How much should I save for retirement?

(Calculate your “Monthly Retirement Savings Needed.”)

Before we zoom into details like a monthly budget, I want to take one more chance to look at the BIG picture — your “WHY.“

WHY do you want to take control of your financial future?

Do you want to . . .

- Feel confident that you’re on track for retirement? 😎

- Be able to achieve financial independence 💸 aka “retirement” earlier than age 67? 🏝️

- Travel more? ✈️

- Start a business or nonprofit to make the world a better place? 🌎

WHATEVER your “WHY”. . . make it HAPPEN with a FINANCIAL PLAN. 💸

Achieve your LIFE GOALS with a PERSONAL FINANCIAL PLAN

To start forming your PERSONAL FINANCIAL PLAN, I want you to start planning for the BIGGEST purchase you’ll ever make: RETIREMENT.

By “Retirement,” I mean FINANCIAL INDEPENDENCE. 💸

Financial independence has nothing to do with age or whether or not you choose to continue working.

Financial Independence is when you have enough investments assets to live off of your investments alone (instead of the income from your job).

You have the CHOICE to continue working after you reach financial independence, you’re just not dependent on that income. That extra income is icing on top of the cake. 🧁

Most people aim to stop working around the time they qualify for social security — which is fine. But you still need to ensure you’re ON TRACK for the retirement YOU want to have.

Money Fit Challenge #2: Start your Personal Financial Plan by CALCULATING your “MONTHLY RETIREMENT SAVINGS NEEDED”

By “Monthly Retirement Savings Needed,” I mean, the amount you will need to start saving (investing) EVERY MONTH (in the most tax-advantaged way possible) to build your retirement nest egg big enough that you can live off of it after you stop working.

Notice I said CALCULATE the amount NOT “start SAVING” that amount towards retirement. We’ll get to that, in-depth, LATER in the Money Fit Challenge (after we cover budgeting, debt-payoff, and building an emergency fund). 🚨 Spoiler alert — The goal with our financial goals will be: Set-it-and-forget-it. So you can worry less and live more.😊

The objective of this challenge: Above all, the goal is to start planning for your big life GOALS so you have MOTIVATION to budget if needed. Before worrying about the HOW, always start with your WHY.

TWO (2) OPTIONS to calculate your “Monthly Retirement Savings Needed”:

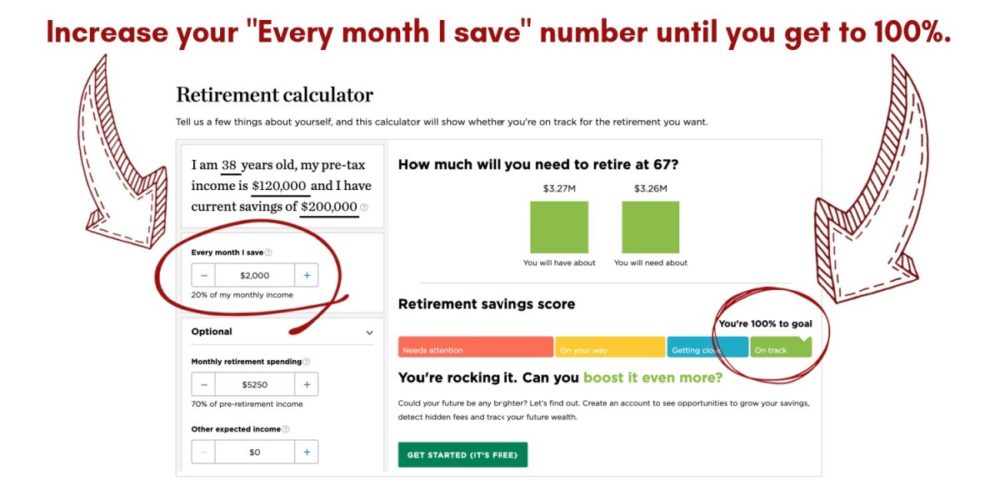

OPTION 1: A BASIC calculation using NerdWallet’s Calculator (or a similar retirement calculator)

Most financial sites have a retirement calculator that works for a basic “back of the napkin” type calculation. I think NerdWallet works for a basic calculation. I definitely would NOT base my whole financial plan on it. But if Option 2 intimidates you, it’s definitely better than no calculation or planning at all.

