Knowing and improving your credit score can save you THOUSANDS of dollars. Read on to find out how to check and improve your credit score–everything you ever wanted to know . . . and then some.

What is a credit score?

That three-digit number measures your credit-worthiness–the likelihood that you’ll be able to repay a lender if you borrow money to buy a car, house, use a credit card, etc. Your credit score is largely based on information obtained from the three major credit bureaus (Experian, Transunion, and Equifax). The higher your score, the more financially trustworthy you appear to lenders.

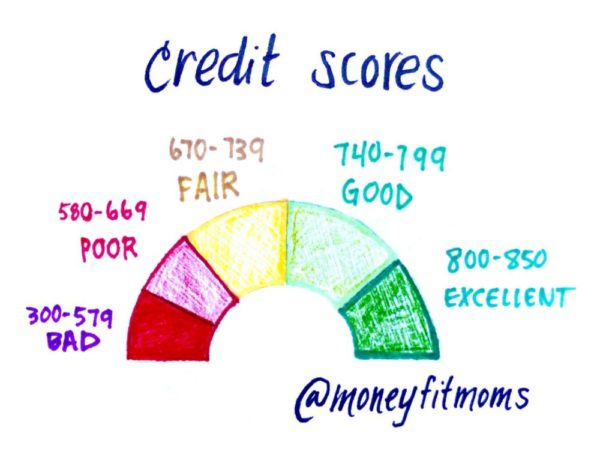

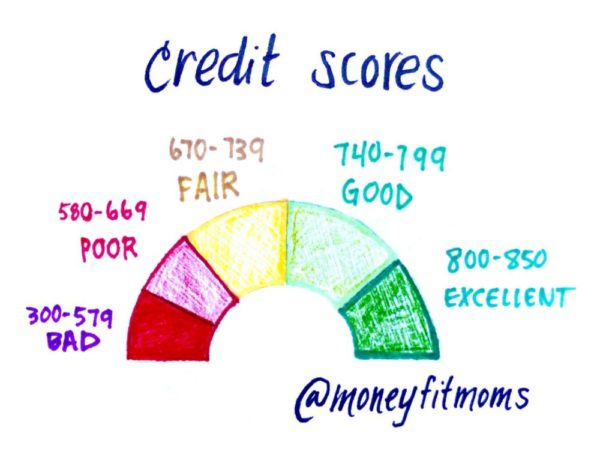

What is the Credit Score Range?

Credit scores range from 300-850.

Bad: 300-579 – A very risky borrower

Poor: 580-669 – Might be approved by some lenders

Fair: 670-739 – Average. May be considered good enough for most lenders.

Good: 740-799 – Dependable borrower, above average.

Excellent: 800-850 – Exceptional borrower, well above average.

What is a good credit score?

“Good” is an objective term in this case and it’s usually around 740 and above.

That being said, many lenders will accept people with fair credit and some will accept poor or even bad credit, but borrowers considered risky often have to pay a higher interest rate on the loan, which is meant to compensate the lender for taking on a higher risk.

So generally speaking:

higher credit score = lower interest rate = more money saved on interest.

•

More than One Credit Score (e.g. FICO, VantageScore 3.0)

You have more than one credit score because there is more than one method of analyzing credit. Just like a ballroom dancing competition with more than one judge, each judge is going to have a slightly different emphasis on the elements of your performance. Each credit score is slightly different and weighs and values different things. The VantageScore 3.0 (one credit score system) puts slightly more emphasis on the past 24 months of history, so someone with relatively new credit will likely find their VantageScore 3.0 is higher than their FICO score.

Different lenders may use different scores. A lender evaluating you for a car loan, for example, may decide to use a credit scoring system that places greater weight on your ability to make monthly payments on time.

•

Most well-known credit score–FICO

The most well-known credit score is your FICO score. FICO’s exact formula is unknown, but credit scores are based on five categories with different weights.

•

The calculation breakdown:

- Payment history (35%)

- Amount owed (30%)

- Length of credit history (15%)

- New Credit (10%)

- Type of credit used (10%)

How to check your credit score for free

- Many credit cards offer free services that let you take a peek at either your FICO score or your VantageScore 3.0.

- Check your current credit card(s) and see if this is a service they offer.

- VantageScore 3.0–You can get it for free at:

- Credit Karma: Scores from Equifax and TransUnion, updated weekly. They make their money from ads, so they’re able to offer both free credit advice and monitoring. This is one of the ways I monitor my score to make sure no new cards have been opened under my name.

Check your CREDIT SCORE for FREE with Credit Karma

Will Checking My Credit Lower My Score?

No. Checking your score is what is called a soft inquiry. Too many hard inquiries–the ones made by potential lenders (e.g. applying for a credit card, home loan, car loan, etc.) can hurt your credit score.

•

How to Improve your Credit Score

- Pay your bills on time (including utility and cell phone payments)

- Since such a large portion of your score is based on your payment history (35%), this is the single best way to improve your score.

- Pay off debt and keep credit card balances low (ideally <10%)

- The amount of debt you owe is 30% of your score so pay off any outstanding debt and pay down your credit cards. NerdWallet recommends using no more than 30% of your credit limit on any card and even less, if possible. The best scores use 10% or less of their credit limit.

- Don’t close unused credit cards

- Unless it’s tempting you to spend more than you should, you are better off keeping your old accounts open as it can help your credit utilization ratio (your outstanding balances divided by the total amount of credit available). Your oldest account is the most important to keep open, as this ages your credit history–The older, the better.

- Cut Back on Applying for New Credit Accounts

- Applying for credit results in hard inquiries on your credit history, too many of which will hurt your score. New accounts also lower your average account age.

- Dispute any inaccuracies on your credit report

- Check your credit report and if anything is inaccurate, dispute it.

Will your spouse’s bad credit affect you?

Each person has an individual credit score based on their credit history, such as loans or credit cards taken under their name. So, unless you are a co-borrower on their loans or cards, your spouse’s bad credit will not negatively yours–however, if you are trying to get a loan together, such as a home mortgage, one spouse’s poor credit history could negatively affect the couple’s ability to qualify for the best interest rates. If you are going the route of a typical home loan, improving both spouse’s credit can end up saving you a lot of money in lower interest rate costs.

•

Dave Ramsey–the personal finance magnate–recommends Living Without a Credit Score. He thinks people should only use debit cards and cash to avoid going into debt. What you have is what you spend. The catch is your credit history will be, at best, nonexistent–creating challenges when you want to buy a house, rent a car, book a hotel room, apply for a job, rent an apartment, or travel.

Dave Ramsey asserts that there are workarounds for the types of things that usually depend on your credit score, detailed here. For example, when buying a house without a credit score, Ramsey thinks a good underwriter can still get you a competitive mortgage interest rate. To rent a car without a credit card, Ramsey partners with Dollar Car rental specifically because they will accept a debit card.

•

Why I Recommend Having a Good Credit Score

I think the goal of being debt-free is an important step to financial freedom (it’s one of my Top Money Fit Moves). That being said, it’s possible to be both debt-free and have good credit, which has some major advantages:

- Save money with lower interest rates

- Better housing – You increase your chances of qualifying for an apartment rental or home purchase

- Job opportunities – Some employers pull a modified credit report to evaluate if you’re a theft or fraud risk

- Lower insurance rates

- Better cell phone deals – Lower to no deposits required

- Better credit cards with perks like cash-back – Even if you don’t want to accrue consumer debt, having access to a credit card will increase your ability to do things like travel or rent a car.

Join the FREE Money Fit Challenge!

Improving your credit score is part it! You’ll learn more about building long-term wealth through investing. 📈