Once you get over the health concerns of the Coronavirus (data chart here), most people’s worries go straight to their budget and finances. The nosedive in the stock market, jobs in question, and overall uncertainty over how long these drastic measures will last have everyone staring at their bank accounts and wondering what lies ahead. Don’t let the worry freeze you into inaction–the best anecdote to fear is often planning and financial stress is no exception.

FOR EVERYONE DEALING WITH THIS CORONAVIRUS DISASTER:

Here are some financial tips that apply to everyone right now:

1. Budget

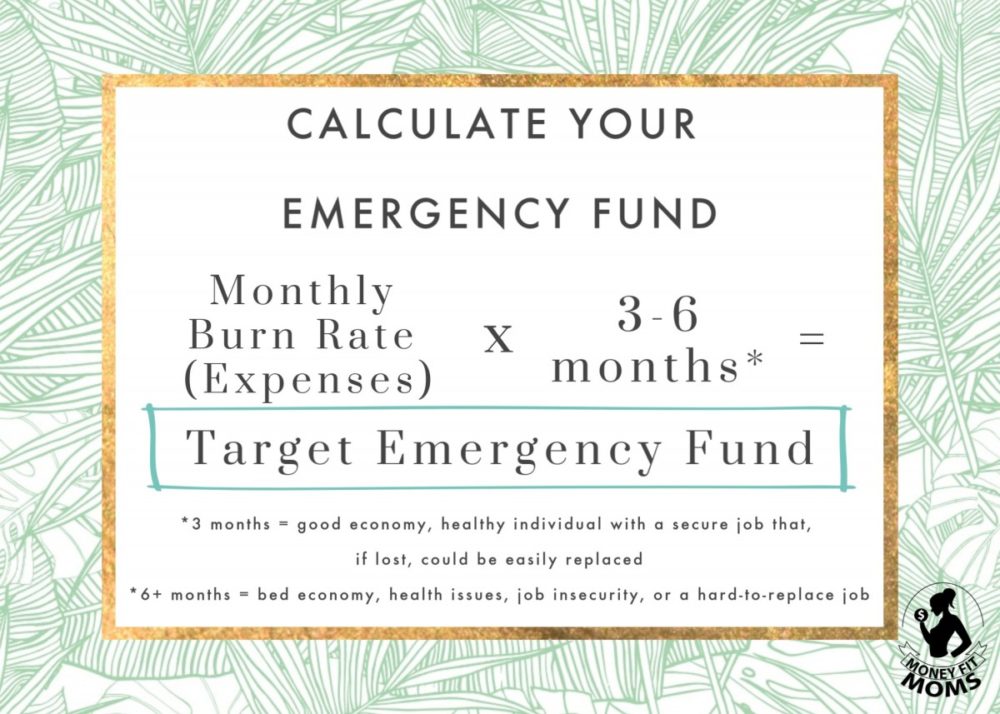

If you weren’t on a budget before–there’s no time like the present! The power of a budget is knowing what your monthly “burn rate” is. You don’t have to wonder how long your current assets will last–you’ll know. Plus it’s a powerful way to make changes to your spending in case of an emergency. You don’t need anything fancy–a spreadsheet will do. But if you’re asking what my favorite budgeting tool is, it’s YNAB.

More about budgeting here.

2. Hold a Monthly Budget Meeting (Sign up for a monthly email reminder here)

Rather than stressing about your finances on a daily basis, spend time each month going over your financial situation in a Monthly Budget Meeting (get a printable agenda here).

- PRO TIP: Set a 10-minute timer

The hardest part of doing anything is starting. Commit to spending ten minutes each month going over your financial goals and budget.

Usually, when that timer goes off, either one of two things happens:

-

- You’re into it. You find you actually want to keep going over your finances.

- You’re done. If things are business-as-usual, sometimes 10 minutes is enough to make a few tweaks to your budget and move on.

3. Beware of Scams

Scammers try to reap the benefits of everyone’s panic. The FTC provided some guidance on how to avoid these scams, but basically:

- Don’t click on links from unknown sources (could be malware)

- Watch for emails claiming to be from the CDC or WHO. Go to their actual websites for updates.

