A 529 Plan is a great way to save for college when you’re (1) on track financially and (2) have money that you’re prepared to dedicate exclusively to educational expenses.

Before you start saving for your child’s college fund, I would make sure you have taken these other higher-priority Money Fit Moves first:

- Have already paid-off all Debt (other than a fixed-rate home mortgage)

- Have fully-funded your emergency fund (3-6 months of expenses)

- Are on track for retirement – Retirement Calculator (e.g. Contributing 15% of your household income to retirement or investment accounts)

That being said, I have to admit we opened our kids 529 plans (with a very low fee fund) and started contributing a very small amount before we met those goals because we wanted somewhere to put those occasional cash gifts people gave our children when they were too young to enjoy spending it. If you decide to try this strategy, double-check your desired 529 plan to make sure you won’t be hit by a lot of fees that would hurt your little investment.

Join the FREE #MoneyFitChallenge

Getting your kids’ college savings on track is part of the FREE #MoneyFitChallenge! Join other moms who are learning how to raise money-savvy kids.

You’re more likely to accomplish financial goals if you have a supportive community and step-by-step instructions.

(1) Join the supportive @MoneyFitMoms community (Instagram and Facebook)

(2) Get FREE step-by-step instructions and tools to accomplish all the Top 10 Money Fit Moves. (e.g. budgeting, pay off debt, investing, retirement, create a will)

Improve your BUDGETING & INVESTING! Join the FREE #MoneyFitChallenge

What is a 529 plan? How does it save more for college?

529 Plans are tax-advantaged accounts to help you save for education.

Earnings grow tax-free

The money you contribute will be invested in underlying funds and (to motivate people to save for college) the government allows those earnings to grow tax-free.

Distributions are tax-free if used for education

The distributions are tax-free when used for qualified education expenses. Although plans cannot guarantee returns, they generally grow at market rates.

You can check out each fund’s historical performance by going to its website. For example, here is the historical performance of My529 Plan (Formerly UESP)–FYI this is the 529 Plan we use and we’re happy with it. Short-term results vary depending on market fluctuations, but their longer-term returns are solid and definitely more than a typical savings account.

Example:

