This five-minute money trick helps you set aside money for large, irregular expenses with a sinking fund. Big expenses will no longer blow your budget because you’ll have already saved for each of those items. The only thing that can blindside you is a true emergency (that will be handled with your emergency fund).

What is a SINKING FUND?

A sinking fund is a name for the process of saving up for things by “Setting aside a little each month.”

The #1 Budget Mistake and How to Avoid It

Most people remember to budget for regular monthly expenses like:

- Rent/Home Mortgage payment

- Food

- Gas / Car Payment

The big mistake people make is they forget to brainstorm and plan for large, irregular expenses like:

- New car

- Large upcoming vacation

- Home repairs/renovations

- New laptops/phone/tablets

- Insurance payments (semi-annual)

- Large gift expenses (e.g. Christmas gifts)

Most of these expenses are not unexpected–they just don’t happen every month. Irregular expenses are easy to forget about–until they hit your bank account and single-handedly blow up your budget.

. . . which brings me to my five-minute trick.

Take Control of Irregular Expenses with a Sinking Fund

The best way to take control of irregular expenses is by spending five minutes a month preparing for them.

- Hold a short MONTHLY BUDGET MEETING

- Make sure you know the (1) time and (2) location this meeting will happen or it simply won’t (I learned this from reading Atomic Habits). For example, my husband and I hold our monthly budget meeting:

- When: On the first Sunday of the month, in the afternoon after we put our kids down for “Quiet Time”

- Where: In my husband’s office

- Set a reminder/trigger (If you want an email reminder to hold your Monthly Budget Meeting on the first Sunday of the month, along with my monthly Money Fit Move, sign up here)

- Make sure you know the (1) time and (2) location this meeting will happen or it simply won’t (I learned this from reading Atomic Habits). For example, my husband and I hold our monthly budget meeting:

- SPEND FIVE MINUTES brainstorming for large, upcoming expenses–see examples below to help you brainstorm.

- Note: I send this list of suggested large irregular expenses in this printable agenda along with my monthly email.

- Read on for a list of large irregular expenses to help you brainstorm.

