Why would Banks/Mortgage Brokers/Realtors want you to buy MORE than you can afford?

How Much House Can I Afford – Rule of Thumb

- Mortgage Payment: Principal + Interest

- Property Taxes

- Homeowner’s Insurance

- HOA fees – If Applicable

- PMI – Private Mortgage Insurance – Applicable if you paid less than 20% down

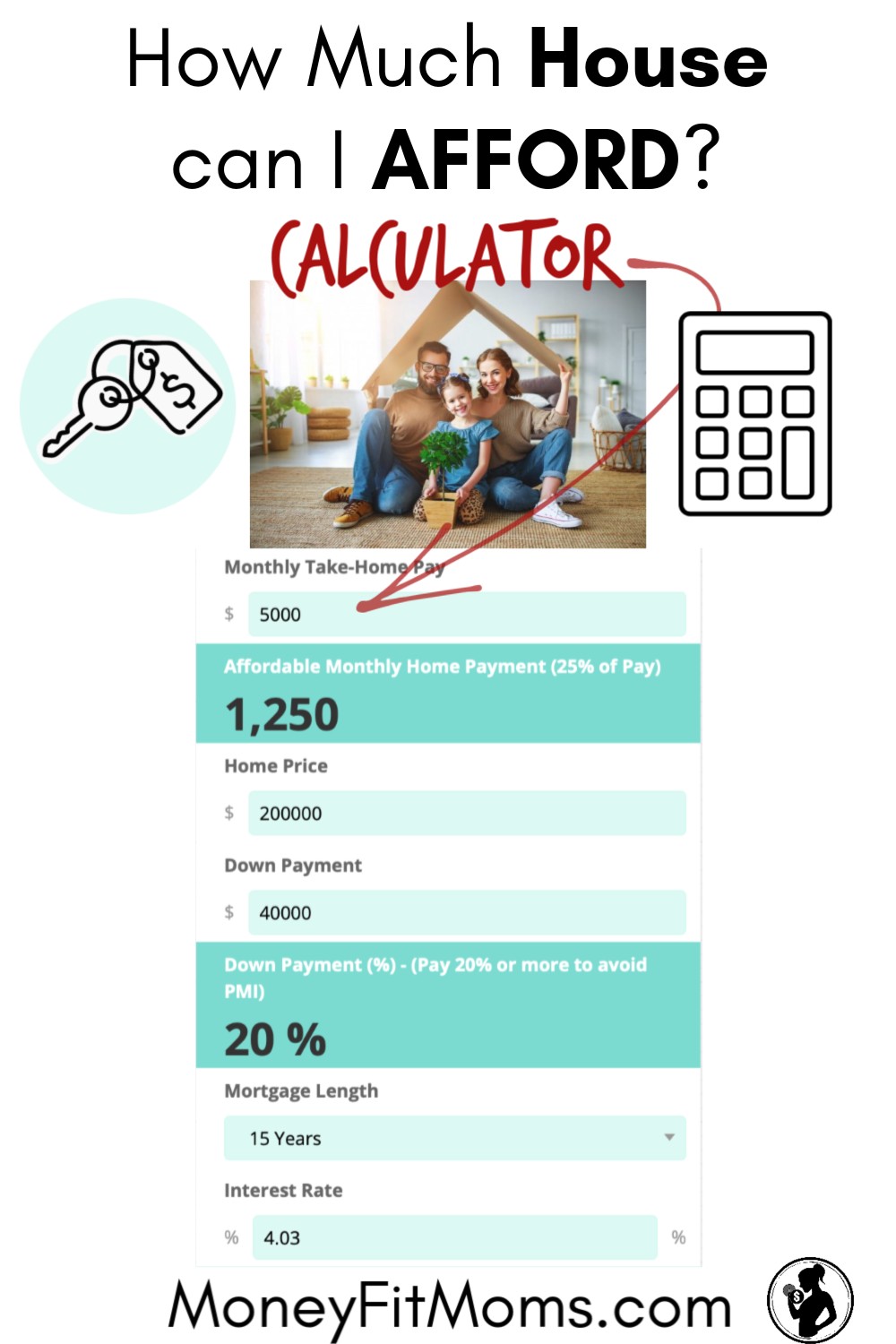

How to calculate how much home you can afford

1. Add up your total monthly income (take-home pay)

You + Spouse = Total

Example: If you make $3,000 after tax and other deductions and your spouse makes $2,000 = $5,000 total monthly take-home pay

2. Multiply it by 25% to get your maximum housing payment

Example: Your take-home pay is $5,000/month. x .25 = $1,250 (Your Maximum Monthly House Payment)

3. Use a mortgage calculator to see how much house you can afford

From here, the amount of house you can buy depends on:

- How much money you put down (Put at least 20% down to avoid paying PMI)

- Interest rate (ALWAYS get a fixed-rate mortgage. Avoid ARMs – Adjustable Rate Mortgage)

- Property Taxes

- Homeowners Insurance

- HOA Fee (If applicable)

- PMI (Private Mortgage Insurance – Applicable if you put more than 20%)

Home Affordability Calculator

Use this mortgage calculator to determine how much house you can afford without going over your Maximum Monthly Housing Payment.