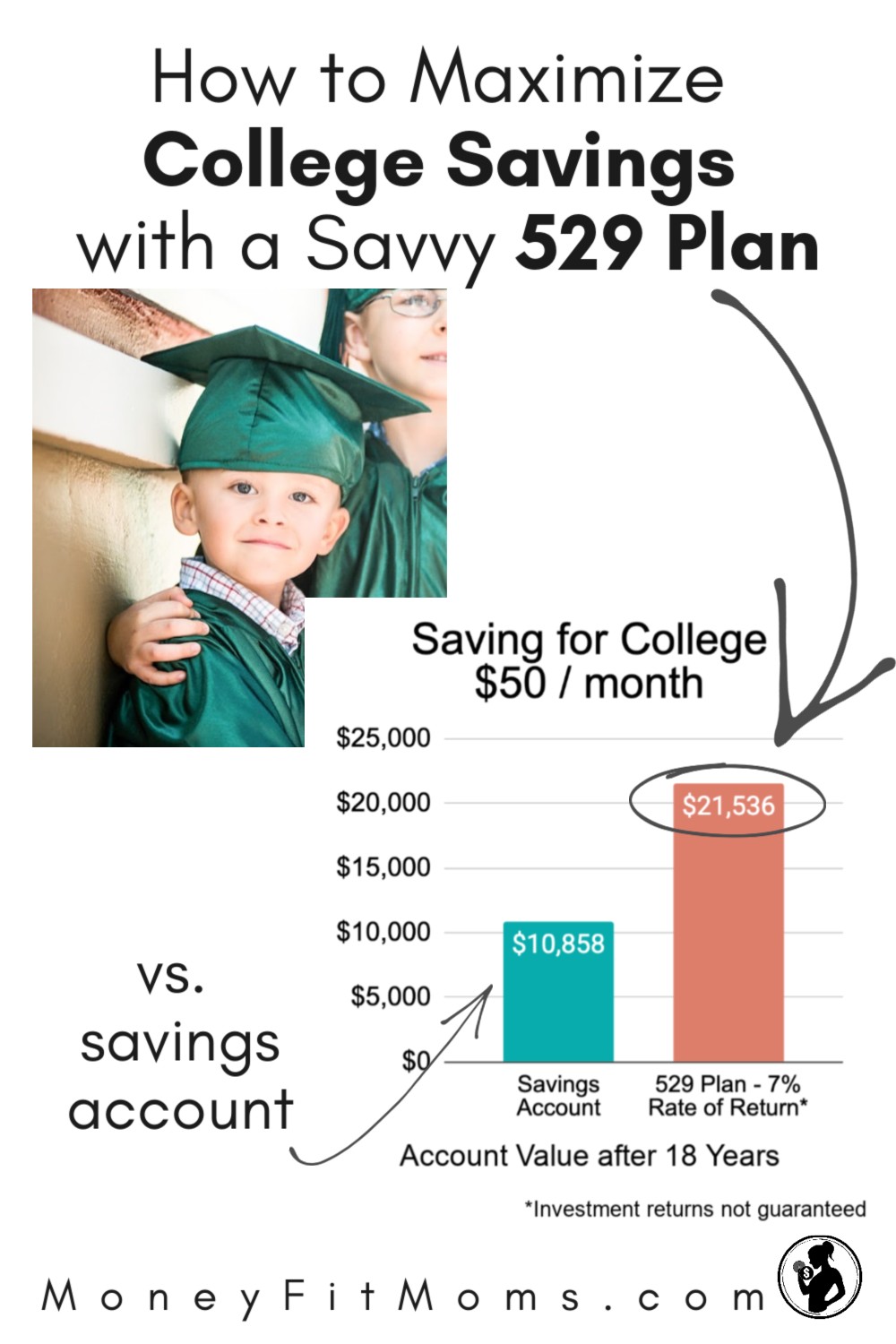

You contribute $50/month to your child’s college fund. What would be the difference if you did this in a regular savings account that earned, say, 0.1% interest (taxed) vs. a 529 plan that, in the long term, earned about 7% (not taxed). The average return on a savings account, according to the FDIC, is less than 0.1%. Only a 6% difference in returns, how much could that matter? QUITE a bit, actually–almost double. After 18 years, this is how much you’d have:

Over Long-Term (5+ years), 529 Plan will usually outperform a typical savings account

Although I can’t predict the future on what market rates will be, over the LONG-TERM they’ll most likely be better than savings account rates. Plus, moving it out of a regular savings account will prevent the temptation to spend that money on other things.

Note: If you’d prefer to have the option to use this money for something other than qualified educational expenses, a 529 plan might not be for you.

529 Plan vs. Savings Plan Calculator

If you want to experiment with the numbers, try this calculator:

[uCalc id=279258 name=529 Plan vs. Savings]

