If you want a learn how to SAVE & INVEST MORE with step-by-step instructions, join the FREE Money Fit Challenge!

Improve your BUDGETING & INVESTING! Join the FREE #MoneyFitChallenge

RETIREMENT / INVESTING

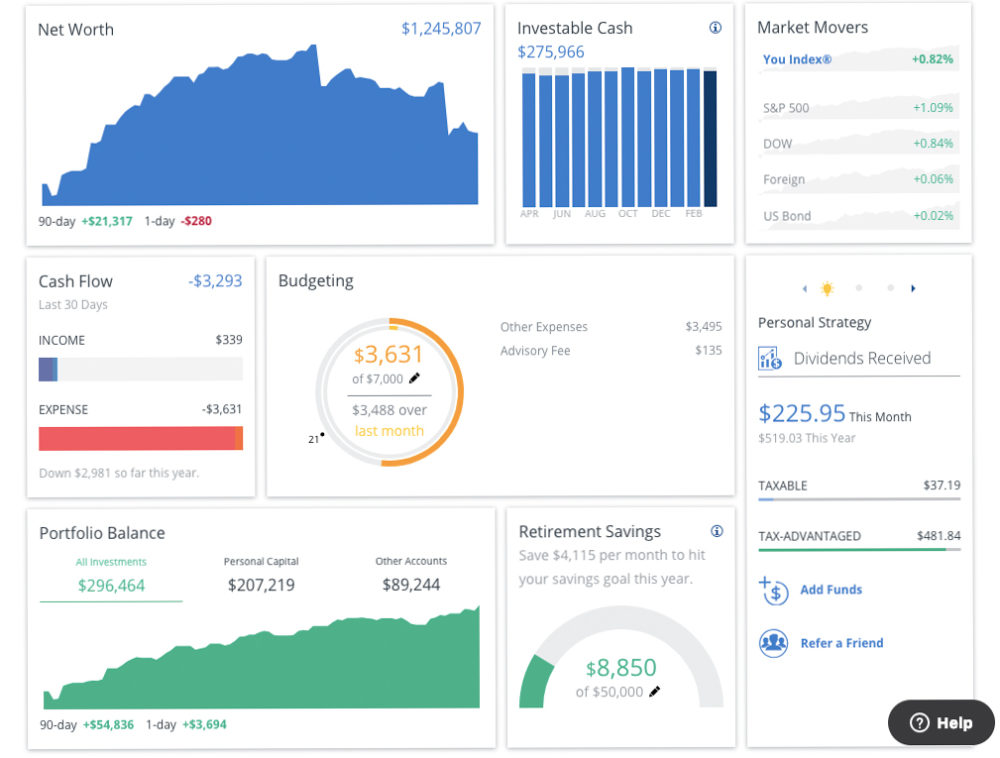

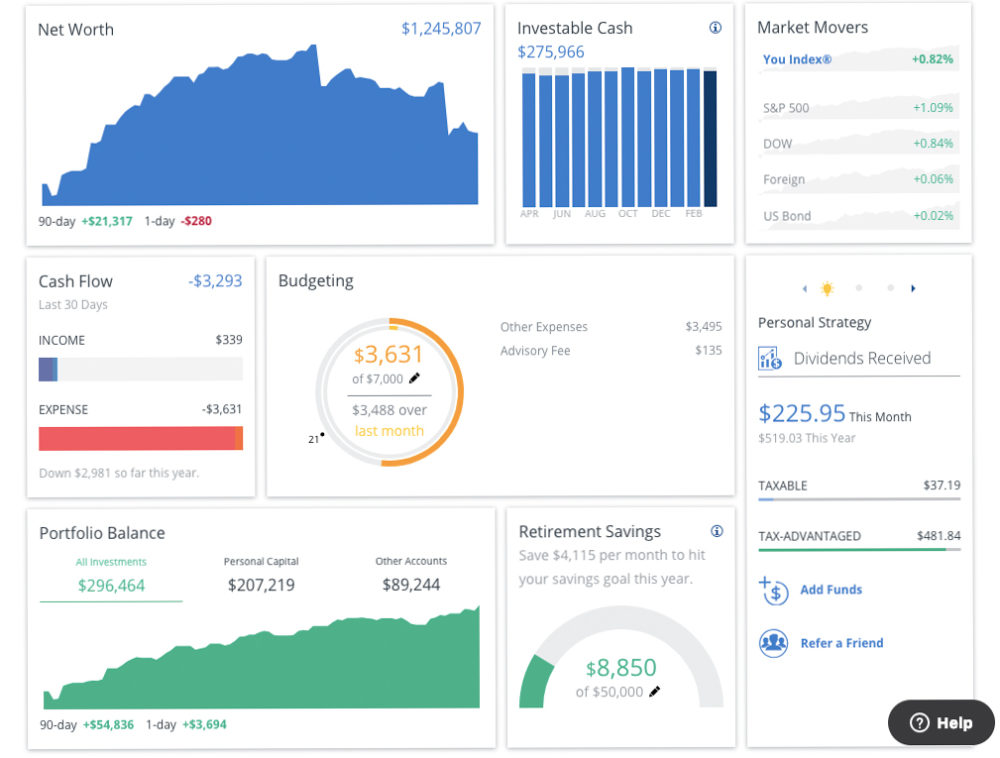

Empower (Formerly Personal Capital)

My favorite FREE financial software and tools (including an investment fee analyzer and my favorite retirement planner (affiliate link)).

Empower’s financial software allows you to pull in all your accounts from all over into one handy dashboard. Watch your financial dreams become reality as you can then chart your overall progress towards your financial goals, such as retirement.

Calculate your NET WORTH. Get your FREE, secure Financial Dashboard (Affiliate Link)

Best Term Life Insurance Tool

Getting Term Life Insurance for the breadwinner(s) in your family is a critical way to protect income. Compare multiple policies at once to find the best deal for you using Policy Genius.

Best Budgeting Apps

Honestly, I’m not a budget tool snob. The best budgeting tool is the ONE YOU’LL ACTUALLY USE–whatever that is. I think a spreadsheet or notebook works fine. But since you asked . . . I’ve used a lot of tools . . . Mint, EveryDollar, Quicken, etc. The budgeting tool I recommend is YNAB (You Need A Budget).

YNAB is not free ($84/yr or $7/month) and has a learning curve (free app: Mint); however, in my experience, nothing beats YNAB’s ability to plan for future large purchases (e.g. new car, vacation, home). YNAB also has great customer service (a real human response to all your questions via email and will continue to follow-up until you’re satisfied), so you won’t be on your own. Also, if you’re trying to pay down debt, you can join one of their Facebook communities to help you stay motivated and on track.

Rakuten – Extra Cash-Back While Shopping–

There are several companies that offer cash-back for your online shopping.

Things I love about Rakuten (formerly Ebates):

