Use this CALCULATOR to figure out how much money you’ll receive from the 2020 Coronavirus Recovery Rebate. Find out WHEN and HOW the IRS will send money.

On March 30. 2020 The Treasury Department and the Internal Revenue Service announced that the distribution of economic impact payments will begin in the next three weeks and will be distributed automatically, with no action required for most people (more info below).

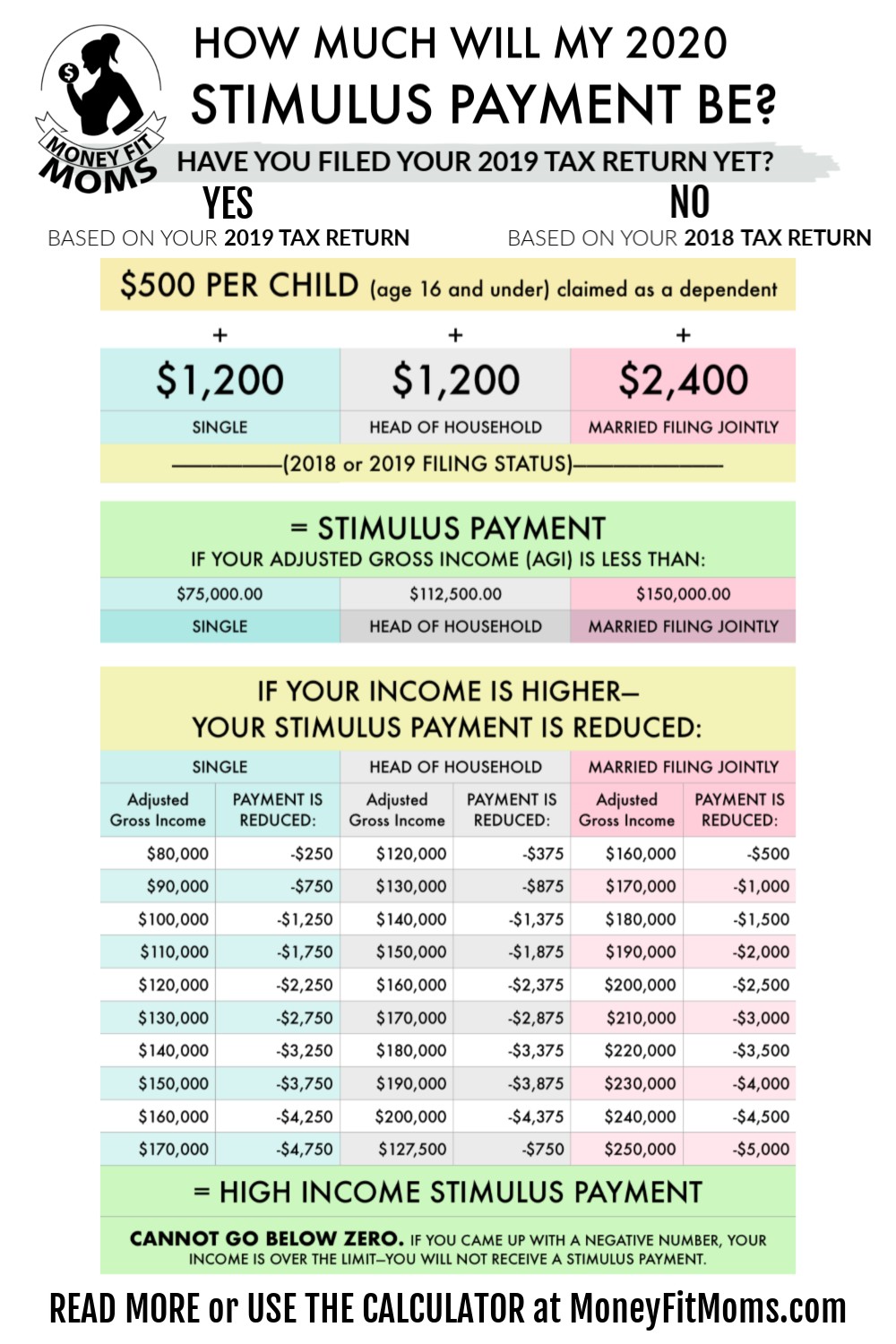

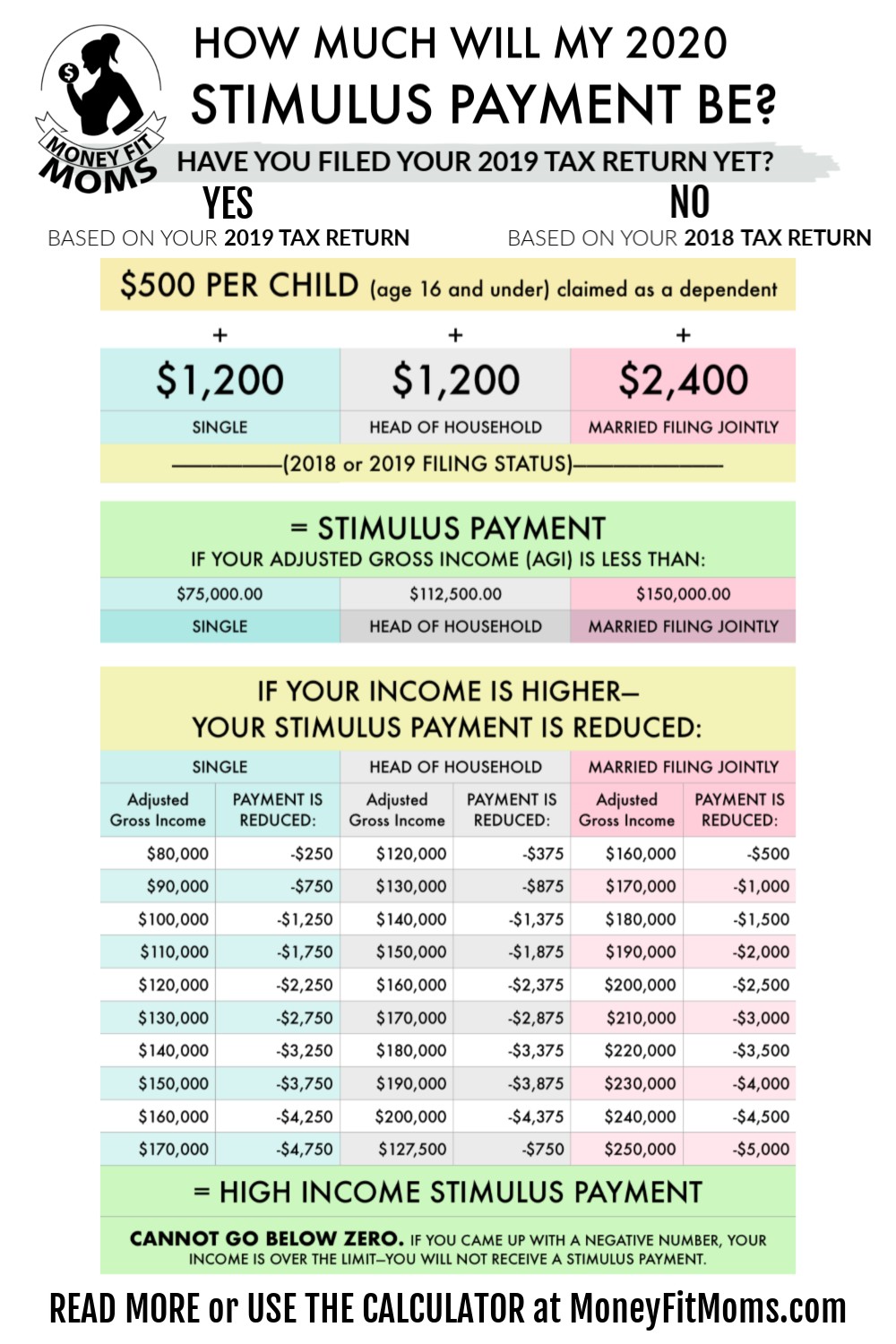

How Much Will My 2020 Coronavirus Recovery Rebate Amount Be?