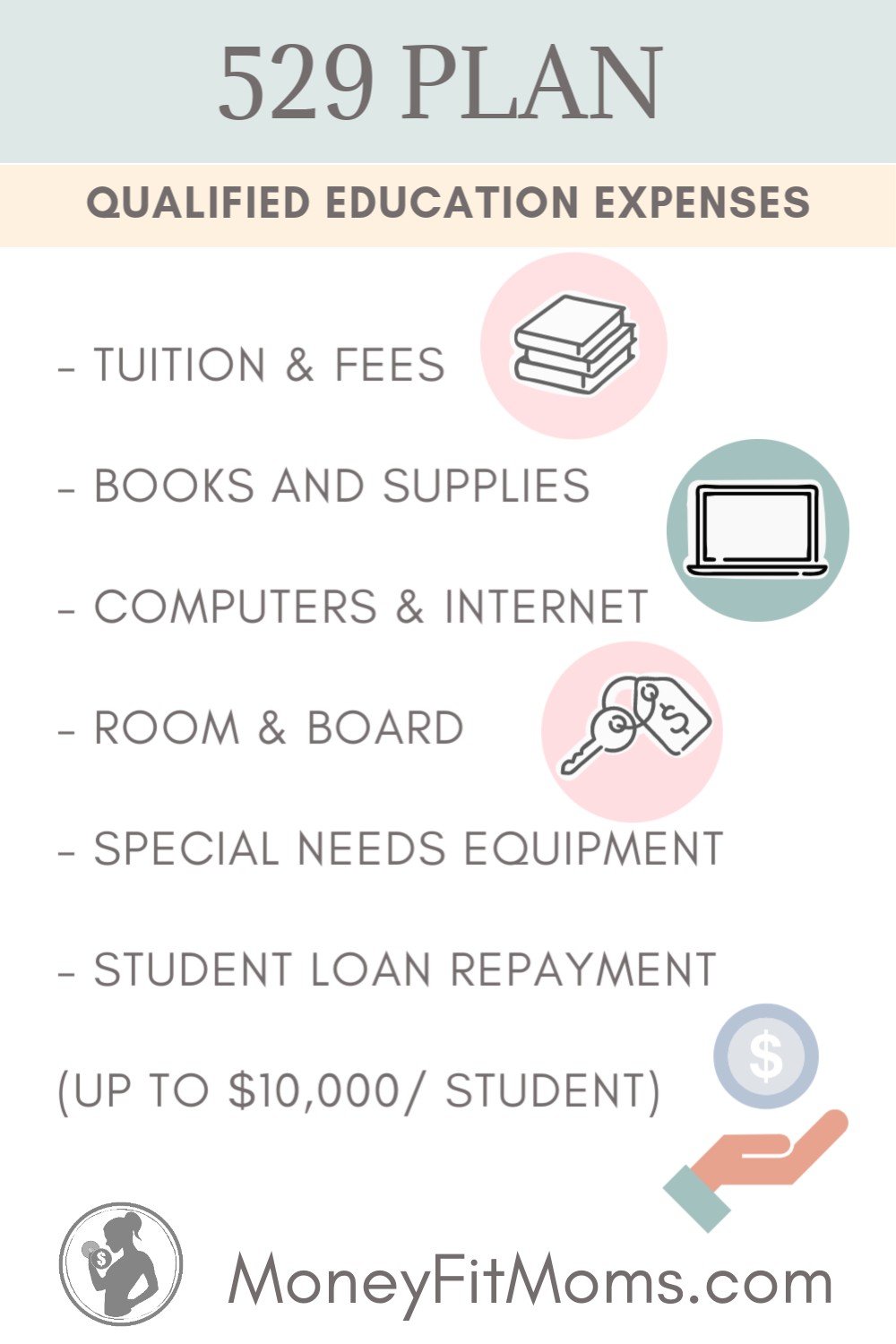

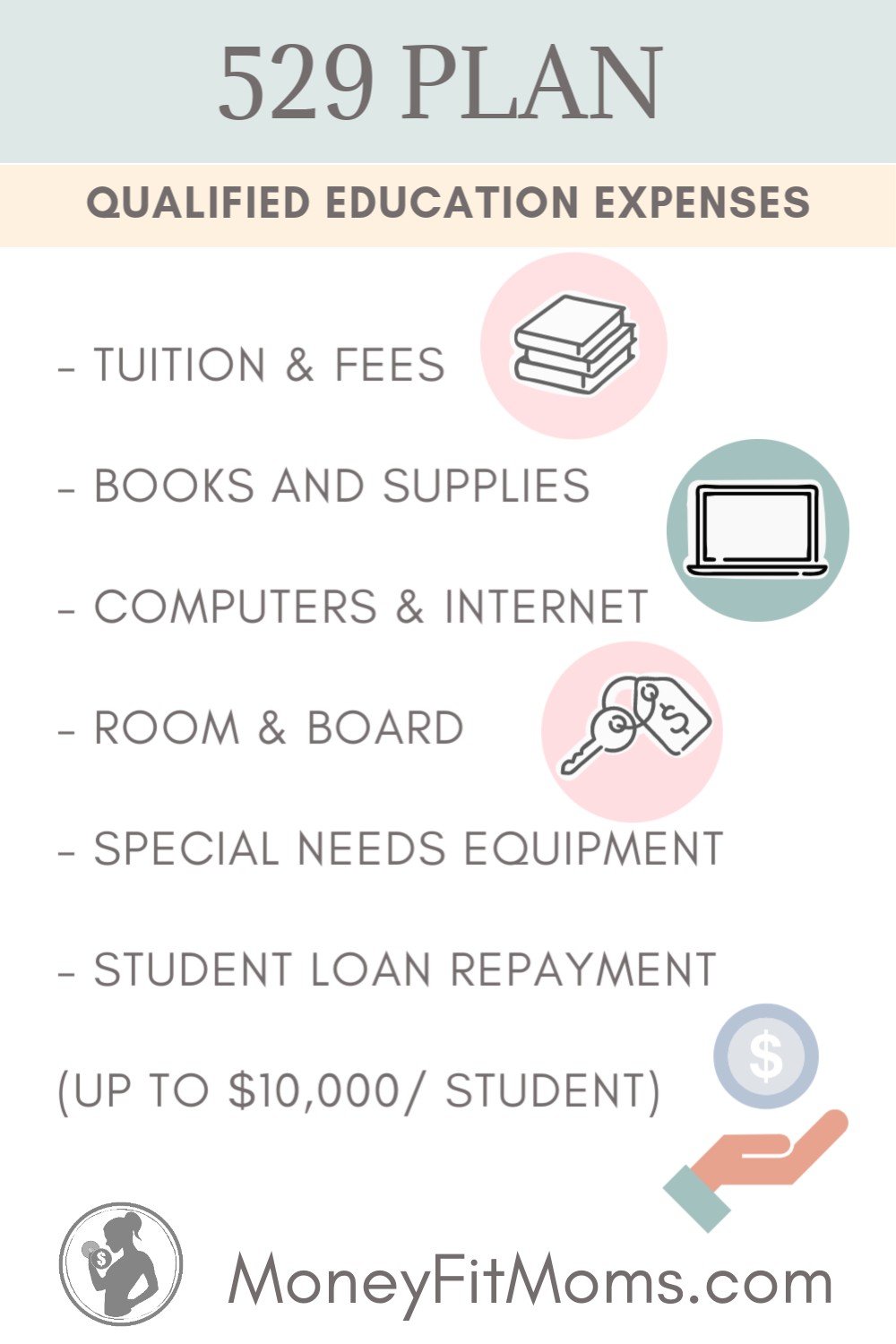

What are 529 Plan “Qualified Education Expenses“

529 Plan Distributions used for Qualified Education Expenses are tax-free. If the funds are withdrawn for a purpose other than qualified education expenses, the earnings will be taxed and assessed an additional 10% federal early withdrawal penalty (ouch!)

But what counts as a Qualified Education Expense?

Note: All of these expenses are only for COLLEGE, with the exception of Tuition (up to $10,000 per year for K-12*).

*Although K-12 Tuition is a qualified distribution for federal purposes, not all states comply.

- Tuition and Fees

- Books and supplies

- Computers and internet access

- Room and board (if the student is enrolled at least half-time)

- Special needs equipment

- Student Loan Repayment up to $10,000 per student (as of Feb 2018 because of the SECURE Act signed by President Trump (source and link to the bill)

Do I need a separate 529 Plan for each child?

