Do you know how to calculate your Financial Freedom Number (or Financial Independence “FI Number”). Do you know your savings rate — the key to Financial Freedom? 💸

What is Financial Freedom (Financial Independence)? Do you have to Retire Early?

First of all, what is Financial Freedom aka Financial Independence (the “FI” of the “FIRE Movement”: Financial Independence Retire Early).

Financial Freedom / Independence is reached when you have accumulated enough income-generating investments that you can live off that income alone rather than being dependent on job income. Financial Independence is often associated with retirement. Once you are financially independent, you can choose to continue working or not. Retirement is often associated with being age 65-67. The truth is some people have managed to reach Financial Independence (even a high-expense retirement or “FatFIRE“) in their 30s or earlier. Even if you want to retire at 67 or not at all, Financial Independence is a great goal for everyone due to the freedom and peace of mind it provides.

Knowing how to calculate your Financial Independence Number “Fi Number” is critical.

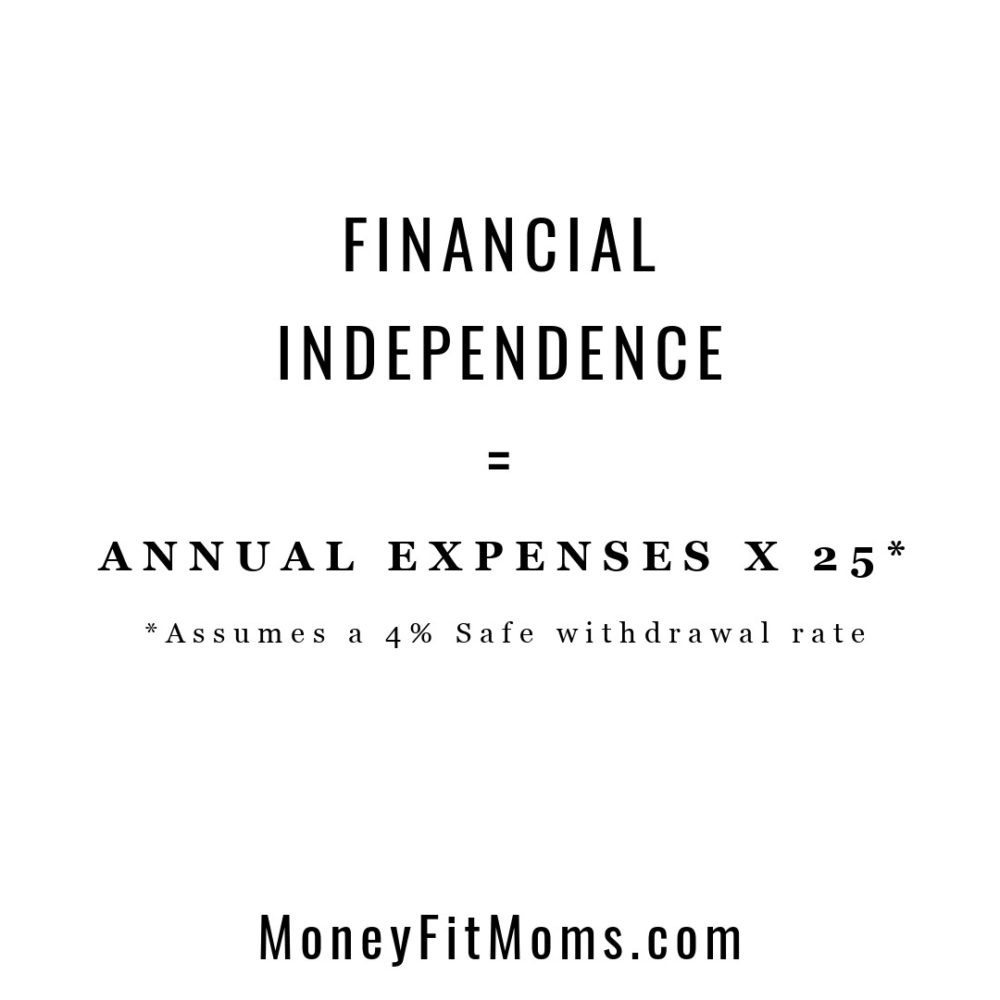

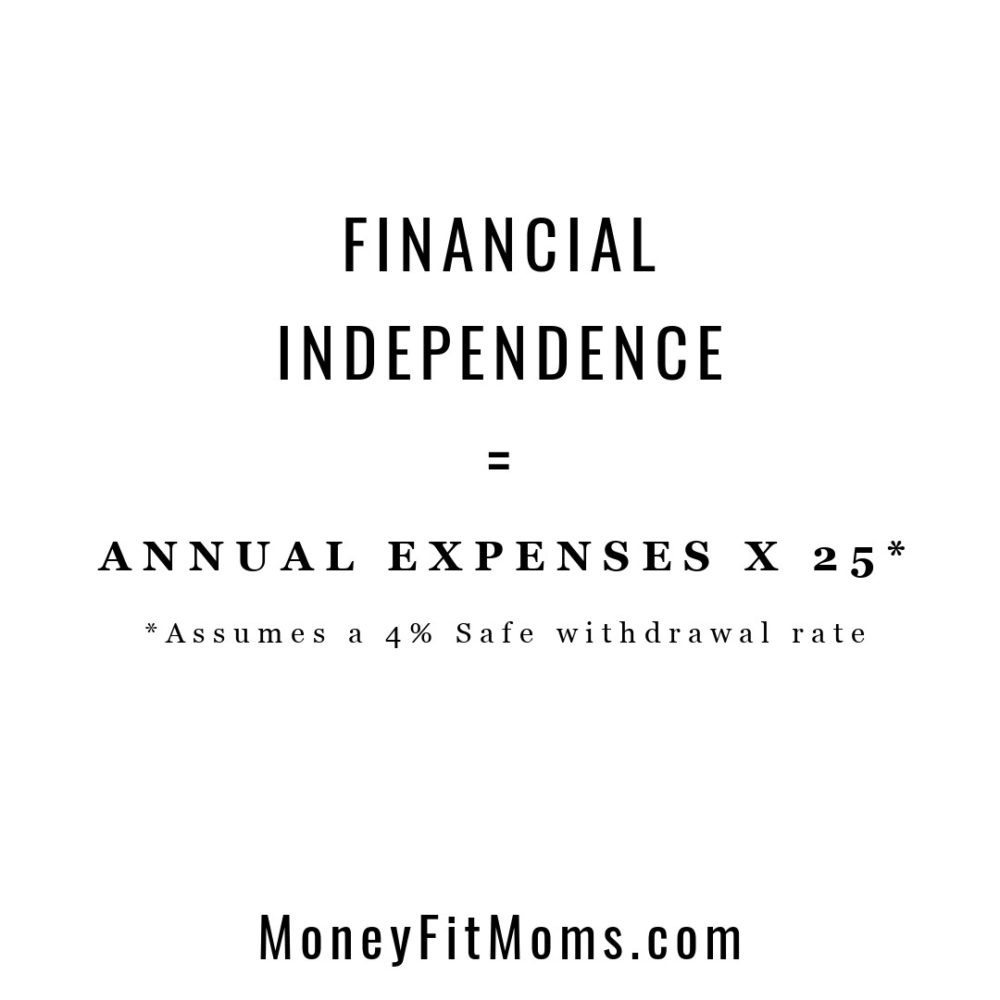

How to calculate your Financial Freedom Number / Financial Independence Number

Simply, your Financial Freedom number is calculated by multiplying your average annual expenses by 25. (How to calculate your annual expenses).

Financial Freedom Number = Annual Expenses x 25

This calculation is based on the principle that 4% is a “safe withdrawal rate”. This assumes you could withdraw 4% of the total value of your investments without depleting your original investment aka running out of money.