My issue with basic retirement calculators:

It assumes your spending and income are straight lines WITHOUT any ONE-TIME or VARIABLE income or expense events, like:

- A stay-at-home parent returning to work to increase the family income 💪

- Buying/Selling a home 🏠

- Sending kids to college 🎓 (Note: We’ll be covering this item in great detail later in the Money Fit Challenge)

- Rental income from an investment property 💵

FOR A MORE ROBUST CALCULATION that can account for more complex events, I recommend doing Option #2 instead (FREE + you can SAVE your retirement planning scenarios for future planning).

The NerdWallet calculator is relatively self-explanatory, but a few notes:

- Your “current savings” should be the sum of all your INVESTMENTS, NOT your Net Worth.

- Why? Unless you sell your home or other assets that add to your net worth, you’re not going to realize those gains. If you DO plan on selling your home as part of your financial plan, I recommend using option 2 instead, which can handle scenarios like that.

- Should I include my cash savings? That is optional, but if cash makes up a significant portion of your savings, I would lower your expected rate of return, as cash will NOT increase in value over time and will LOSE value over time (due to inflation).

Click on the “Optional” drop-down arrow

Also, be sure to click the drop-down arrow for “Optional” inputs:

- Change monthly retirement spending to what you expect your spending to be. If you’re not sure, the default is 70% of your current income.

- Change the retirement age if you plan to retire earlier.

- Rate of Return: To be conservative, I would not recommend estimating higher than a 6% rate of return. It’s wiser to have a better-than-expected retirement than to run out of money because of poorly performing markets.

OPTION 2: A more RELIABLE calculation using Empower’s (FREE!) Retirement Planner (that SAVES and automatically UPDATES)

The BEST Retirement Planner: Create a FREE Empower Account (Affiliate Link)

Do I sound like the spokesperson for Empower? Their financial tools are awesome. Rather than spending a ton of money on ad campaigns, Empower developed really good financial tools (including their Retirement Planner), made them available for FREE, and then depended on word-of-mouth to grow. Their plan worked! I’m hooked and telling everyone I know to start using their tools, too. 🙌

THE CATCH: When you first sign up, they will try to sell their OPTIONAL paid wealth management services.

If you tell them you’re not interested, they will leave you alone.

We’ll be discussing investing later in the Money Fit Challenge

The bottom line: At this point, their financial tools (including their retirement planner) are FREE. Paid wealth management services are OPTIONAL.

The nice things about Empower’s Retirement Planner:

- You can securely LINK to your financial accounts so your personal financial plan automatically UPDATES based on your actual investment portfolio results.

Trust me when I say it’s secure. My husband is an IT Security professional and we’ve been happily using Empower since 2014.

- Your Retirement Plan is SAVED so you can review/change it in the future.

- You can create MULTIPLE Retirement Plan scenarios.

This allows you to try different scenarios where you:

-

- Change careers 👩🍳

- Retire early 🏝️

- Buy / sell a home 🏠

- Move to a lower-cost area 📦

- Add one-time events like:

- Selling your home 🏠

- Sending your kids to college 🎓

- Change assumptions:

- For example, whether or not you want to assume social security income (currently available to those you have worked long enough and paid enough into the social security system).

- Blog Post: “How much Social Security will get?“

- Your tax rate (if you moved to a lower-cost area)

- For example, whether or not you want to assume social security income (currently available to those you have worked long enough and paid enough into the social security system).

How to use the Empower Retirement Planner – How much do I have to save for retirement?

Check out my Empower Retirement Planner Tutorial:

NOTE: To use all features, I recommend using a LAPTOP.

STEP 1. Create a FREE account with Empower.

The BEST Retirement Planner: Create a FREE Empower Account (Affiliate Link)

First, you need to create a free Empower account. Some of you already created an accounting during calculating your net worth because I told you Empower is how I instantly track my updated Net Worth.

