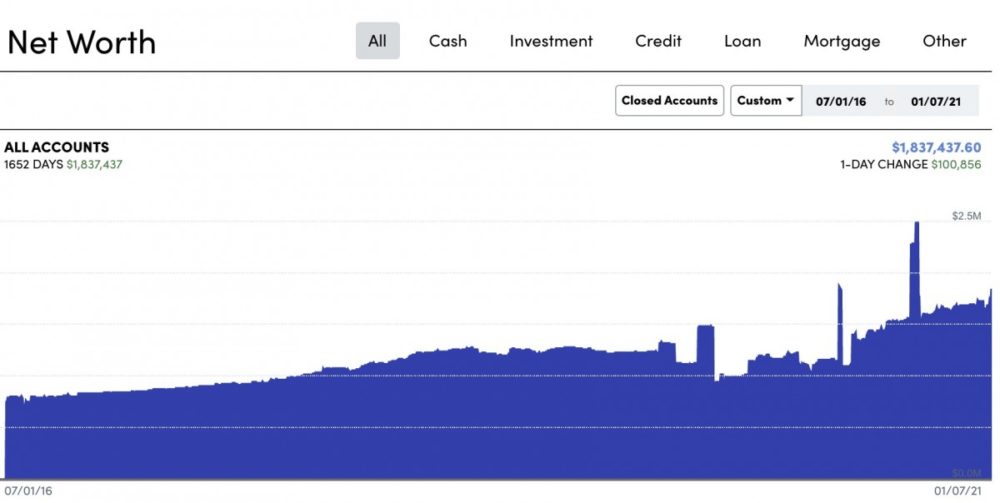

Learn how to calculate your net worth. Tracking your net worth can improve your finances because it will motivate you to spend less than you earn, invest the rest, and avoid/payoff debt. These three strategies are the “Simple Path to Wealth” laid out by JL Collins. That’s the formula my husband and I used to become millionaires in our early 30s. Lastly, find out how I can easily check my updated net worth in less than 2 minutes.

Welcome to the Money Fit Challenge!

Calculating your net worth is the 1st step of the #MoneyFitChallenge. Join thist challenge to improve your:

- Budgeting

- Investing

- Retirement planning

- Creating a will, etc., here’s the link:

Improve your BUDGETING & INVESTING! Join the FREE #MoneyFitChallenge

STEP 1: Complete the Money Fit Challenge of the month:

JANUARY: CALCULATE YOUR NET WORTH

I encourage clients to update their Net Worth every month. Stick with me and I’ll be your nerdy friend who reminds you to check-up on your financial goals.

What is your personal net worth?

