There is nothing that helps a couple with money and marriage unity like reaching a huge financial goal TOGETHER.

To borrow the rocks/pebbles/sand analogy from Stephen Covey, in order to fit everything, you need to start with the big things first.

ROCKS: BIG Financial goals (HIGH Savings rate for retirement, buying a home)

PEBBLES: Needs (housing, food, utilities, transportation)

SAND: Wants (aka Everything else)

STEP 4: Let your BUDGET become your Money and Marriage Financial Counselor

Some people call budgeting “the ‘b’ word” because they feel like budgeting is the source of stress. In reality, budgeting can be a great tool for communication and resolving differences.

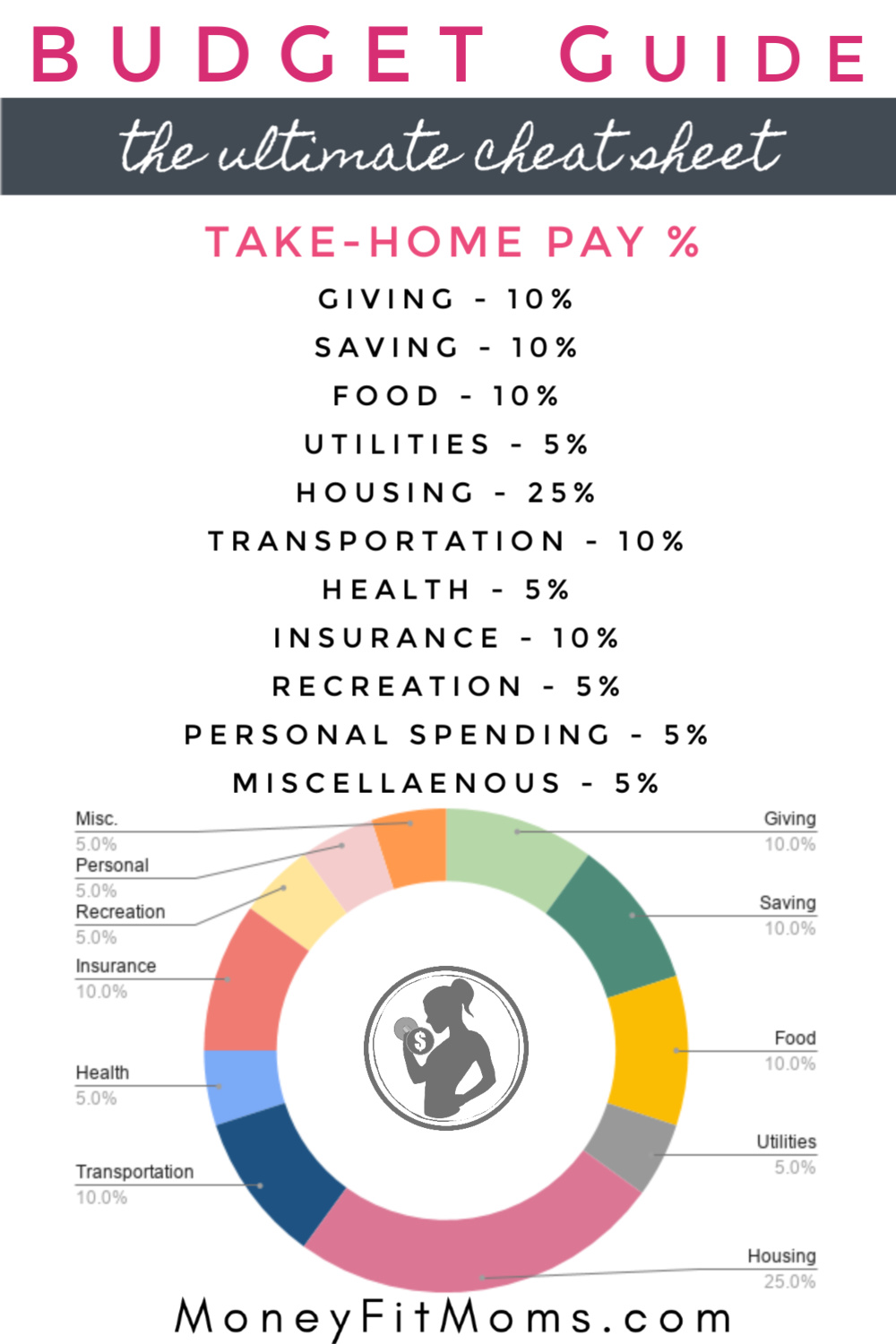

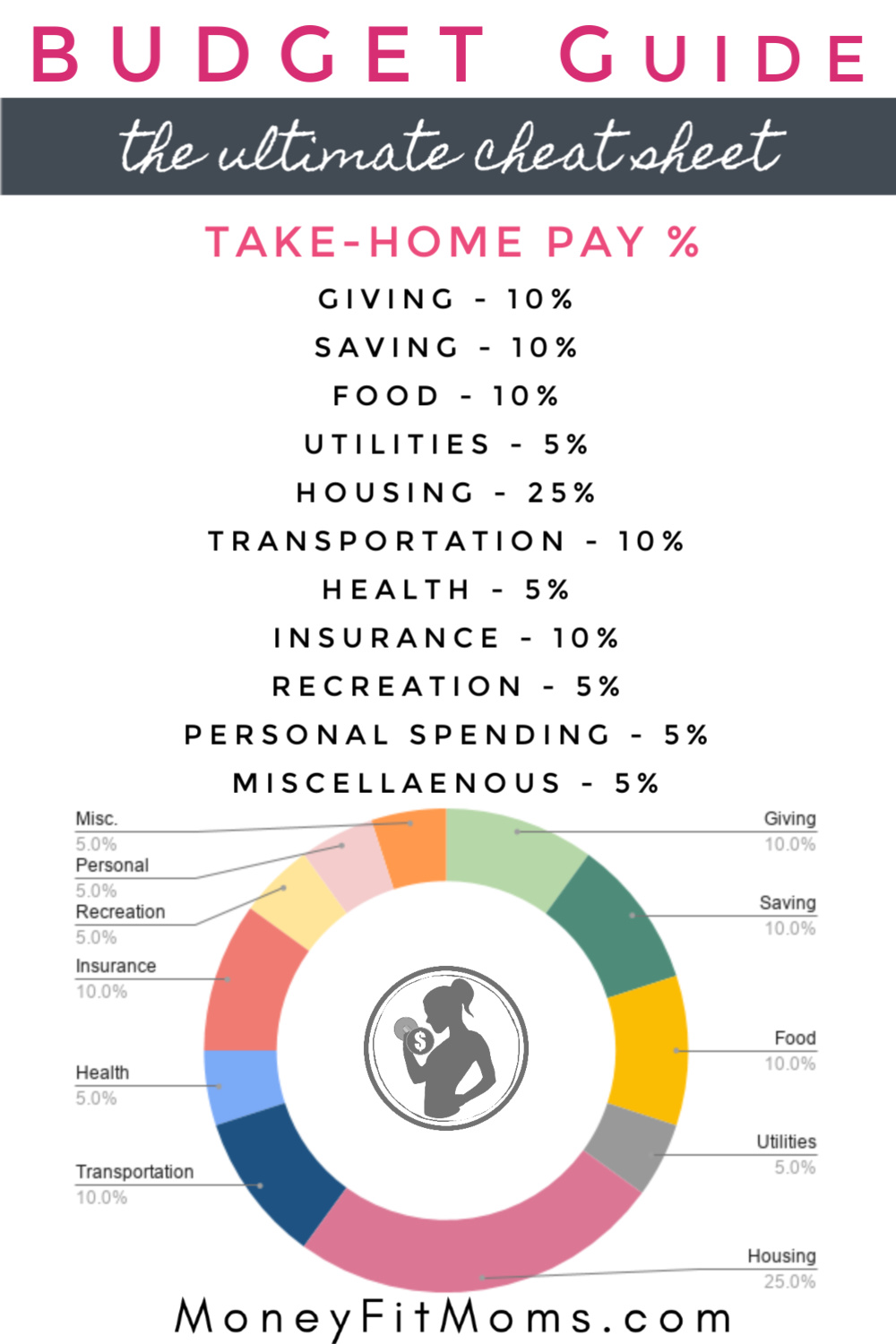

Budgets are NOT perfect calculations of all your spending, they’re guidelines to help you determine and stick to YOUR FINANCIAL PRIORITIES.

To create a budget that fits your financial goals, obligations, and wants, there’s going to be some give and take. The first budget you create should not be your last — it’s a “jumping-off point for negotiations” (points if you know the source of that quote).

STEP 5: Use Fun Money Accounts to help manage different financial priorities

“Fun Money” or “Mad Money” accounts are HUGE for money and marriage harmony. The truth is, no matter how much your budget and discuss your financial goals, you’ll always have some different financial priorities.

Rather than trying to agree on absolutely everything (not possible), pick a reasonable amount of money for each spouse to spend on whatever they value.

The “Spender” can spend their money each month and the “Saver” can save it towards bigger items. My husband likes to buy electronics and clothes with his fun money. I like to go to concerts and travel.

When we were broke college students, we both got about $5 a month because that was seriously all we had to spare. Now we have a larger amount, but the point is that the amount is ours to spend on whatever we value.

