RENT vs. BUY–both have Pros and Cons. Buying a home can be an incredibly effective and tax-advantaged way to build wealth. But home buying is a huge financial decision with a lot to take into account. We’ll take you through the decision process including calculators to help you make the best decision for your finances and lifestyle.

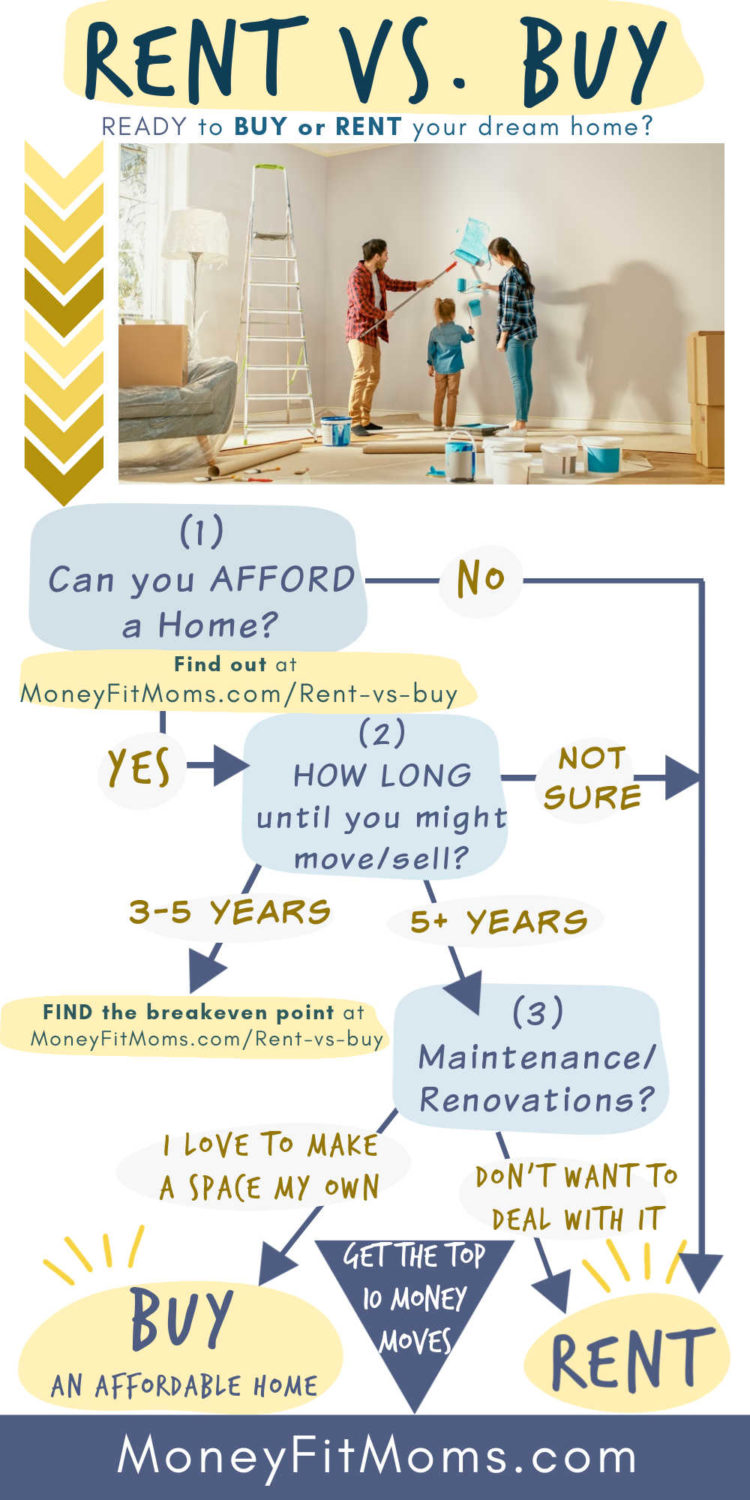

Here’s a 3-step process to help you decide if you’re ready to buy your dream home or if you should keep renting (for now).

Buying a home can be a dream or a nightmare–you have to take into account:

- AFFORDABILITY: If you can afford to buy a home

- STABILITY: How long will you live in the house?

- PRIORITIES: Weigh the pros and cons of owning vs. renting (stability vs. flexibility)

I know the feeling–you pull up Zillow or RedFin and your heart starts pumping. First, you feel the exciting rush of picking out your dream home. Then your heart is pounding when you start looking at the cost of the mortgage, property taxes, closing costs, HOA fees, and about a million other things that make the picket fence out front seem a little less quaint.