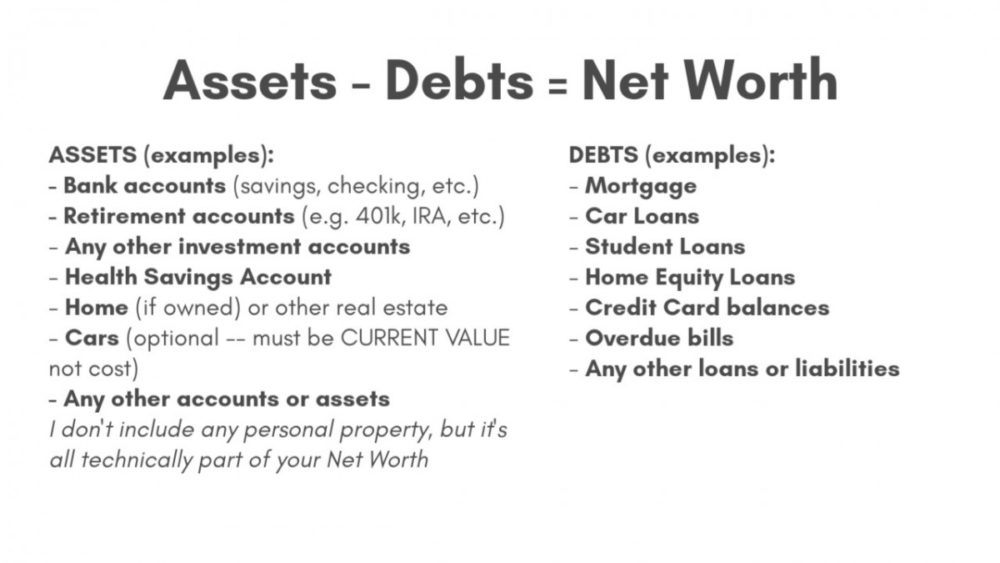

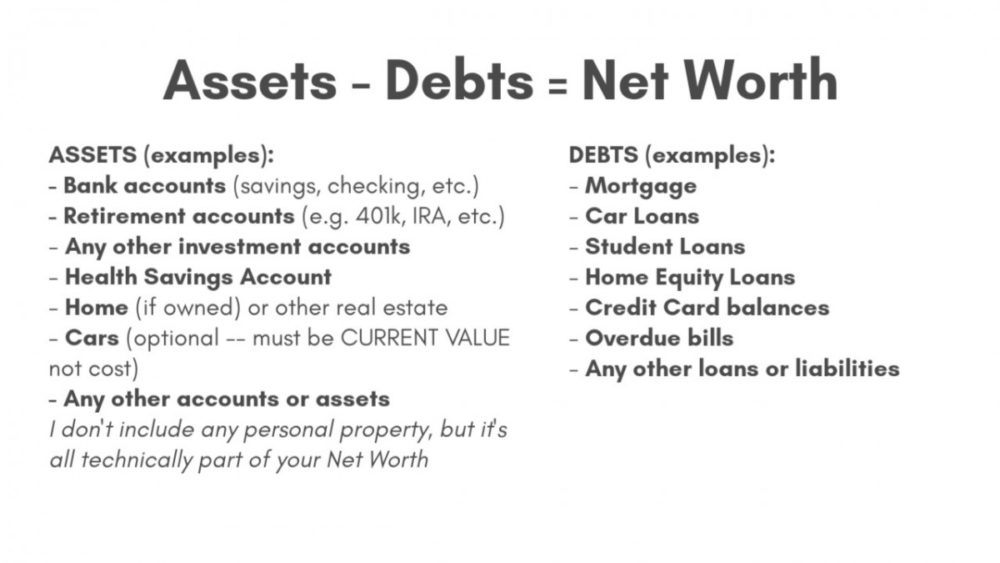

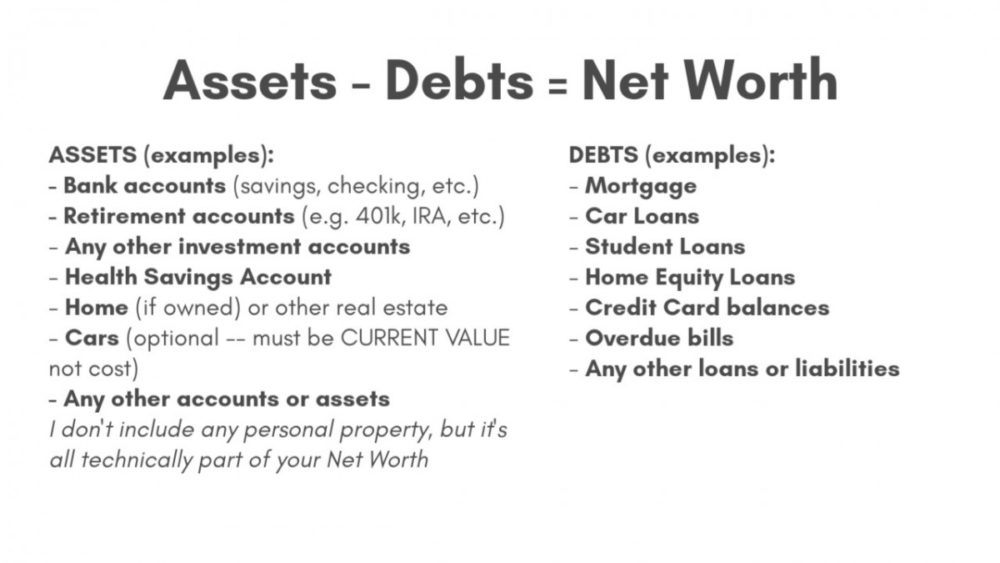

Net worth is simply the sum value of your assets (bank accounts, investments, property, etc.), minus your liabilities or debts (mortgage, student loans, unpaid credit cards, etc.).

Why bother tracking your net worth? You manage what you measure.

Budgeting is great (I’ll cover some tips next month), but Net Worth is a better measure of PROGRESS toward financial GOALS.

Updating your Net Worth will also MOTIVATE you better follow the 3 Keys from the Simple Path the Wealth:

- Spend LESS than you earn

- Invest the rest

- Avoid DEBT

Won’t checking all my accounts take too long?

Here’s a tip for how to quickly UPDATE YOUR NET WORTH every month in 2 MINUTES OR LESS.

It takes about 15-20 MINUTES to set-up now, but will have a BIG PAYOFF in the long run because it will:

- SAVE TIME EVERY MONTH when it’s time to calculate your net worth.

- Help you make MUCH SMARTER financial choices (Spend less, invest more, avoid debt)

HOW TO CALCULATE YOUR NET WORTH

1. Write a list of all your assets, accounts, and debts

2. Look up all their values individually -OR- Open a FREE Empower account (affiliate link) so you can check ALL your accounts at once with your own FREE Financial Dashboard

Calculate your NET WORTH. Get your FREE, secure Financial Dashboard (Affiliate Link)

3. Link as many of your accounts as possible, so the values will update automatically.

Having a financial dashboard with all your accounts in one place will help you see the big picture of your financial situation.

NOTE: You’ll be using your FREE Empower account again in June when you use their AWESOME (FREE) RETIREMENT PLANNER. It will help us calculate how much we need to save each year to get on track for our retirement goal.

STEP 2. CELEBRATE!

Don’t skip this step! Celebrating *rewards* your brain, so you’ll be more motivated to accomplish your NEXT goal.

Whether or not you’re disappointed or pleasantly surprised with your Net Worth . . . celebrating completing this challenge. Taking stock of a situation is the first step to improving it.

Empower Personal Wealth, LLC (“EPW”) compensates Money Fit LLC for new leads. Money Fit LLC is not an investment client of Empower Advisory Group, LLC.