Money Fasting is the best way to become debt-free, build an emergency fund, get on track for retirement, and move toward financial freedom. Many of us fall into lifestyle inflation due to the impulse to buy more expensive homes, cars, and vacations — even if we’re not on track for our long-term financial goals. A commitment to money fasting until you’re on track for your financial goals is LIFE CHANGING. The first few months of adjusting your spending are painful until you adjust to your less-expensive lifestyle. After that, seeing the progress toward your financial goals is thrilling and rewarding. In this article, we will look at how money fasting can accelerate your journey to financial freedom.

What Is Money Fasting?

Money fasting is only spending money on necessities (housing, food, utilities, and transportation to work) and cutting all other expenses. Living on a strict budget until you get on track for your financial goals will change your life. Plus, because of compound interest, the SOONER you adjust your spending, the MORE it will pay off. You’ll be able to put money toward investing (the key to building long-term wealth) rather than debt. Money fasting will also help you avoid lifestyle inflation. Depending on how quickly you get on track, you may even be able to achieve FIRE (Financial Independence Retire Early) – like this “FatFire” couple who retired in their 30s, even with high expenses.

What Is Lifestyle Inflation?

Lifestyle Inflation is an increase in spending when income rises. Lifestyle Inflation is common when you face sudden lifestyle changes like a promotion or raise. Due to the rush and excitement, you may buy luxury items you can’t really afford yet. In the end, you end up living from paycheck to paycheck. Lifestyle inflation can make it difficult to save for retirement or cover emergencies.

More money, more problems? For some people, yes! We often make the same mistakes with $100,000 that we make with $100. The key is to have a financial plan (like the free Money Fit Challenge) and know your next long-term financial goal.

Before making any lifestyle upgrades, you’ll want to accomplish these financial goals FIRST:

✅ Debt-Free — Payoff all debts (other than a fixed-rate mortgage)

✅ Full Emergency Fund (3-6 months of expenses saved in a separate, untouched account — why you NEED an emergency fund)

☑️ On track for retirement – How much should you be saving toward retirement each month? Calculate your monthly retirement savings needed.

AFTER you’ve accomplished these financial goals (and considered other goals, such as saving toward a down payment on an affordable home, saving for college), you can consider upgrading your lifestyle. The secret is to upgrade your lifestyle with slow, measured steps.

How MONEY FASTING Can Help You Reach FINANCIAL FREEDOM

How can money fasting help you avoid lifestyle inflation and reach your financial goals?

#1. Set your financial goals, in order

This is the most critical step that people often skip! You will make progress MUCH faster if you know EXACTLY what your next financial goal is. I recommend working on one goal at a time.

As written above, this is the order I recommend working toward financial freedom:

✅ 1. Debt-Free — Payoff all debts (other than a fixed-rate mortgage)

✅ 2. Full Emergency Fund (3-6 months of expenses saved in a separate, untouched account — why you NEED an emergency fund)

✅ 3. On track for retirement – How much should you be saving toward retirement each month? Calculate your monthly retirement savings needed.

✅ 4. Other financial goals (E.g. Save toward a down payment on an affordable home, save for college)

✅ 5. LAST (Optional): Lifestyle upgrades (E.g. Home renovations, new-to-you car, etc.) This key is optional because you might prefer to increase your investing in order to reach FIRE (Financial Independence, Retire Early)

Not upgrading our lifestyles until we’re on track for more critical financial goals is THE KEY to financial freedom.

By the way, if you want step-by-step instructions about how to reach each of these goals, I recommend signing up for my FREE Money Fit Challenge.

Improve your BUDGETING & INVESTING! Join the FREE #MoneyFitChallenge

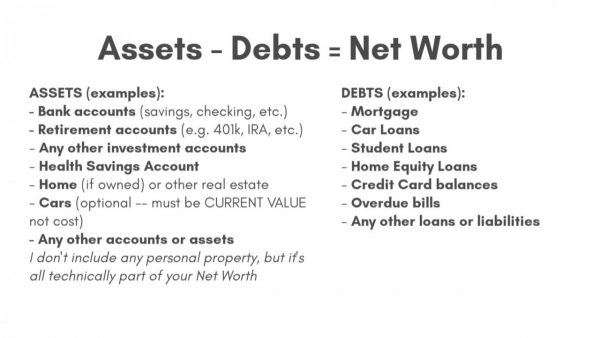

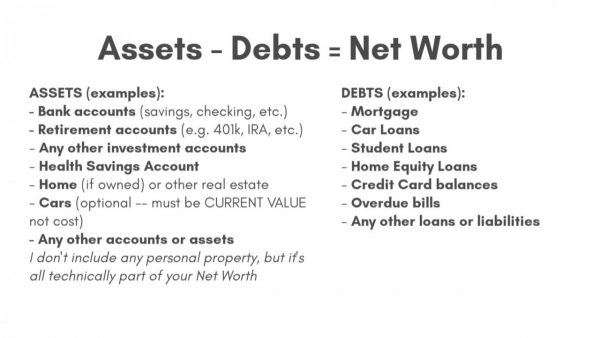

#2. Start Tracking Your Progress Using NET WORTH

Budgeting is great (see step #4 below), but I find tracking net worth to be an easier, more effective way to track progress toward your financial goals.