Each 529 plan must have one designated beneficiary (aka the person you’re trying to send to college). However, you can later change the beneficiary of the account to another member of his or her family as defined here. The definition is pretty broad and includes everything from their siblings, children, and parents to your niece’s spouse and mother-in-law.

Can change to younger children

Let’s say you open an account for your oldest child. They don’t go to college or they don’t use up everything you saved for them. You could roll this over to another sibling (or another relative included on this list) and use it for their college expenses.

529 Plans can be used for GRADUATE SCHOOL

Note: 529 plans can be paid for the beneficiary’s graduate school or professional school (source).

We’re planning on our kids managing their own graduate school expenses as we did. Both my husband and I worked multiple jobs while going to graduate school full-time (while walking in the snow, uphill both ways–seriously though, there was a lot of snow and hills at our university). That process taught us how to work hard and manage our expenses so we were able to prioritize investing after college.

What if my child does not go to college? Is that money recoverable?

If the beneficiary chooses not to attend college, you have a few options:

1. Rollover to a Roth IRA (NEW! Starting in 2024)

Secure Act 2.0 (as of 2024) will allow rollovers of 529 Plans into a Roth IRA (which is AMAZING news since contributing too much used to be a major concern for 529 plans).

Some limitations:

-

- The plan must be more than 15 years old.

- Subject to Roth IRA Annual contribution limits (e.g. as of 2023, this annual limit was $6,500/year)

- $35,000 is the maximum lifetime rollover amount allowed.

- Roth IRA must be in the name of the 529 beneficiary

- Can’t rollover contributions or earnings made in the last 5 years (would have to wait until they’ve been in the account > 5 years)

2. Name a new beneficiary for the 529 Plan

Instead of rolling over to a Roth IRA, you could keep in a 529 Plan and change beneficiaries to another relative (e.g. a younger sibling).

3. Pay the penalty and taxes

If you withdraw funds for a purpose other than qualified education expenses, the earnings will be taxed and assessed an additional 10% federal tax. Not ideal. I’d recommend option 1 or 2.

What this means:

529 plans can rolled over to a Roth IRA for your child or you can change the 529 to benefit another relative (e.g. a younger child).

What if my child gets a scholarship?

If the beneficiary receives a scholarship, you can withdraw that amount from your account without the 10% federal penalty (source). You’ll pay tax on the earnings, but they will have been deferred.

What this means:

If your kid gets a scholarship, good for them! You won’t be penalized.

Consequences of using funds for Non-Qualified Expenses

Each state is different, but for Federal purposes, the earnings will be taxed with an additional 10% early withdrawal penalty). So if you have the money you’re determined to use for a family member’s education, contributing to a 529 plan is a great way to maximize those savings.

Which fund should I choose for my 529 plan?

Check out your state’s plan to start to see if they offer tax advantages, but realize you may be better off using another plan as state tax advantages, if they exist, or often small.

It Doesn’t Usually Matter What State You’re In

There may be tax advantages for enrolling in your state of residence, but you can enroll in almost any state’s plan (e.g. you can live in California, enroll in Utah’s 529 plan and send your kid to college in Massachusetts).

So if your state doesn’t offer anything in the way of state tax benefits and you find another state’s plan more appealing (lower plan fees and better returns), you may decide to invest elsewhere.

For example, even though we live in California, CA doesn’t currently offer any state tax deduction or credit for using their 529 Plan. Our kids’ 529 plans are with My529.org, formerly UESP (Utah-based).

How to Compare 529 Plans

Each plan is completely different, so take a look at several plans, including the one(s) in your state of residence and compare different features (e.g. state tax and other benefits, fees, etc.) before choosing.

Compare Tools – Savingforcollege.com

Top 10 Performing 529 College Savings Plans – Savingforcollege.com

5-Cap Ratings: An easy at-a-glance comparison

More advances 529 Plan Comparison Tools

Is to Too Late to Set Up a 529 Plan?