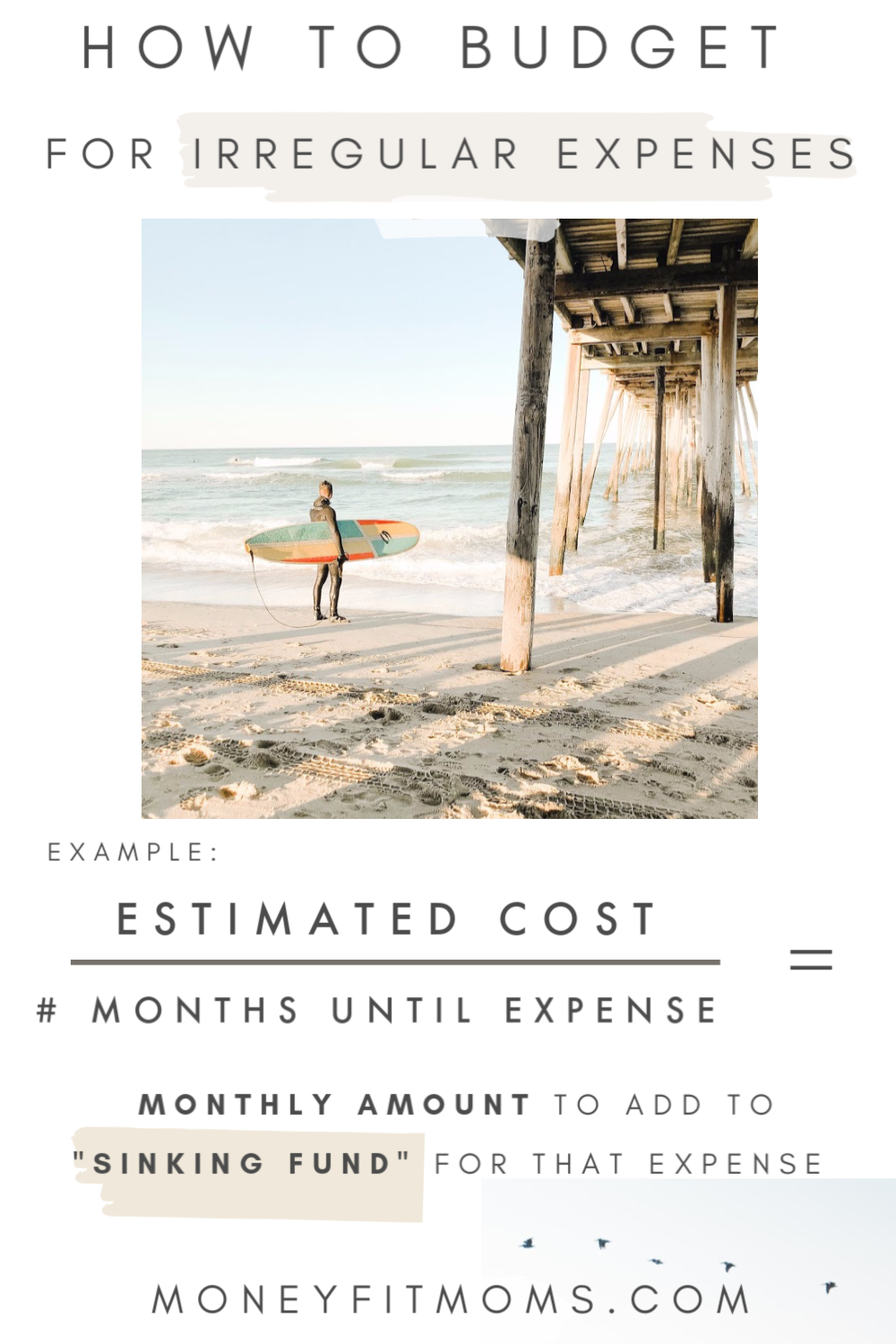

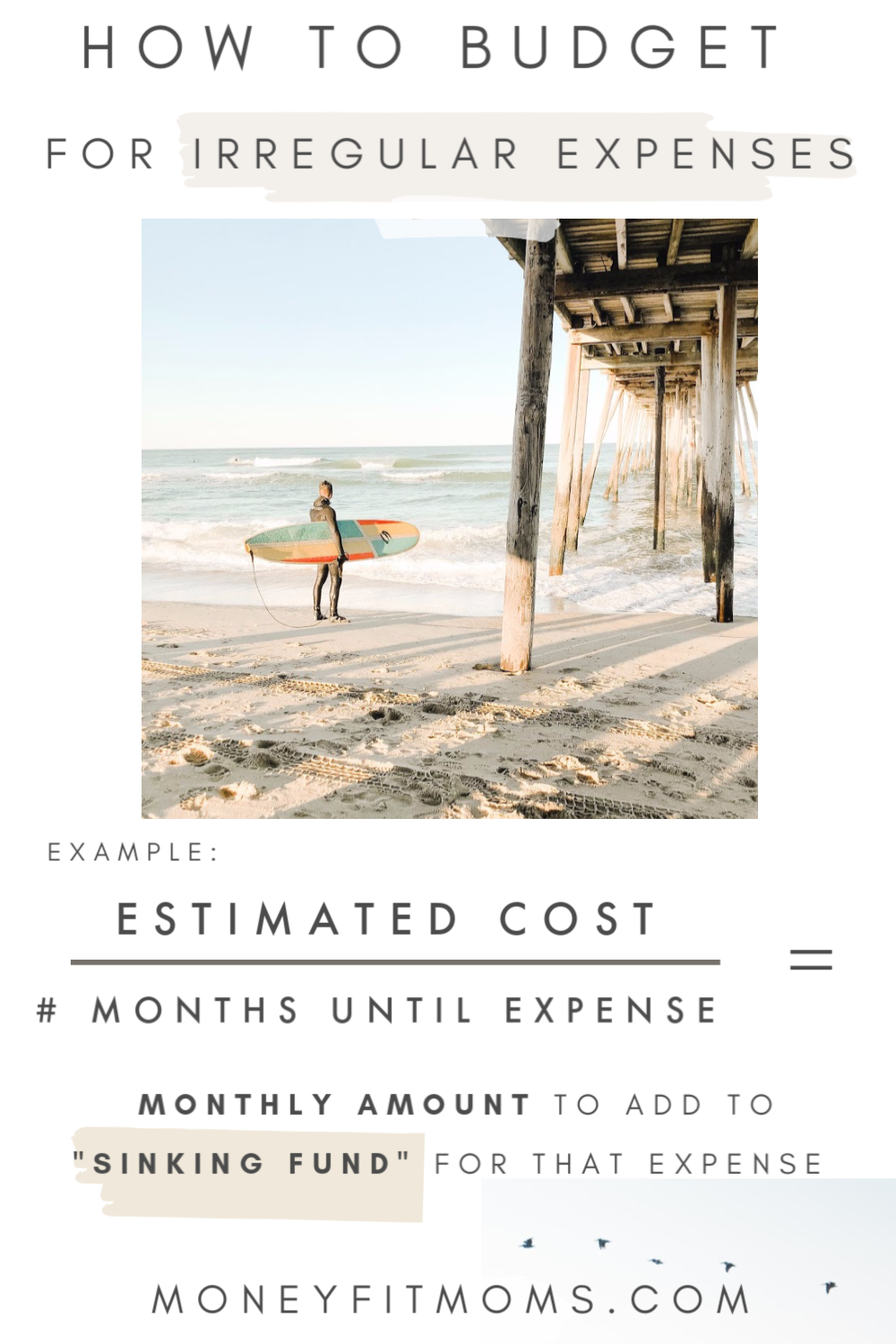

- BREAK DOWN the expense into a monthly amount and include in your budget as a SINKING FUND.

- Each month you can slowly set money aside so when the expense comes around, you’ve already saved up for it.

- Note: If you’ve tried doing this before and have struggled, the budgeting app YNAB has a really great way to set money aside for various expenses without having to open a separate bank account. YNAB calls this category of large, irregular expenses “True Expenses.”)

- Each month you can slowly set money aside so when the expense comes around, you’ve already saved up for it.

You’re Not Psychic–DO YOUR BEST!

You can’t always predict the timing and amount of irregular expenses. For example, you don’t know when you’re going to need an expensive root canal.

Sinking Funds and budgets, in general, are NOT meant to be perfect predictions of the future. They help you prepare for your best guess and an emergency fund helps you fill in the gaps.

