You’re here because you’re ready to begin your debt-free journey! You’re making the right money move and I’m excited for you. You wouldn’t have clicked on this page unless you were good and ready, so let me help you get there. By the way, if you want any encouragement along the way, feel free to message me for encouragement on Instagram @MoneyFitMoms. I created Money Fit Moms to help others so I’d love to help you in any way I can!

Step 1: Get MOTIVATED for DEBT-FREE FREEDOM

Sometimes the hardest part of a journey is (1) Committing to doing it and (2) Taking those first steps. Here are some action steps to help you get moving on your debt-free journey:

Choose at least 2 cheerleaders & text them right now

State your intentions and find people to keep you accountable in one step. Choose at least two people: a partner, friends, or family members who are your biggest cheerleaders in life. Text your biggest cheerleaders right now and tell them something along the lines of,

“I’ve decided to pay off my debt as fast as humanly possible! I’d love for you to be one of my cheerleaders.”

Changing your lifestyle to pay off debt requires a mental and emotional shift. Making any changes to your normal habits takes energy and willpower — both finite resources. Fuel those changes with the joy of celebrating your wins along the way–and celebrating with others is way more fun! If you had a friend who was determined to do something as amazing as become debt-free, wouldn’t you want to cheer them on? Let your cheerleaders do the same for you. Even if you’re disappointed in where you are now, it’s important to adopt a growth mindset and turn your attention toward where you want to be.

Log Your Debt-Free Journey

We manage what we track. Support your debt-free journey by documenting and celebrating your progress and wins. Find a way to track your journey that fits your personality.

Here are some ideas of how you can log your progress:

- Hold a monthly budget meeting with a partner (or check in with one of your cheerleaders) to track your progress in paying down your debts.

- Get a monthly reminder to check your budget/debt pay-off progress

- Start another Instagram account to document your progress (you can have up to 5–instructions here) dedicated to your debt-free journey.

- Keep it private or make it public. People love cheering on debt-free journeys! Find like-minded people by using the hashtag #debtfreejourney #debtfreecommunity

- I would love to cheer you on, so Follow me @MoneyFitMoms and/or let me follow you!

- If you love spreadsheets and visuals, use a debt spreadsheet (here are several visual debt-payoff charts and trackers from Vertex42 – a spreadsheet wizard)

- If you’re a pen-and-paper person–start a debt-free journal

Step 2: Make a list of all your debts

Debt is now your enemy. It’s time to round them up so you can begin to eliminate them one by one.

For each debt, write down the:

- Total Balance of the debt or loan

- Interest rate

- Monthly Minimum Payment

What are the most common types of debt?

A fixed-rate mortgage is usually low-interest rate and does not need to be paid off early. Here is a list of the most common types of high-interest debt to help you brainstorm and ensure you list all of your various types of debt.

- Credit card

- Personal loans

- Payday loans

- Car loan

- Unpaid bills (Cell phone, utility)

- Medical bills

- Home Equity Loan

- Student loans (If low-interest, you could choose to pay this off over time and move on to investing for retirement)

Creditors are not required to report debts to credit agencies, so it’s possible to have a debt that is not listed on your credit report. However, credit reports will likely contain many of your debts, so it’s a great place to start.

- Get your credit report(s) from annualcreditreport.com. (More about credit reports here)

Step 3: Create a Debt Plan with a Debt Snowball

A debt plan is basically writing down how much you plan to pay toward each debt each month.

I love the Snowball Method.

Set aside $1,000 as an Emergency Fund

Before attacking debt, I recommend saving up (or setting aside) $1,000 into an emergency fund. Don’t touch it unless it’s a true emergency and absolutely necessary.

Create a Debt Snowball

-

Figure out how much you can pay towards debt each month

Start with:

Your Monthly Take-Home Pay

Subtract – (Your Monthly Expenses including the minimum balances of each debt)

= Your Debt Snowball

For Example:

Monthly Take-Home Pay: $4,000

Subtract – Monthly Expenses $3,300 (Rent $1,500 + Food $500 + Utilities $300 + Insurance $200 + Gas $200 + Debt Minimum Payments $400 + Misc. $200)

= Debt Snowball: $700

2. Each month, pay:

– The minimum balance of each debt

and

– Pay the debt snowball on your smallest debt

You can technically save a little money on interest by paying off the debt with the highest interest rate first, but the moral victory of completely eliminating an entire debt will motivate you to pay off your debt FASTER.

3. Once you pay off one debt, move onto the next until you’re debt-free.

And don’t forget to celebrate after each victory!

How Long Will It Take Me to Pay Off All My Debts?

If you’re a lover of spreadsheets, here’s a fancy Debt Reduction Spreadsheet from Vertex42 that helps you calculate how long it’ll take to pay off all your debts.

Hint: The less you spend and instead apply towards debt, the faster you’ll pay them off! This brings me to my last step . . .

Step 4: Freeze Your Spending to Be Debt-Free Faster (and Build Wealth)

Freeze Your Spending to Cut Your Expenses

Insanity is repeating the same mistakes and expecting different results. If you continue using credit cards or personal loans, it’s like trying to brush your teeth with Oreos–it just won’t work. Switch to cash (or debit cards if necessary) to avoid the temptation to buy things on credit. Research shows that you spend less when you use cash!

Now that we’re debt-free, I use credit cards now for convenience, but if you’re finding they’re increasing your spending to the point that you’re not on track for your debt-free journey or investment goals, it’s time to ditch the credit card.

Pay Off Debt Faster to Begin Building Wealth

The faster you pay off debt, the sooner you can begin to BUILD WEALTH through investing.