No, you can set up a 529 plan anytime, but realize the main advantage of the plan is to have the earnings grow tax-free.

As with all things that involving investing, the SOONER you start contributing:

- You investment will usually grow more due to the time value of money (although returns are not guaranteed).

- You can better ride out the market fluctuations. Returns are more volatile and sometimes even negative in the short-run.

That being said, 529 plans usually vary what you’re invested in based on the age of the beneficiary to mitigate risk. You may be able to benefit even if you’re less than 5 years away from sending your child to college.

I’m not on track for retirement (401(k), IRAs, etc.), should I be contributing to a 529 Plan?

Maybe not. Even though 529 plans have huge benefits, they are not for everyone. Generally speaking, you should NOT sacrifice retirement for a college savings plan. To put it simply, your kids can get a loan for school, but you can’t get a loan for retirement. This doesn’t give you a free pass to not save for your kids’ college education. If anything, it should make you realize how important it is to be saving enough for retirement.

SAVE MONEY with Electronic Statements

Make sure you check your plan to see if there are any ways to lower fees.

For example, some plans reduce fees if you opt for electronic statements instead of paper statements.

Will A 529 Plan Affect my Student’s Ability to qualify for FAFSA?

It depends on a lot of factors, but probably. In my opinion, the gains you enjoy from tax-free growth will most likely outweigh any government assistance you’ll qualify for.

529 Plan Calculators

How much do I need to contribute to be able to pay for my kid’s college education?

Great question! Note that you may not want to try to fund exactly 100% of your child’s future estimated educational expenses. Doing so will lock that amount into paying for educational expenses and, if not used, will need to be passed to another relative or, if taken out, the earnings will be taxed + 10% penalty. If you aim for funding 100% of expenses, make sure you take into account how much your child will be contributing toward their own educational expenses.