This 4% safe withdrawal rate assumes:

- 7% Average annual investment return

- – 3% Inflation

- = 4% Safe Withdrawal Rate

What about a recession? Adjust your spending

Understandably, your initial reaction to these assumptions is likely, “What if the market crashes? What is inflation is sky-high?” You’re correct — both of these are real possibilities. For this reason, the 4% “safe withdrawal” rate assumes you would lower expenses during a recession.

What if I want to assume a different safe withdrawal rate?

To assume a lower rate of return (I would not recommend assuming higher):

FI Number: (100/Withdrawal rate) * Annual Expenses.

For example, if you want to assume a 3% Rate of Withdrawal (6% return – 3% Inflation), your FI number would be:

FI = (100/3) * Annual Expenses, or about 33.3x your annual expenses.

How do I calculate my annual expenses?

Current expenses +/- anticipated adjustments

First, start by figuring out how much you spend now by tracking your expenses. My favorite paid budgeting tool is YNAB or you can use a free option like Mint.

Make adjustments as needed to arrive at your estimated future annual expenses.

Second, some potential adjustments might include:

- Increased health care expenses (For example, if you plan to quit working before you’d be old enough to qualify for medicare)

- Decreased housing costs (As a homeowner, once your mortgage is paid off, that payment would eventually end)

- Increased travel expenses

- Decreased work-related expenses (gas for commuting, new clothes, etc.)

How long will it take me to reach Financial Freedom?