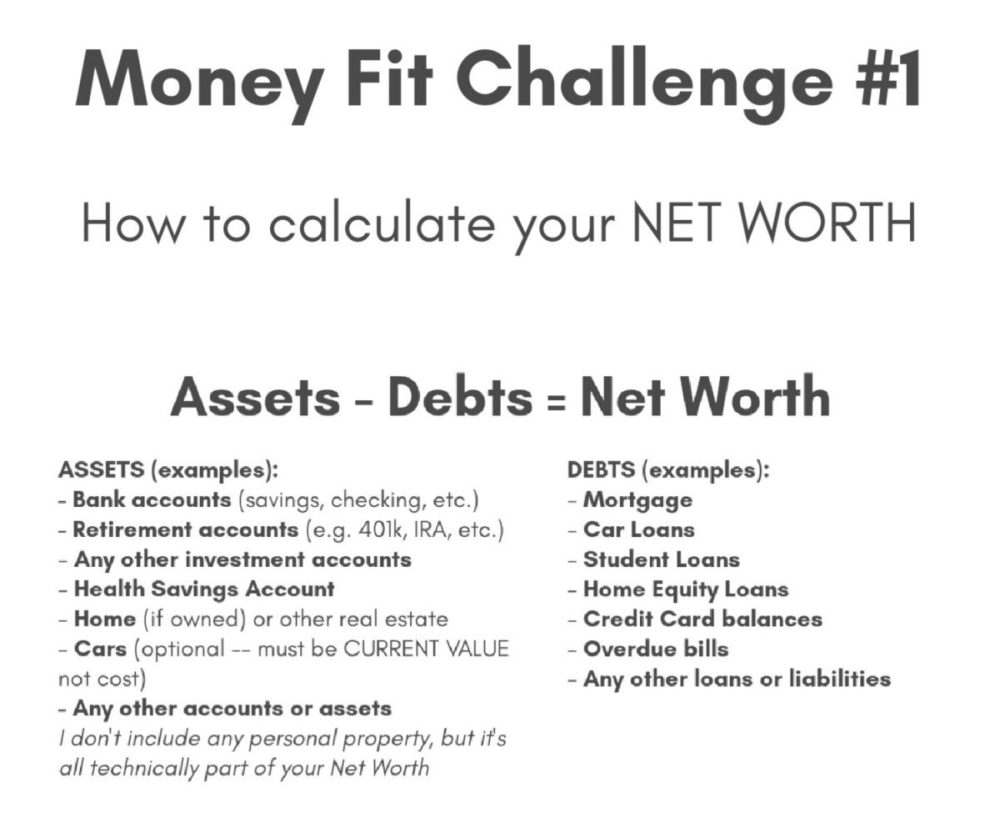

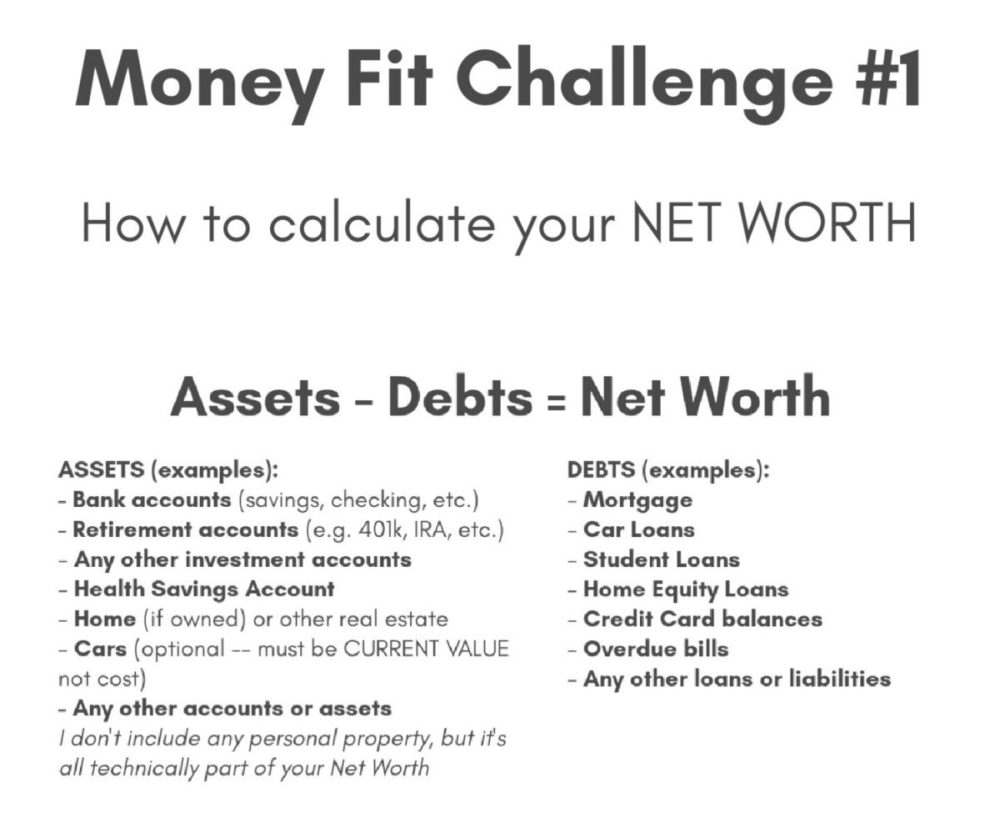

STEP 2. Link your accounts to fill out your net worth.