- Ignore online offers for vaccinations and cures.

- Be alert of “investment opportunities”

4. Keep calm

The whole country is in the same situation. We’re going to pull together to help those most affected by this disaster. Those who can are making generous donations to food banks. The government is doing what it can to help everyone recover from this economic hardship–they have already delayed the tax deadline and tax payment. I expect more relief to come, both from private individuals as we help our communities and from the federal and state governments (see the various federal Coronavirus information and relief for business, housing, etc. here). Until then, see more tips below for those in economic hardship.

SITUATION #1: IF YOU STILL HAVE A JOB:

1. Start building an Emergency Fund

If you’re debt-free, the next step is to start an emergency fund with 3-6 months of expenses. With times as uncertain as these, I would lean more towards the 6 months, especially if there’s any question about whether you will continue to have a job.

Read more about Emergency Funds

Read more about Emergency Funds

2. Possibly Cut Expenses

How will you fund your emergency fund? By cutting some expenses. If your job is secure, your emergency fund is full, and you’ve already saved for all your major upcoming purchases (car, house, etc.), do you need to cut expenses? Not necessarily. However, in my opinion, it’s a great time to invest some extra money (note that I am not an investment advisor or personal financial planner–I’m just telling you what we’re doing over here at La Casa Schader (investment-wise) in response to the Coronavirus catastrophe). Which brings me to item #3 . . .

3. Don’t Give up on the Stock Market

Possibly THE MOST IMPORTANT!!! and will have the GREATEST IMPACT on your long-term financial future. So many people have the urge to exit the stock market when it’s low. This is the EXACT OPPOSITE of smart. It seems obvious that you want to BUY LOW and SELL HIGH and yet people can’t seem to fight the impulse to SELL LOW for fear that the market could go lower. And it could. But the truth is, the best time to invest in the stock market is when it is low. I am NOT telling you to put your emergency fund in the stock market. I AM telling you to continue making regular contributions to your retirement and investment accounts (assuming you’re (1) debt-free and (2) have your emergency fund in place).

SITUATION #2: IF YOU’VE LOST YOUR JOB / INCOME:

1. Take care of your “four walls”–then CUT ALL OTHER EXPENSES

This is a term from Dave Ramsey.

What are the four walls?

- Food

- Utilities

- Shelter

- Transportation–so you can get to and from your job.

Those are your financial priorities. Cut out everything else until you’re back on your feet again. That includes:

- Pausing subscriptions

- Pause paying off your debt

- I’m all for becoming debt-free, but not at the expense of being without food or shelter.

- Anything that isn’t food, utilities, shelter, or transportation. Now isn’t the time to try to keep up appearances. Remember that this won’t be forever–just until you get back on your feet.

2. Find other sources of income ASAP

- Find a new job or a side hustle–or both

- Start delivering groceries, Ubereats, Amazon, or PostMates

- Get creative

- I have a friend in the restaurant industry whose hours were cut to zero. She started detailing cars.

- Sell your stuff–desperate times call for desperate measures.

- File your tax return–possibly

- Even though the deadline has been extended, if you’re due a refund, then you’ll want to file to get that cash now. If you owe, you can take advantage of the fact that the payment and filing deadlines have been extended.

3. Contact your lenders and loan services

Tell them about your situation and be prepared to explain:

- Your situation

- How much you can afford to pay

- If it’s a mortgage, they’ll ask about your income, expenses, and assets.

- If it’s a student loan, the government is providing student loan relief.

4. Your last resorts

- Pull from your emergency fund. Coronavirus is a global pandemic. Yup–that’s an emergency.

- Reach out to family and friends. I know it’s not ideal, but please consider this before raiding your retirement funds.

- AVOID PAYDAY LOANS LIKE THE PLAGUE! They have interest rates that when calculated as APR (annual percentage rates) are up to 400%!!! You read that right. FOUR-HUNDRED PERCENT!!!!

- Talk to a financial counselor.

- Read more tips from the government about how to protect yourself financially from the impact of coronavirus.