Let’s De-Mystify Your Credit Report and Save you Money

- Improve their credit score and

- Save them a LOT of money on interest (e.g. on your home mortgage)

Credit Score vs. Credit Report

What is the difference and why do they matter?

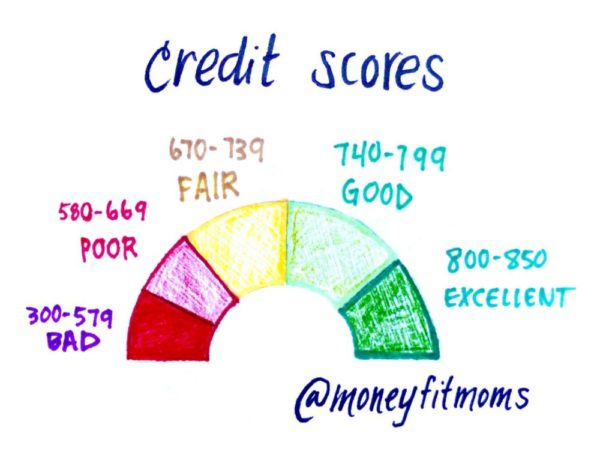

What is a credit score?

What is a credit report?

A detailed breakdown of your credit history, as reported by the three major credit bureaus (Experian, Transunion, and Equifax). Each of their reports may differ slightly, as not all lenders and required to provide all information to the credit bureaus. That being said, the credit reports are often relatively similar, with a listing of personal financial details such as:

- Current and previous addresses

- Bank and credit card accounts

- Outstanding credit balances

- Bill-paying habits

- Did you pay your bill each month?

- Did you pay ON TIME

- Potential negative information such as:

- Loan defaults

- Late payments

- Delinquencies (missed payments)

- Charge-offs (when a lender decides a debt is unlikely to be collected)

- Collections

- Hard inquiries (when a lender or landlord checks your credit–too many or too often will hurt your credit score)

Why it’s important to check your credit report at least once a year

- Dispute errors on your credit report–About 20% of consumers have an error on at least one of their credit reports (according to the FTC)–(More on how to dispute credit report errors below)

- Protect from identity theft and check for fraud

- Discover and pay off any unknown debts to remove that negative information

- Improve your credit score (by taking care of the previous three items)

How to Check Your Credit Reports for Free

- Get your credit reports from annualcreditreport.com.

Federal law allows you to have free access to your credit reports once every 12 months from each of the three major credit bureaus:

- Experian

- Transunion

- Equifax

There are a lot of places that will let you buy your credit report, but the official site to get your credit report for free is annualcreditreport.com as recommended by the FTC (Federal Trade Commission).

Because there are three different credit bureaus, each with slightly different reports, you have two options:

- Set one yearly calendar trigger to download all three credit reports from all three bureaus (e.g. every January 1st)

- Set three calendar triggers to download one of the bureau’s credit report once every four months

- (e.g. Check Experian every Jan 1st, Transunion every May 1st, and Equifax every September 1st)

Whether you check all three credit reports at once or spread them out will depend on:

- How concerned you are about your credit score (are you buying a house or another large loan soon)

- Your style and preference–I’ve found that checking all three credit reports at once has been enough for me to stay on top of my credit.

You might find a surprise debt–We did!

When pulling your credit report, you might find a previously forgotten debt. Paying that off can improve your credit score and save you money by allowing you to qualify for lower interest rates.

My husband and I pulled our credit report for the first time when we were both in graduate school. We were taking a personal finance class together and checking our credit report was part of the coursework. We both thought we were debt-free.

My husband incurred a medical bill when he was 19. My husband was on a volunteer assignment away from home and assumed his parents paid the medical bill. Because of a miscommunication, the bill was unpaid and went to collections. Years later, that debt was still sitting on my husband’s credit report and negatively affecting his credit score. Once we saw this item on our credit report, we were able to pay it.

We ended up buying a house a couple of years later. Had we waited until then to check our credit, we might’ve had a nasty surprise and a higher interest rate that would cost us more money in interest month after month.

How to Dispute an Error on Your Credit Report

The FTC found that one in five consumers has an error on at least one of their three credit reports (study here). If you’re one of those unlucky ones, here’s how to correct the error (source: Credit Karma):

If you think the error is due to the company that furnished the data aka “furnisher” (e.g. your bank, credit card company), then:

1. Start by contacting your bank, credit card company, etc. directly about correcting the error.

If you think the error is due to an identity-related mistake and/or you’ve already completed Step 1 (if needed), then:

2. Contact the credit bureau that included the error on their report to dispute:

| Equifax | TransUnion | Experian |

| File an online dispute | File an online dispute | File an online dispute |

3. Wait ~45 days for credit bureau(s) to respond to the dispute

-

- The credit bureaus have 30 days to respond and 5 days to communicate their results

4. Review bureau(s) investigation

-

- The bureau may require you to work out further details with the furnisher (credit card, bank) before updating your report.

5. Check for updates to your credit report(s). This may take time, depending on the bureau’s update cycle.

Questions?

Good luck–Let me know if you end up finding any surprises on your credit report!