Next, link your banking, investment, retirement, and debt accounts so they will automatically update (for both net worth and retirement planning).

To help you out, here’s a reminder of what types of accounts/debts you’ll want to add:

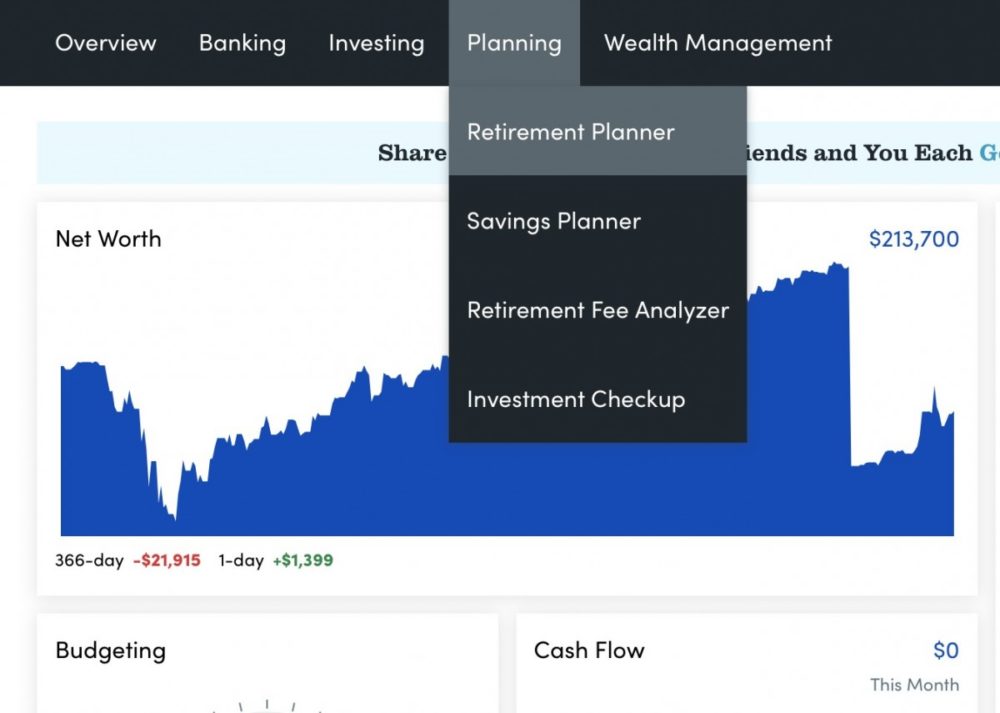

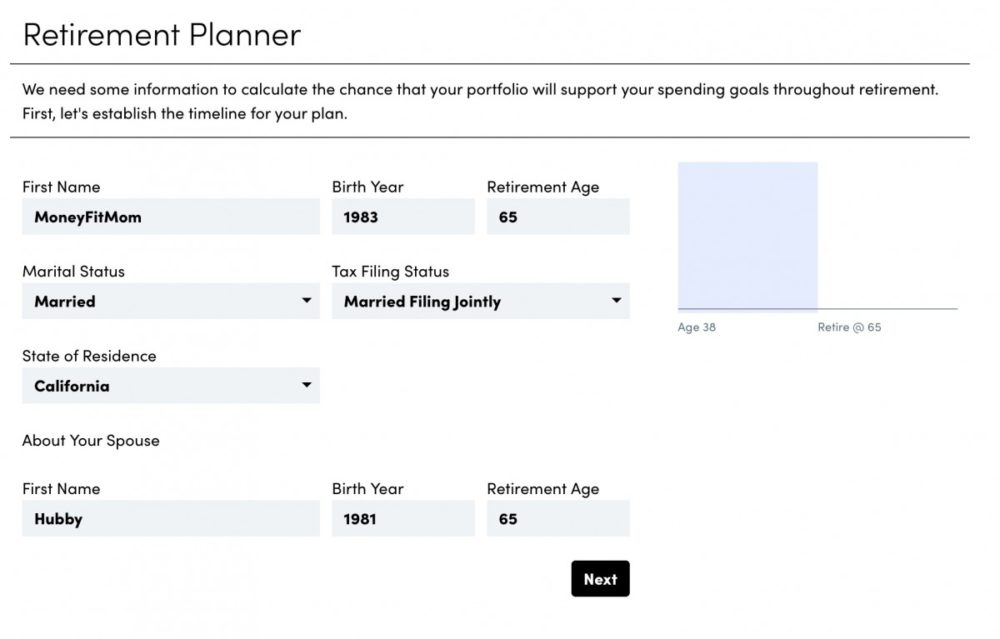

STEP 3: Go to Planning: Click “Retirement Planning”

Then, follow the prompts to start creating your retirement plan.