You can increase income and/or decrease expenses to accelerate how quickly you can pay off debt and begin building wealth.

It may be easier to motivate yourself to make some sacrifices to your lifestyle when you see what it does for your long-term wealth.

Short Term Sacrifice Equal a Long-Term Payoff

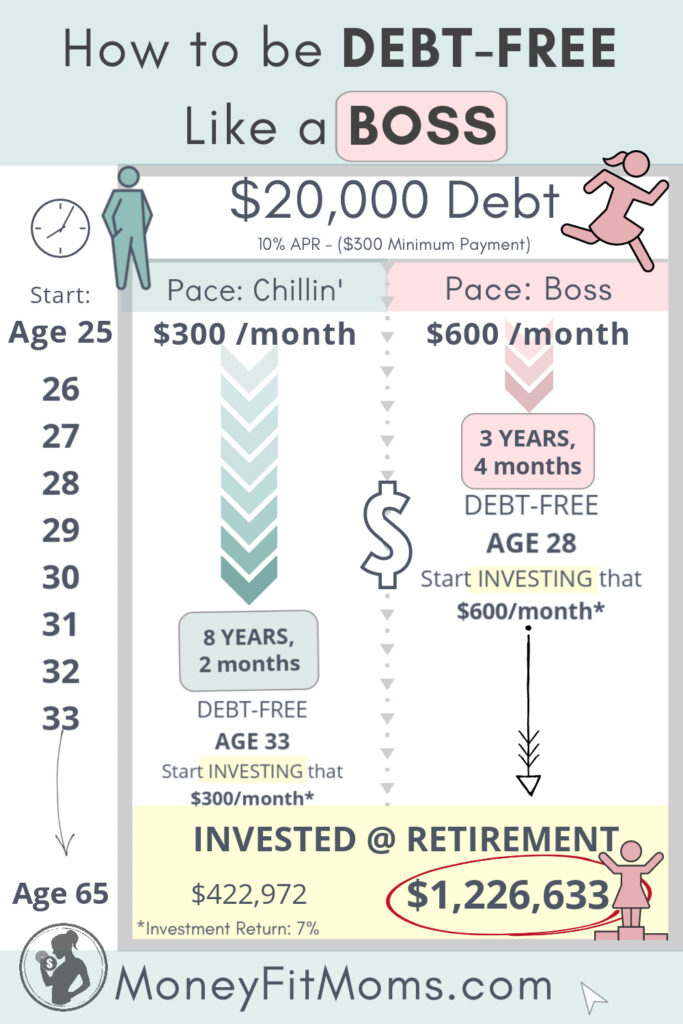

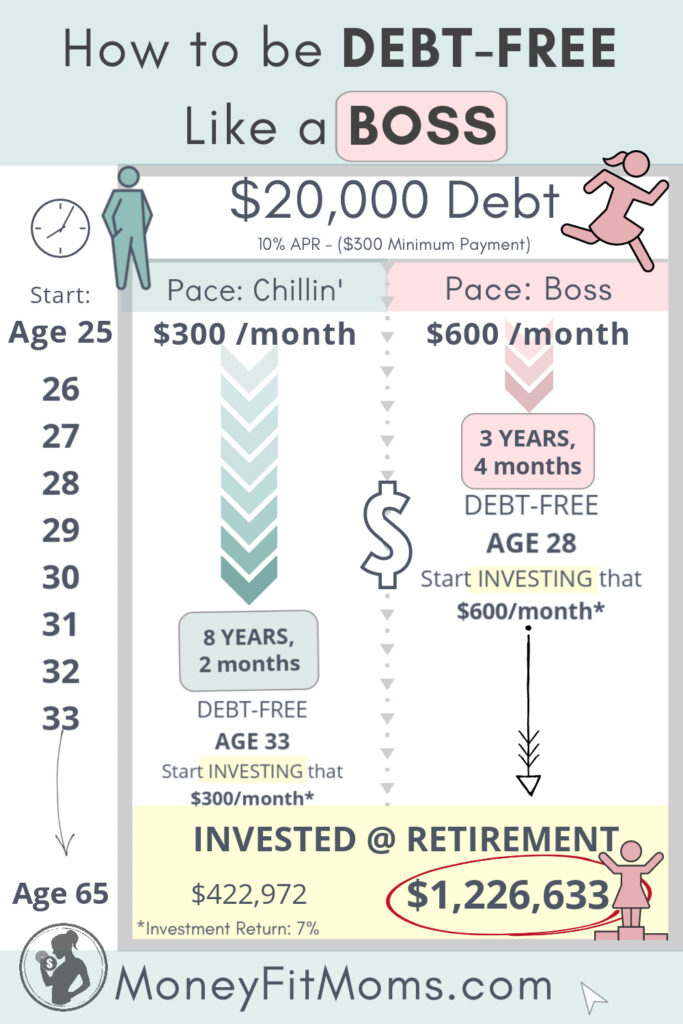

Example: You’re 25 years old and have $20,000 of debt at 10% interest. Let’s say the minimum payment is $300 a month.

Scenario 1: If you only ever pay the $300 minimum payment: It’ll take about 8 years and 2 months to pay off your debt. You’ll be 32 years old before you pay it all off.

Scenario 2: If you scrape together an extra $300 and pay $600 towards your debts every month: You’ll pay off your debt in 3 years, 4 months. Almost 5 years faster. Your debts will be paid off at age 28.

The BIG PAYOFF: Building WEALTH

If after you pay off debt, you invest that $600 every month, by age 65, it’ll be worth well over $1,000,000 (assuming a 7% long-term overall investment growth rate).