Rent vs. Buy

Ultimately, the decision about whether to rent or buy comes down to a few important factors.

Why you should buy – YOU:

- Can afford it

- Will live in the home for at least four or five years before selling (read about this calculation here)

- Want the stability and financial advantages of homeownership

Why you should rent – YOU:

- Cannot afford to buy a home yet

- Are unsure if you’re going to live there for long (Your job requires flexibility or you don’t love where you live)

- Don’t want to be a homeowner

Rent vs. Buy: How to decide in 3 Easy Steps:

STEP 1 – RENT vs BUY: Can you AFFORD to buy a home?

All too often, the last thing we consider when buying a home is whether we can afford it. In reality, affordability should be the first thing we consider when pondering homeownership.

Homeownership: The American Dream or Financial Nightmare?

Many people who end up in huge debt are there partly due to a home-buying nightmare.

They had:

- Bought a home too early–before they were financially prepared and/or

- Bought a more expensive home than they could afford.

Here are some financial milestones you should hit BEFORE buying a home:

1. DEBT: Be debt-free (other than a conventional fixed-rate mortgage, if this home you’re considering is a second purchase)

This means no car loans, student loans, home equity loans, credit card debt or consumer debt of any kind. If you’re really motivated to get into a home, attack that debt fast so you can start working on getting into a home you love!

2. EMERGENCY FUND: Have a fully funded Emergency Fund (3-6 months of expenses)

Homes, even relatively new homes, can surprise you with unexpected maintenance costs. A fully-funded emergency fund acts as insurance to protect you from going into debt for expensive home repairs.

3. DOWN PAYMENT: Have enough cash for a 10-20% down payment.

Paying 20% or more down will help you avoid paying expensive PMI (Private Mortgage Insurance)–an expensive cost that you would have to pay on TOP of your down payment

4. AFFORDABILITY (25% rule): Will your house payment be 25% or less of your monthly take-home pay?

Your monthly housing cost includes:

- Mortgage Payment: Principal + Interest

- Property Taxes

- Homeowner’s Insurance

- HOA fees – If Applicable

- PMI – Private Mortgage Insurance – Applicable if you paid less than 20% down

===EXAMPLE===

Mortgage Payment: $2,000/month

Property Taxes: $200/month

Homeowners Insurance: $70/month

HOA fees – $200/month

PMI – N/A <–In this example, we put 20% down, so we don’t have to pay PMI.

TOTAL MONTHLY HOUSING COST: $2,470 ÷ .25 =

$9,880 Monthly Take-Home Pay needed to cover that housing cost.

NOTE: You will be able to qualify for much more than this. But what you can QUALIFY for and what you can AFFORD are two different things. Banks lending money to people to buy more house than they could afford is what led to the Subprime Mortgage Crisis in 2008 and brought the whole U.S. economy to its knees.

Cannot Afford to Buy A Home Yet?

You are making the right move by not jumping the gun and setting yourself up for a financial nightmare. If you’re feeling deflated–don’t! YOU are capable of hitting these milestones and THEN getting your dream home.

If you need help and encouragement, start with my Money Fit Challenge and follow along on Instagram and Facebook.

Improve your BUDGETING & INVESTING! Join the FREE #MoneyFitChallenge

STEP 2 – RENT vs BUY: Estimate HOW LONG you plan to stay in the home

Buying and selling homes is EXPENSIVE due to closing costs.

How much are closing costs?

For the buyer: According to Zillow, closing costs for buyers are usually around 2-5% of the purchase price. Realtor fees are typically paid by the seller, so these costs to the buyer are typically lender-related fees.

For the seller: Zillow estimates that for the seller, closing costs can be up to 8-10% of the selling price (2-4% in fees + 6% fee to the realtors)

Home Ownership can be Less Expensive in the Long-Term

Closing costs can make frequently buying/selling homes prohibitively expensive. But because a fixed-rate mortgage payment stays the same and rental costs increase over time, homeownership can sometimes be less expensive in the long run. According to the National Association of REALTORS®, after 6 years, a homeowner’s mortgage is lower than that of a renter (assuming renting increases 5% each year and that homeowner has a fixed payment).

How long do you have to stay in the home for it to be cheaper than renting?

When is the breakeven point of whether it’s cheaper to buy or rent? It depends on where you live. Many financial sources say you need to stay in a home for at least four or five years to make it a worthwhile financial decision, but it could be as long as 15 years. Use a calculator to find a breakeven point.