HOW TO TRACK YOUR PROGRESS USING NET WORTH:

First, write a list of all your assets, accounts, and debts.

Send, look up your account values

You can do this individually or Open a FREE Empower account (affiliate link) so you can check ALL your accounts at once with your own FREE Financial Dashboard:

Calculate your NET WORTH. Get your FREE, secure Financial Dashboard (Affiliate Link)

Last, link as many of your accounts as possible, so the values will update automatically.

Having a financial dashboard with all your accounts in one place will allow you to track progress toward your financial goals, keeping you motivated! 🙌

#3. Create A Wedge Between Earnings & Expenses

To turn your finances around, you need a wedge between your expenses and earnings. This gap is called sometimes called “The Margin” or your “Savings Rate.” Money fasting creates a bigger margin that you can then apply toward your NEXT FINANCIAL GOAL (Debt payoff, building an emergency fund, investing toward retirement, saving for a house down payment, etc.)

Once your salary or raise comes in, pay your needed expenses (food, housing, utilities, and transportation) and save the rest toward your next financial goal.

#4. Track Your Spending to create a Needs-Based Budget

Once you start your money fast, begin tracking your spending (best budgeting apps here). This will allow you to create a budget that starts with your NEEDS before adding any WANTS. This will help you notice any unnecessary expenses that you can eliminate to reach your goals faster. Avoid the temptation to level up each time your income increases. Spending all your bonuses and raises will not help you reach your financial goals. Stick to buying needs-only until you’re on track for your goals.

Needs-Only Budget Categories aka “The 4 Walls”

| Budget Categories | % of Take-Home Pay

Max Recommended |

Example:

Take-home pay $4,000/month |

| 1. Food | 10% | $400 |

| 2. Housing | 25% | $1,000 |

| 3. Utilities | 5% | $200 |

| 4. Transportation to Work | 10% | $400 |

#5. Payoff Debt (And Avoid Future Debt)

Debts and loans (with the exception of a fixed-rate mortgage) are a guarantee that you have fallen into the trap of lifestyle inflation. Many of us think that if we can afford the payment (e.g. car loan payment), that means we can afford the item. This is a trap you into putting money paying interest rather than building wealth! To truly afford something, save up for the item until you can pay cash for it.

Commit to never again “buying” anything with a loan or financing with a credit card. (FYI: Becoming debt-free is a step in the free Money Fit Challenge). Personally, I use credit cards as a convenience and to earn cash-back rewards. However, if you have ever carried a balance on a credit card, use only debit cards in the future. This will remove the temptation to buy more than you can afford.

#6. Set a Timeline for your Financial Goals

Once you’re budgeting and know your savings margin, you can calculate how long it’ll take you to achieve your goals. For instance, how long it will take to pay off your mortgage or car loan. Having a time-based goal helps you stay motivated, even if the goal is difficult and will take years to achieve. Once again, compound interest helps us realize the sooner we reach financial, the more our investment gains can grow and compound, so money fasting adds up to greater returns!

Conclusion on Money Fasting

The journey to financial freedom requires intentional goal-setting and hard work, often in the form of money fasting. Lifestyle inflation is tempting when you get a raise or bonus, but make sure you’re on track for your financial goals first! MONEY FASTING is the best way to become debt-free, build an emergency fund, get on track for retirement, and move toward financial freedom!

Join the FREE Money Fit Challenge!

Lastly, while you’re here, did you know you’re more likely to accomplish financial goals if you have a supportive community and step-by-step instructions? Get both from Money Fit Moms!

(1) Join the supportive @MoneyFitMoms community (Instagram, Facebook and Pinterest, YouTube, and TikTok)

(2) Then, get FREE step-by-step instructions and tools to accomplish all the Money Fit Challenge. (e.g. budgeting, pay off debt, investing, retirement, create a will)

Empower Personal Wealth, LLC (“EPW”) compensates Money Fit LLC for new leads. Money Fit LLC is not an investment client of Empower Advisory Group, LLC.