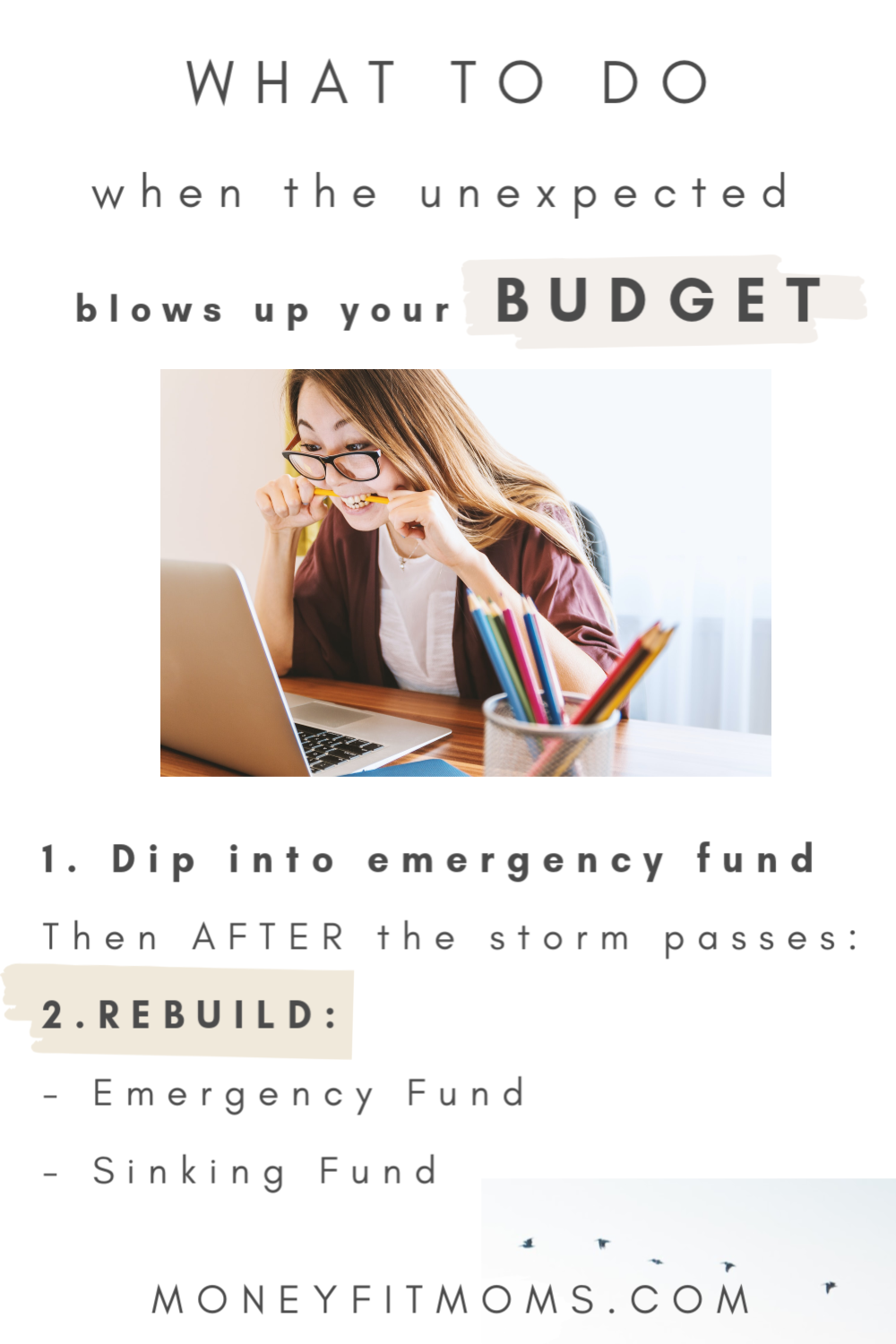

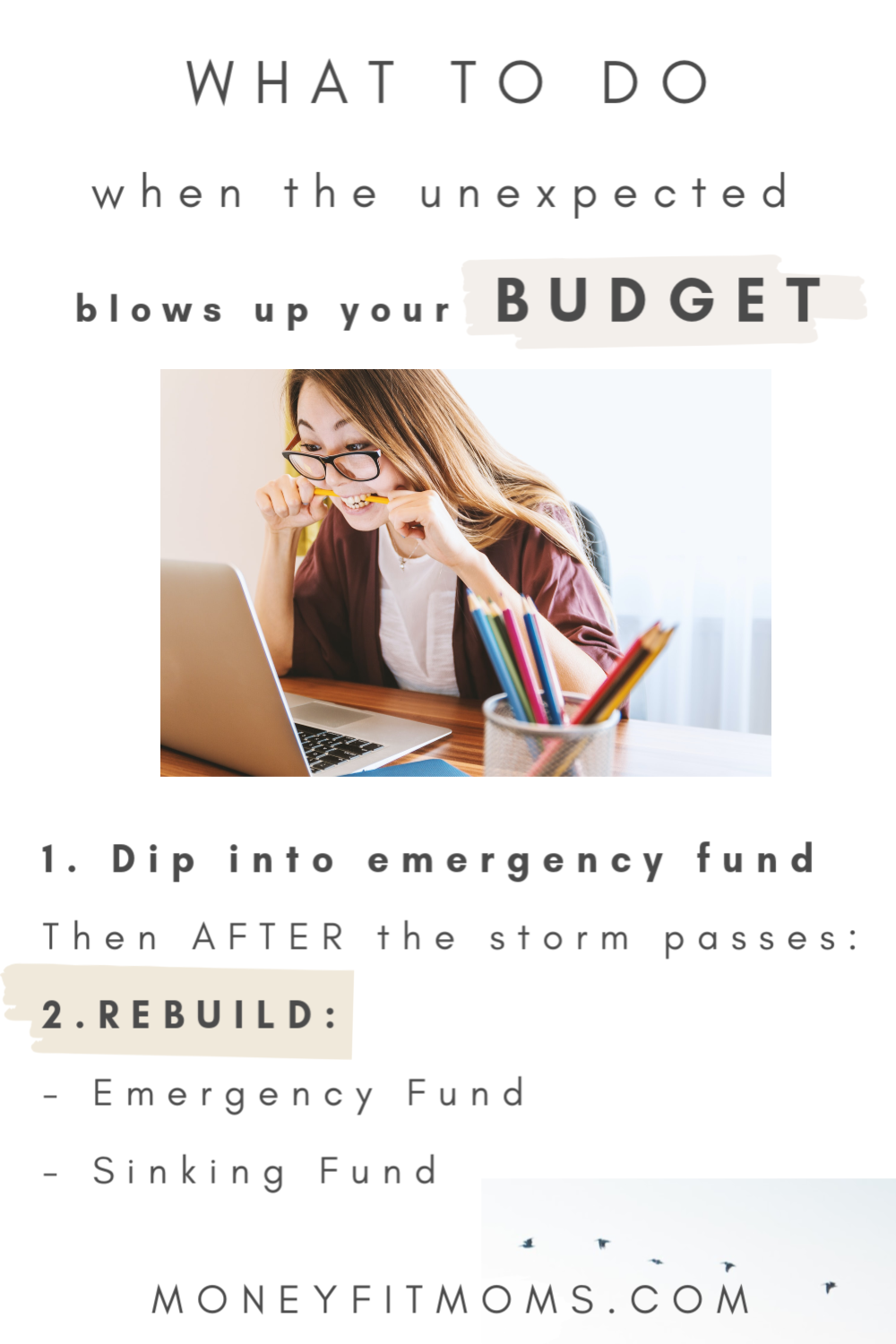

When a Surprise NECESSARY Expense hits

If an irregular expense overwhelms your sinking fund, dip into your emergency fund as needed. However, you’ll want to start rebuilding both the sinking fund and emergency fund as soon as possible.

THE FIVE MINUTE MONEY TRICK

In summary, the FIVE MINUTE MONEY TRICK is to spend five minutes during your Monthly Budget Meeting brainstorming upcoming large expenses and to start setting aside money each month so you’ve saved up to pay cash for those expenses when they hit (rather than financing that purchase with debt and paying hundreds or thousands of dollars in unnecessary interest expenses).

List of large irregular expenses to help you brainstorm and prepare:

(Want to print these items for your monthly budget meeting? They’re listed under Item #4 of this Printable Monthly Budget Meeting Agenda)

- Property Taxes (If not rolled into your mortgage expense, I definitely recommend accruing each month in your monthly budget)

- Insurance Payments (e.g. car insurance, life insurance, etc.)

- Home repairs/renovations

- Medical expenses (e.g. If you’re planning on having another child)

- Veterinarian expenses

- Dental work and braces

- A new car (or preferably gently used and therefore cheaper car)

- Car repairs (I recommend including a monthly average for car maintenance and repairs)