- They *AUTOMATICALLY MAIL YOU A CHECK* quarterly so it’s hassle-free. My husband and I have been using them since 2010 and have so far received $5,573 (for things we were buying anyway–we always get our biggest check post-Christmas).

- They *AUTOMATICALLY REMIND YOU* when you’re on a site that offers cash-back (When you install the web browser app–which you SHOULD). One-click on that reminder and you’re set.

- At check-out, they automatically apply every *COUPON CODE* available so you DON’T MISS A DEAL–it often fides a coupon I didn’t know about that saves me money.

Sign-up bonus:

This affiliate link *GIVES YOU AN EXTRA CASHBACK* for your first quarterly check! Enjoy!

To Stay On Top of My Credit Report / Score:

CreditKarma.com – (Free) They break down your score into the five categories that make up your credit score (payment history, debt usage, credit age, account mix, and credit inquiries). Also, they’ll suggest a plan of attack to help you improve your score.

Check your CREDIT SCORE for FREE with Credit Karma

Taxes

I wrote about my favorite ways to file taxes online (for FREE). Including TaxSlayer.

Rate-Checking

Bankrate.com – This helps me stay on top of the current market rates for mortgages, savings, and money market accounts.

Blogging

Here are all my favorite blogging resources (including the course I took to learn about how to make money blogging).

Those are my favorite resources! I’ll update this page regularly so you can always stay up to date on my favorites tools for keeping your finances in shape. I only recommend my truly favorite products that I actually use, but FYI, some of these links are affiliate links. What does that mean? If you click on affiliate links and then purchase the product, I’ll receive some money to cover the costs of running Money Fit Moms. Thank you in advance for supporting the mission of MFM! – Lisa

Empower Personal Wealth, LLC (“EPW”) compensates Money Fit LLC for new leads. Money Fit LLC is not an investment client of Empower Advisory Group, LLC.