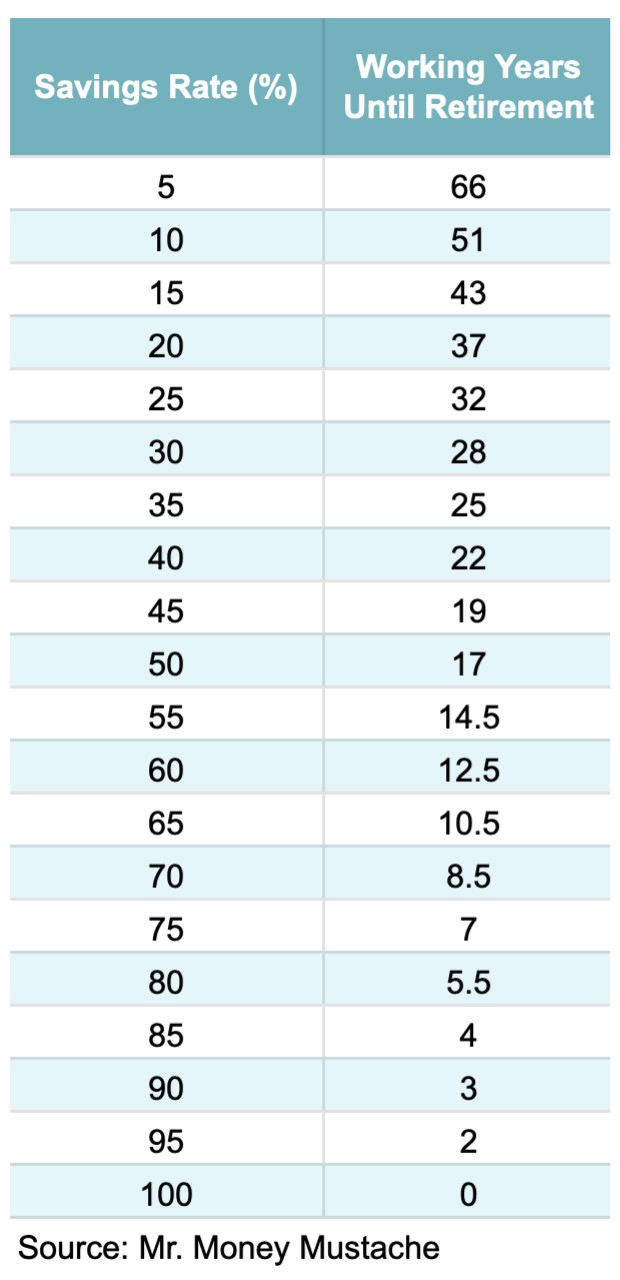

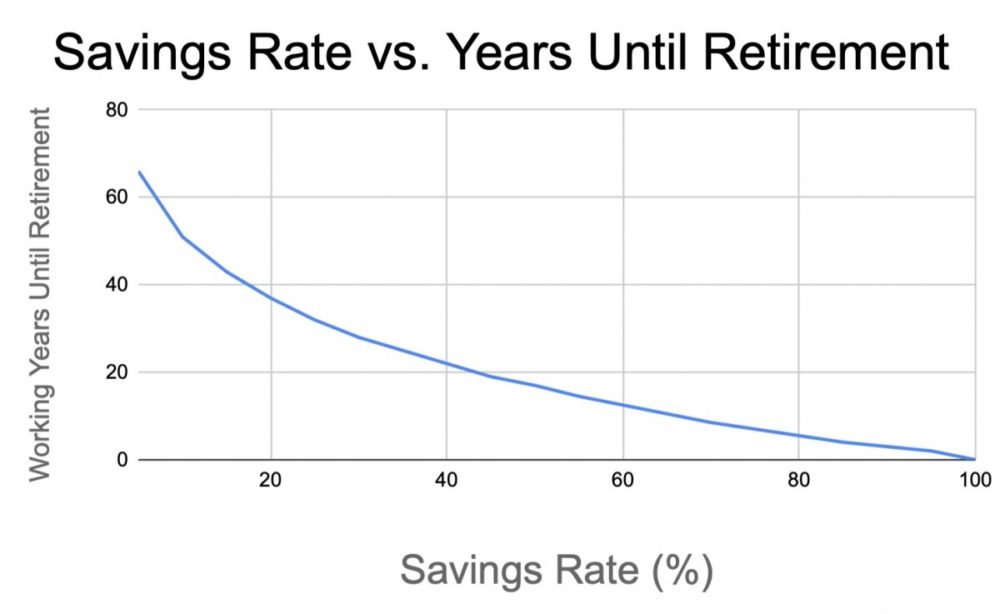

Next, how long it will take you to reach Financial Independence is determined by your savings rate. The higher your saving rate, the sooner you will arrive at Financial Independence.

How to calculate your savings rate? (Savings Formula)

Your savings rate is calculated as a percentage of after-tax income (gross income minus all taxes).

Savings rate = Annual Amount Saved (Invested) / Net Income

Net Income = Gross Income minus All Taxes

Alternatively, another way to calculate your Net Income:

Net Income = Take-Home Pay + any 401k contributions, HSA contributions, other savings taken out of your paycheck

Example of how to calculate savings rate:

Let’s say your gross income is $50,000 minus $10,000 in taxes. Your net income would be $40,000.

If you contribute 5% of your salary to your 401k ($2,500) and your employer matches half of that ($1,250), you contribute $3,600 toward your HSA (which you opted to invest and save/pay for health care costs out-of-pocket) and you put $6,000 in a Roth IRA every year, your total amount saved/invested annually would be:

$2,500 + $1,250 + $3,600 + $6,000 = $13,350 Annual Amount Saved/Invested

$13,350 (saved/invested annually) / $40,000 (gross income) = 33.3% Savings Rate

What if you are starting with a nest egg of zero? If you kept your savings rate up 33%, you would be able to retire in 25-28 years (see chart above).

For example, if you started saving 33% of your net income at age 25, you’d be financially independent around age 50-53.

Alternatively, if you’re starting at age 40, you’d retire around 65-68.

Do people actually become financially independent and retire early?

Lastly, is financial independence and early retirement achievable? Yes, it is! The most famous example is perhaps Mr. Money Mustache who retired at age 30. He is famous for living a relatively low-cost life. Do you want a higher expense lifestyle? You’d be in the “FatFIRE” camp (high expenses). This requires building a larger net wealth, but this couple will retire in their 30s while continuing to live high-travel, high-expense lives in the LA California area.

![]()