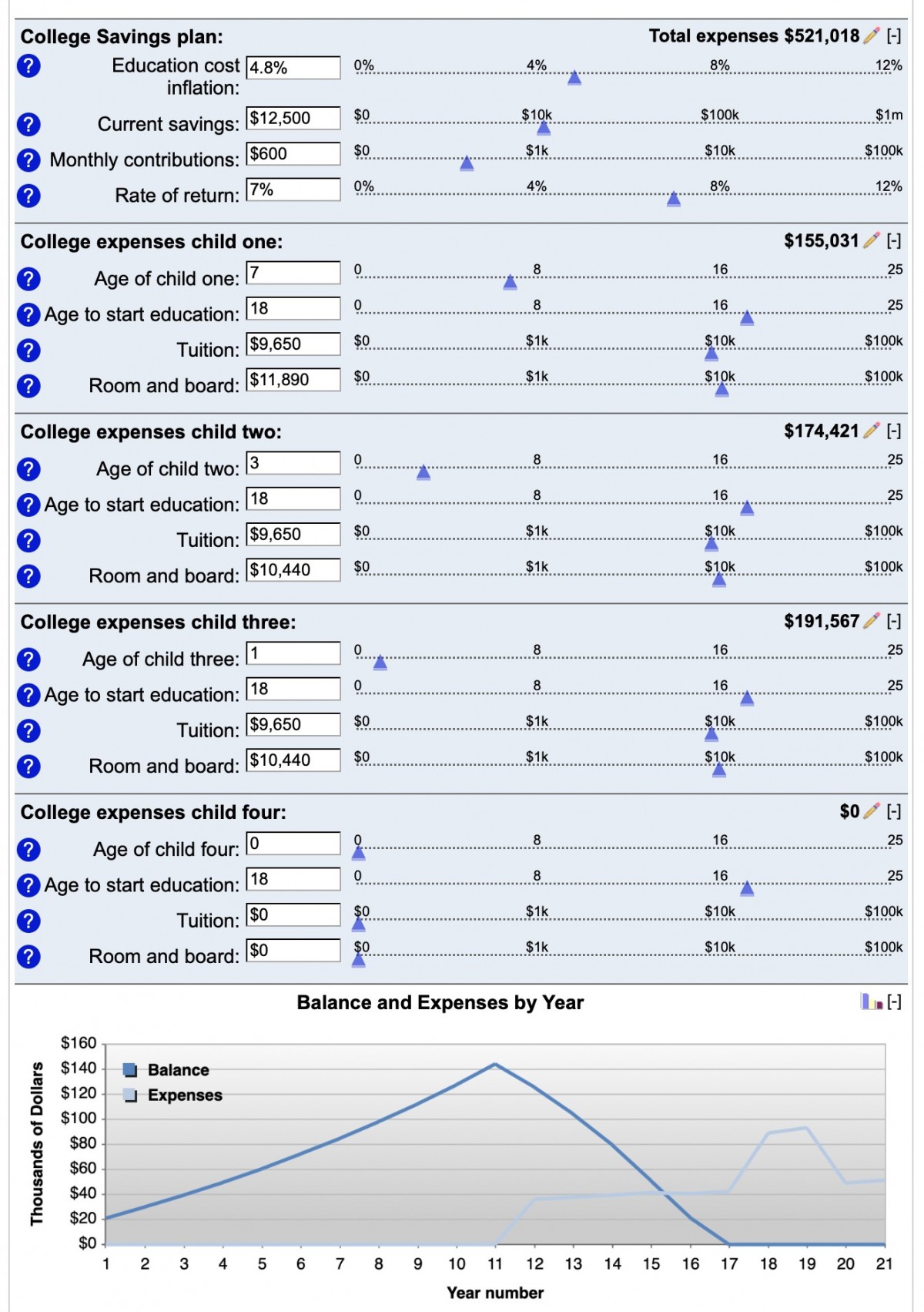

Option 1 – Bankrate College Savings Calculator

They let you account for up to four children at once.

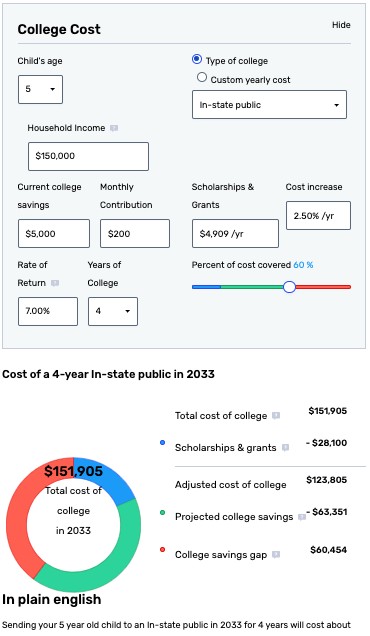

Option 2 – Saving for College Calculator

How do I enroll in a 529 plan?

There are a couple of different ways to enroll in a 529 plan.

a. Directly with a 529 plan manager

Go to that plan’s website and follow the directions to “Open an Account”. Setting up our first 529 account took a little effort, but it wasn’t too difficult. After that, making contributions is simple (we do automatic monthly contributions).

-OR-

b. Through a financial advisor (e.g. Fidelity, Vanguard, etc.).

Also, your employer may already have relationships with advisors in connection with your retirement plan.

Join the FREE #MoneyFitChallenge

Getting your kids’ college savings on track is part of the FREE #MoneyFitChallenge! Join other moms who are learning how to raise money-savvy kids.

You’re more likely to accomplish financial goals if you have a supportive community and step-by-step instructions.

(1) Join the supportive @MoneyFitMoms community (Instagram and Facebook)

(2) Get FREE step-by-step instructions and tools to accomplish all the Top 10 Money Fit Moves. (e.g. budgeting, pay off debt, investing, retirement, create a will)

Improve your BUDGETING & INVESTING! Join the FREE #MoneyFitChallenge

Updated as of 2022-12-30