First, fill in your basic data to help the planner calculator the timing of your goals. The planner automatically takes inflation into account.

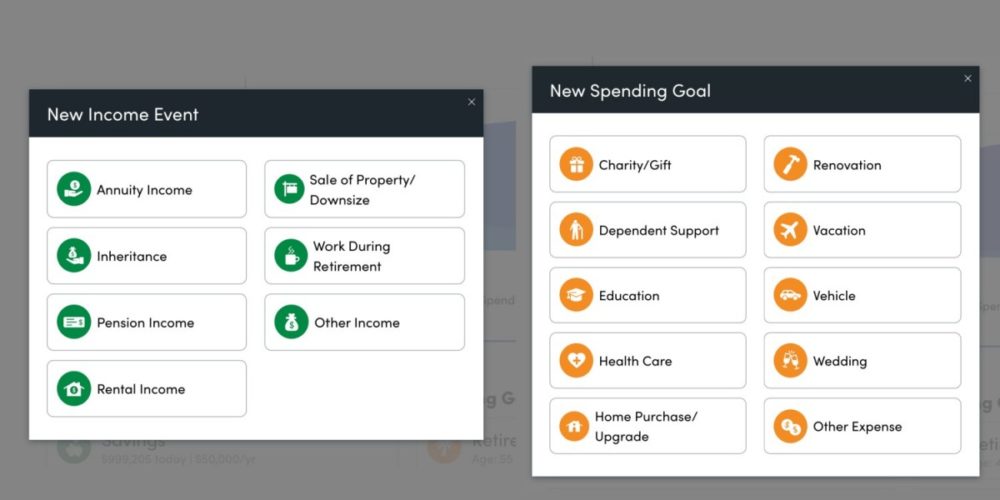

STEP 4: Add any additional income/expense events to make a more detailed financial plan

(e.g. Buying or selling a home, Education: sending kids to college) Note: I will be discussing both of these items later in the Money Fit Challenge.

Here are all your income/expense options:

I only added the major events. For us, that was:

INCOME EVENTS:

- 👉Savings👈 (this is THE MOST IMPORTANT number — the one you’re trying to figure out for this Money Fit Challenge) is your yearly savings amount.

- My husband’s social security (at this point, I have not earned enough work credits to qualify for my own social security benefit. I could eventually qualify for a smaller spousal benefit, but to be conservative, we left that out of our planning.)

- Other income: We added an additional income amount for future years because of the way my husband’s compensation is structured. We plan to put this extra amount towards our retirement nest egg.

- Sale of partnership: My husband bought into a business partnership that we will sell when he retires. Empower allowed us to structure this as a multi-year cash event. Once again, I love what this tool can handle.

- Kids’ Higher education: We added an Education expense event for each of our kids for the time/cost we estimate for their college expenses.

- Health Care: Because my husband plans to retire early (before he would qualify for medicare), we added an additional $20,000/year expense from his retirement year until medicare