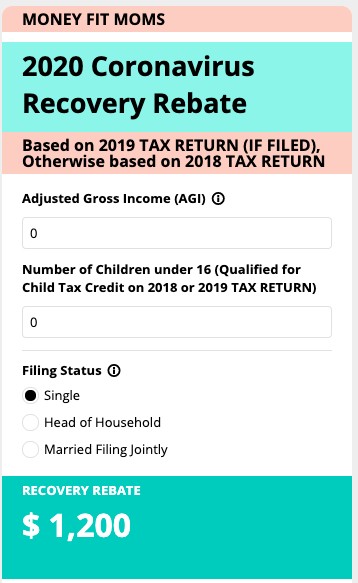

2020 RECOVERY REBATE CALCULATOR

How Many Payments Will I Receive?

Right now, only one payment has been passed through legislation. More relief payments could possibly come in the future, but nothing has been decided yet.

When Will I Receive My 2020 Coronavirus Recovery Rebate?

The IRS announced the money should be sent within three weeks.

However, it depends on how quickly the IRS can execute. In 2008, the stimulus checks took a couple of months to get out, but the current staff has an advantage: most taxpayers now have refunds directly deposited, which allows the government to distribute money more quickly (faster than printing and mailing checks). Although because of the coronavirus, they’re dealing with staff inefficiencies from working remotely (aren’t we all?).

How will the IRS know where to send my payment?

The vast majority of people do not need to take any action. The IRS will calculate and automatically send the economic impact payment to those eligible.

For people who have already filed their 2019 tax returns, the IRS will use this information to calculate the payment amount. For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The economic impact payment will be deposited directly into the same banking account reflected on the return filed.

The IRS does not have my direct deposit information. What can I do?

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online. This will allow individuals to receive payments immediately as opposed to checks in the mail. IRS.gov/coronavirus will soon provide information.

I am not typically required to file a tax return. Can I still receive my 2020 Recovery Rebate?

Yes. The IRS will use the information on the Form SSA-1099 or Form RRB-1099 to generate Economic Impact Payments to recipients of benefits reflected in the Form SSA-1099 or Form RRB-1099 who are not required to file a tax return and did not file a return for 2018 or 2019. This includes senior citizens, Social Security recipients and railroad retirees who are not otherwise required to file a tax return.

Since the IRS would not have information regarding any dependents for these people, each person would receive $1,200 per person, without the additional amount for any dependents at this time.

I have not filed my tax return for 2018 or 2019. Can I still receive an economic impact payment?

Yes. The IRS urges anyone with a tax filing obligation who has not yet filed a tax return for 2018 or 2019 to file as soon as they can to receive an economic impact payment. Taxpayers should include direct deposit banking information on the return.

I need to file a tax return. How long are the economic impact payments available?

These economic impact payments will be available throughout the rest of 2020.

Where can I get more information?

The IRS will post all key information on IRS.gov/coronavirus as soon as it becomes available.

The IRS has reduced staff in many of its offices but remains committed to helping eligible individuals receive their payments expeditiously. Check for updated information on IRS.gov/coronavirus rather than calling IRS assistors who are helping process 2019 returns.

Beware of scams involving the 2020 Recovery Rebate

Scammers are notorious for pretending the be the IRS. Scammer will call to ask for your social security number, direct deposit information, and other personal information. DO NOT GIVE THIS INFORMATION OVER THE PHONE to random people who call you, no matter who they say they are. The IRS has said that the portal will come through IRS.gov, so if that’s not the website you’re on, DO NOT PROVIDE YOUR BANK INFORMATION.

I’m a nerd and I want to read the Full Text of the CARES Act

You must also have spent years of your life reading the Internal Revenue Code. Knock yourself out. The full text of the CARES Act is here.

Have More Questions?

Lisa,

You are awesome. Thank you for sharing this information. It’s very helpful at this difficult time. You have so many talents. Thank you for sharing them to help us. Have a really great day!

Thanks so much, Karen! The feeling is mutual. <3