STEP 6: Have a Monthly Budget Meeting

Set aside a time for a Monthly Budget Meeting (printable agenda here). A Monthly Budget Meeting creates a dedicated safe space to have these sometimes challenging financial conversations. Rather than snapping at your spouse whenever they come home from spending money, let your budget serve as the mediator. When you create your financial goals and budget TOGETHER, you’re on the same page, even if you’re not always on the same paragraph.

Receive a Monthly Email Reminder to hold your Monthly Budget Meeting

If you want a reminder to have these monthly budget meetings, you can sign up to receive my Top 10 Money Fit Moves.

Improve your BUDGETING & INVESTING!

STEP 7: Don’t let salary differences come between you

I have to admit, as the primary caregiver, this is an area I’ve struggled with over the years. I have to constantly remind myself that careers and income are a family effort. When one parent becomes the primary giver, that does NOT make the working spouse more valuable. I loved the Harvard Business Review article, “Being a Two-Career Couple Requires a Long-Term Plan.” The author, Avivah Wittenberg-Cox, does a great job of showing the thought process of taking both family and career aspirations into account and designing a long-term plan accordingly.

Every couple and family will have a different way of crafting their long-term family career plan. You’ll have to adapt your plan to unexpected life events. The important part is to have those conversations and make sure each partner feels appreciated and valued.

Money and Marriage – A Great Partnership

Finances and relationships can be challenging, but working on financial goals together will STRENGTHEN a relationship. Good luck!

Empower Personal Wealth, LLC (“EPW”) compensates Money Fit LLC for new leads. Money Fit LLC is not an investment client of Empower Advisory Group, LLC.