- Kids extracurricular programs, lessons (if not part of your monthly budget)

- Annual memberships (e.g. Costco, gym, pool, sports)

- School Tuition or other educational expenses

- Electronics (laptops, phones, and tablet don’t last forever–start saving now or be frustrated later

- Travel and Vacations

- Gifts (e.g. Christmas gifts, if you’re not already including this in your monthly budget amount

Wait Until the Sinking Fund is Full before Purchasing

We discussed the unexpected necessary expenses (like emergency dental work) above. But what do you do when an amazing unnecessary expense (like a fun vacation or home upgrade) comes to tempt you? Stick to your guns and wait until you’ve saved up! If you don’t have money saved up to buy something, that means you can’t afford it . . .yet. Don’t be tempted to get into debt. It’s not worth it!

Comic Relief–SNL Clip: Don’t Buy Stuff

If you can handle a little humor on this topic, this SNL skit with Amy Poehler and Steve Martin hits the nail right on the head.

Money Fit Move #5: Plan for upcoming large expenses with a sinking fund

Large expenses are inevitable. Cars break down. Laptops quit. If you want to buy a home, you’ll need a down payment. Property tax and insurance payments come due. Rather than waiting for these expenses to pop up and hoping you have the money, make your best guess for the amount and timing of the expenses and start saving now with a sinking fund.