Comparison 1: 25% of Take-Home Pay

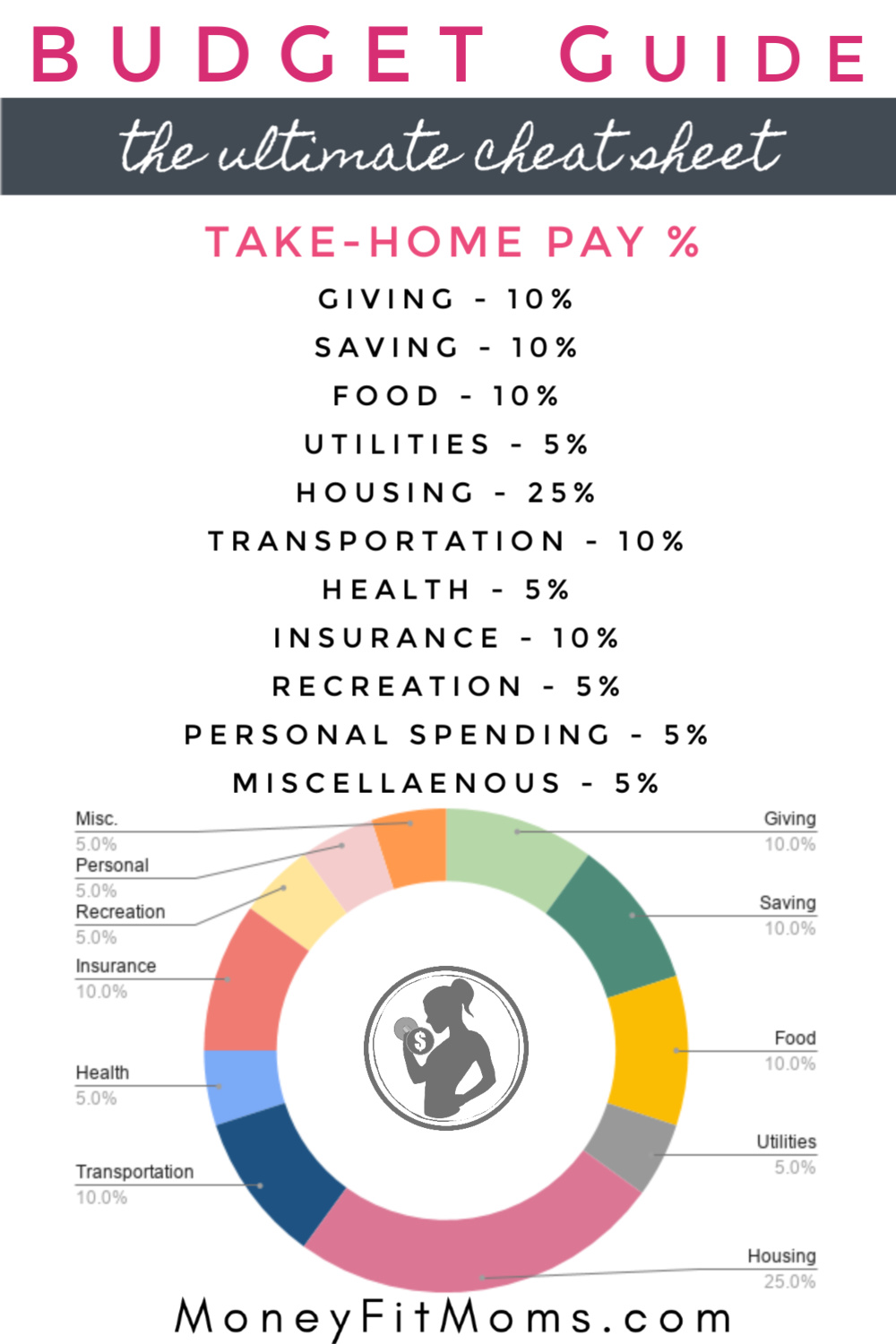

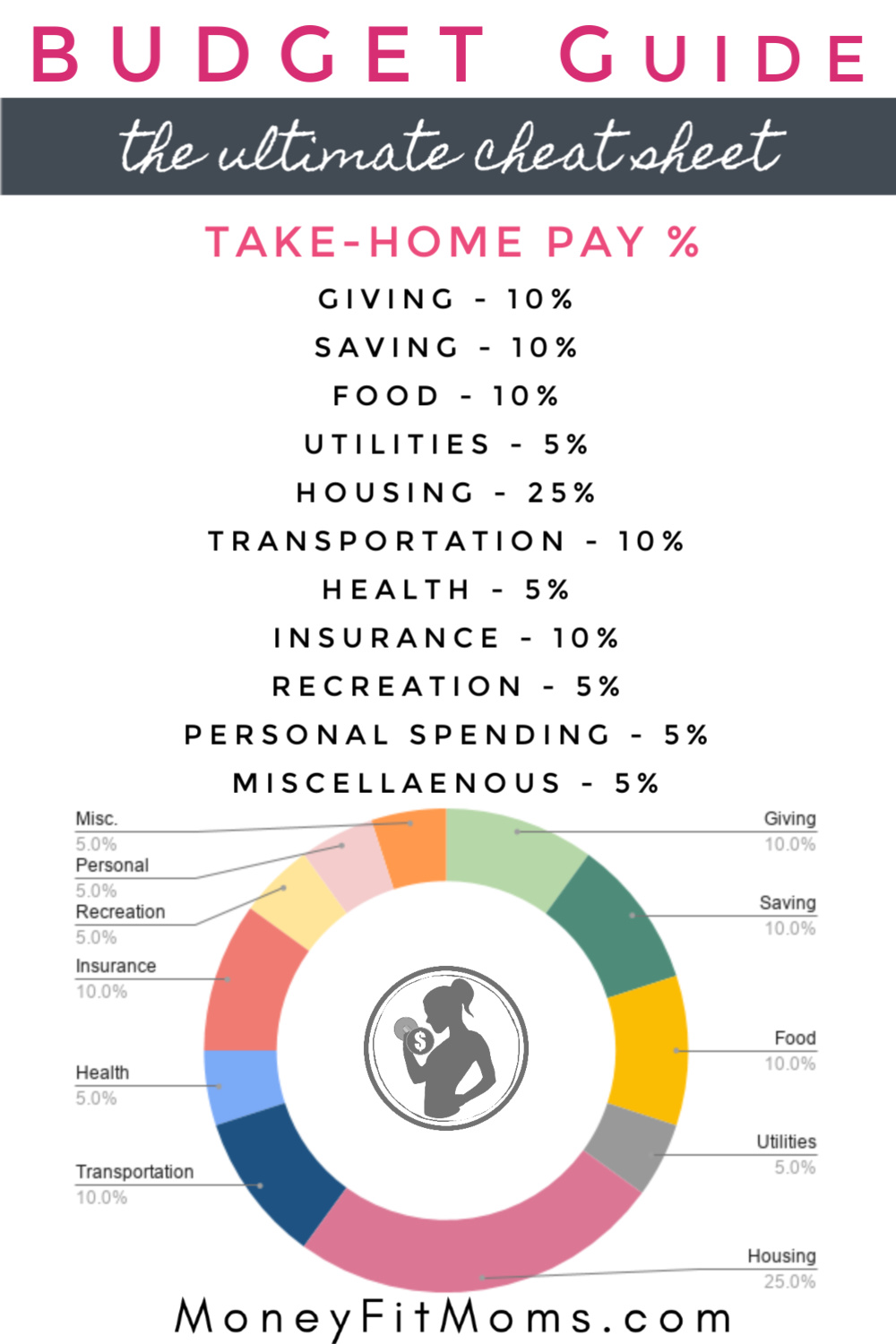

Budget Percentages Guide

Comparison 2: Zillow’s DANGEROUS Recommendation

According to Zillow’s home affordability calculator, they will allow your debt-to-income ratio to go up to 36% of your GROSS income.

- Saving – 9% (not enough)

- Food – 10%

- Utility – 5%

- Transportation – 10%

- Health/Medical – 5%

- Insurance – 10%

Total: 49%

You don’t have ANY MONEY leftover for:

- Recreation (sports, music lessons, activities)

- Vacations

- Personal spending (haircuts, clothes)

- Miscellaneous (birthday parties, Christmas presents)

You’re more than house poor though–you’re also not saving enough to be able to be both on track for retirement and replenishing your emergency fund, which means you’re vulnerable in case of:

- Job loss

- Health issues (both medical bills and loss of income)

Rent vs. Buy: Are you financially READY to buy?

Some people who end up in huge debt were there partly due to a home-buying nightmare.

They had:

- Bought a home too early–before they were financially prepared and/or

- Bought a more expensive home than they could afford.

Here are some financial milestones you should hit BEFORE buying a home:

1. DEBT: Be debt-free (other than a conventional fixed-rate mortgage, if this home you’re considering is a second purchase)

This means no home equity loans, credit card debt, or consumer debt of any kind. If you’re really motivated to get into a home, attack that debt fast so you can start working on getting into a home you love!

2. EMERGENCY FUND: Have a fully funded Emergency Fund (3-6 months of expenses)

Homes, even relatively new homes, can surprise you with unexpected maintenance costs. A fully-funded emergency fund acts as insurance to protect you from going into debt for expensive home repairs.

3. DOWN PAYMENT: Have enough cash for a 10-20% down payment and a 15-year fixed-rate mortgage

Paying 20% or more down will help you avoid paying expensive PMI (Private Mortgage Insurance)–an expensive cost that you would have to pay on TOP of your down payment

How Much House Can You Afford? Stick to the 25% Rule-of-Thumb

Cannot Afford to Buy A Home Yet?

You are making the right move by not jumping the gun and setting yourself up for a financial nightmare. If you’re feeling deflated–don’t! YOU are capable of hitting these milestones and THEN getting your dream home.

If you need help and encouragement, start with my Money Fit Challenge and follow along on Instagram and Facebook.