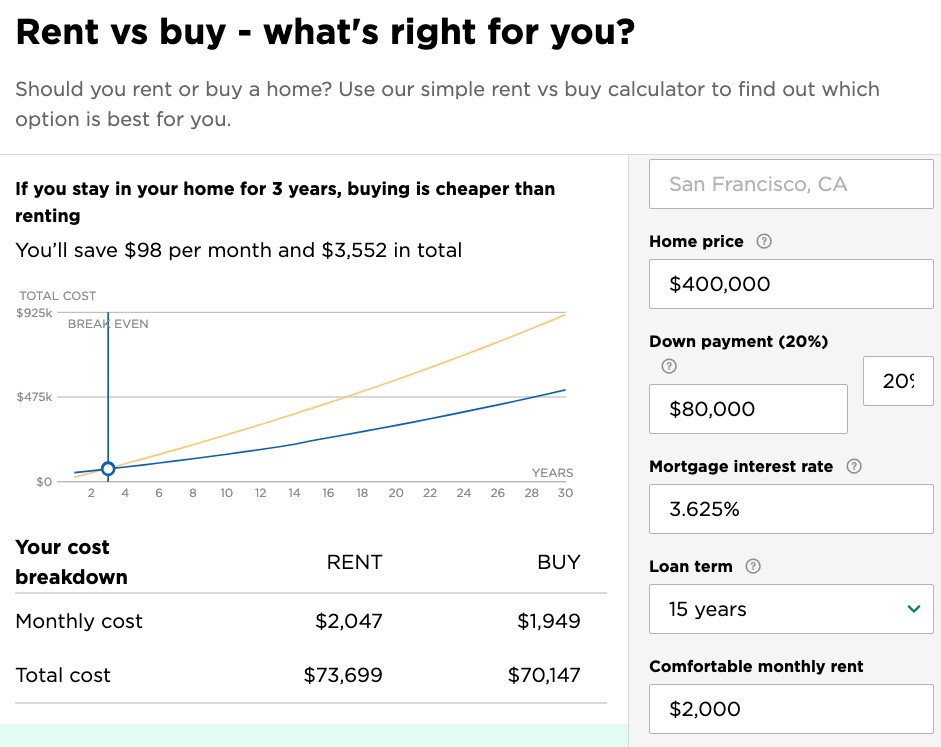

NerdWallet Calculator: Find Breakeven Point

If you want to nail down an exact number of years, you can try this NerdWallet Calculator:

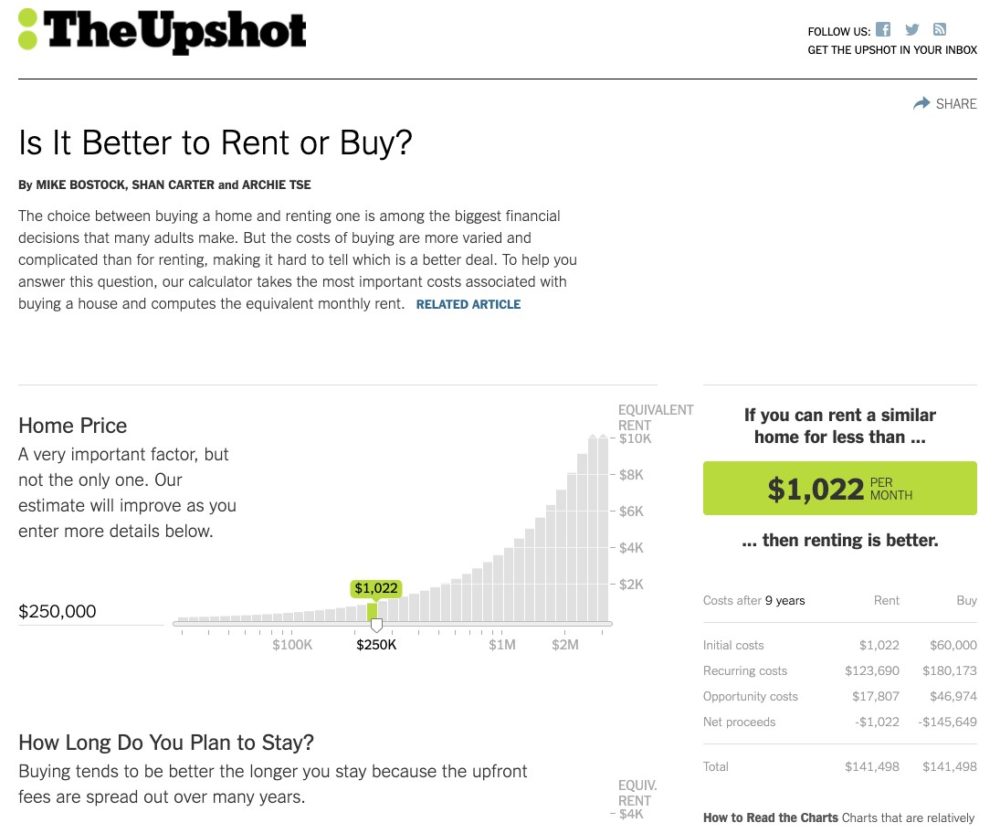

Optional: NYTimes Rent Vs. Buy Calculator

The New York Times created a legendary Rent vs. Buy calculator that takes into account every factor you can imagine.

It can be overwhelming, but if you’re really torn and want to consider every factor, it can help you come up with a more concrete analysis of what factors to consider, such as:

- Mortgage interest rates

- Home Appreciation vs. Rent Growth Rate

- Property Tax rate

- Closing Costs

- Maintenance Fees

- The opportunity cost of investing the money

STEP 3 – RENT vs BUY: Do you WANT to own a home? Flexibility vs. Stability

Now that we’ve crunched the numbers, it’s time to weigh the more intangible pros and cons of buying vs. selling.

Stability or Flexibility?

Are you ready to put down roots where you are or do you want the flexibility to move with job opportunities?

Home Maintenance/Renovations: Freeing or Time-consuming?

When renting, your options for customizing or deciding what upgrades you want are limited. But when you’re a homeowner and your plumbing fails, you have to fix it or pay for someone else to do it. You can outsource some home maintenance, but it comes at a cost. Plus, even just managing the work and making all the selections still takes time and energy. But what you end up with is exactly what you wanted and that’s gratifying. Homeownership has tradeoffs, so you have to weigh the pros and cons.

Rent Vs. Buy – Pros & Cons

BUYING

PROS of Buying:

- ASSET: You build equity with your mortgage payments and will eventually own your home, which you can pass on to your children.

- APPRECIATION: Home value can increase over time, growing with inflation

- TAX BENEFITS: Some tax benefits (deductibility of property taxes and mortgage interest if you itemize your deductions)

- CUSTOMIZE: Freedom to renovate

- STABILITY: You’re free from a landlord’s decisions and have a permanent place to live.

- SAVE MONEY: In the long run, you save money on living expenses. Once the mortgage is paid off, you no longer have that expense.

CONS of Buying:

- EXPENSIVE: Closing costs are expensive when you buy and very expensive when you sell. Ongoing home maintenance and renovations can be costly.

- TIME-CONSUMING: You are responsible for maintenance and repairs.

- LOW FLEXIBILITY: Moving is both expensive and difficult.

- RISKS: Although home values usually appreciate over the long term, they may decrease significantly (e.g. the mid-2000s housing bubble).

RENTING

PROS of Renting:

- MOBILITY: Freedom to move around without the costly expense of buying/selling homes.

- VARIETY: You can try different areas before committing.

- LOW MAINTENANCE: The landlord handles the time/expenses of maintenance.

- SAVE MONEY: In the first few years, it’s cheaper. You don’t have to pay expensive closing costs or expensive maintenance/renovations.

- FREEDOM: Less time spent maintaining home.

CONS of Renting:

- EXPENSE, NOT ASSET: You don’t build equity. You don’t have an asset to pass on to your children.

- FEW OPTIONS: Limited customizability to your living space.

- EXPENSIVE: In the long term, rent will usually increase, and eventually your rent may be more than you would have paid for a mortgage.

- VULNERABLE: The landlord may decide to sell or stop renting–limiting some stability/permanence

Rent vs. Buy

Ultimately, the decision about whether to rent or buy comes down to a few important factors.

Why you should buy – YOU:

- Can afford it

- Will live in the home for at least four or five years before selling (read about this calculation here)

- Want the stability and financial advantages of homeownership

Why you should rent – YOU:

- Cannot afford to buy a home yet

- Are unsure if you’re going to live there for long (Your job requires flexibility or you don’t love where you live)

- Don’t want to be a homeowner

What made you decide to rent or buy? Tell me about it on Instagram, Facebook or Pinterest. Reach your financial goals faster with our Money Fit Challenge. Improve your BUDGETING & INVESTING! Join the FREE #MoneyFitChallenge