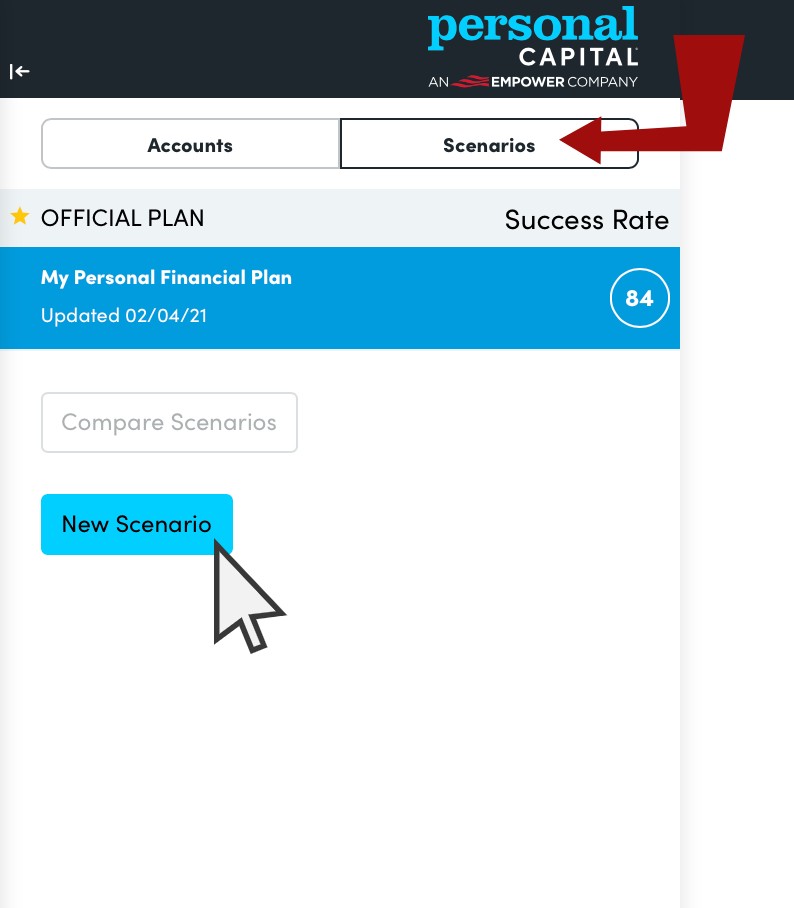

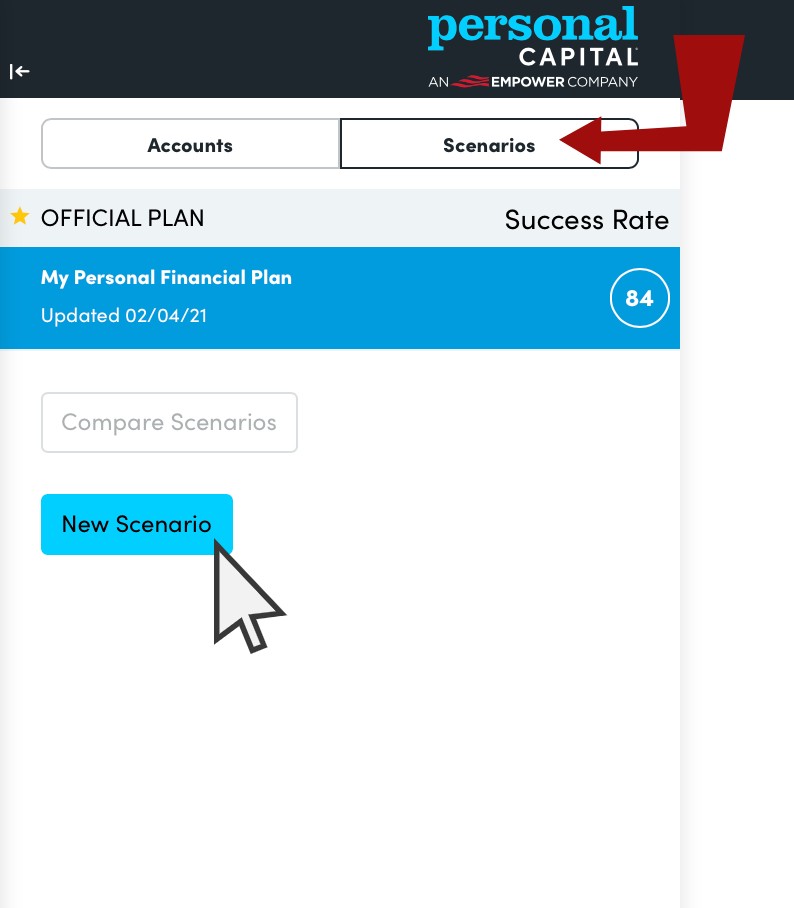

STEP 5 (OPTIONAL): Create alternative Scenarios to try out some ideas

Lastly, you can try out a few different financial scenarios.

- Early retirement

- Retire to a lower-cost area

Sign up for the Money Fit Challenge

If you’re not already signed up, accomplish your financial goals faster! Join the FREE Money Fit Challenge!

Empower Personal Wealth, LLC (“EPW”) compensates Money Fit LLC for new leads. Money Fit LLC is not an investment client of Empower Advisory Group, LLC.