Looking for a way to file taxes online for free? Here are the best options — plus some COUPONS (I am a Financial Coach, so I love saving money)! There are countless ways to file taxes online, so I polled my friends (many of which are tax accountants themselves) to get the scoop on the BEST options out there. 🙌

Do-It-Yourself: File taxes online

For More COMPLEX Returns (e.g. if you buy/sell stock and have many sales to report)

TurboTax

My friend Steve who works in Private Equity buys and sells stocks for his personal investments, so he loves how Turbo Tax can link to his bank and investment accounts and do most of the work for him. If you have a more complex return but still want to prepare it yourself, this may be a good option for you. It’s definitely pricier compared to more basic options (TaxSlayer), but still perhaps cheaper than having a professional prepare your return (options for professionals below)

Want the option of PAIRING with a PRO?

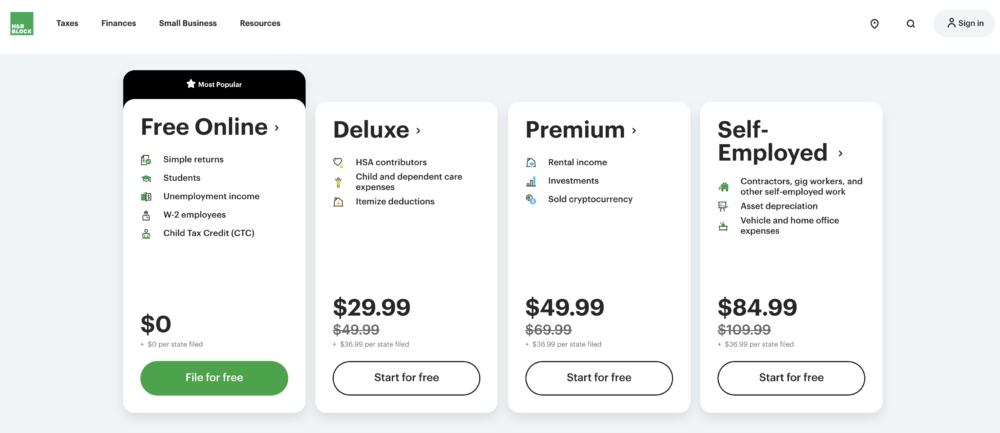

H&R BLOCK (20% OFF with this link)

A benefit of H&R Block is the variety of either Doing-It-Yourself or pairing with a professional.

For A BASIC Return with fewer tools (less expensive than Turbo Tax)

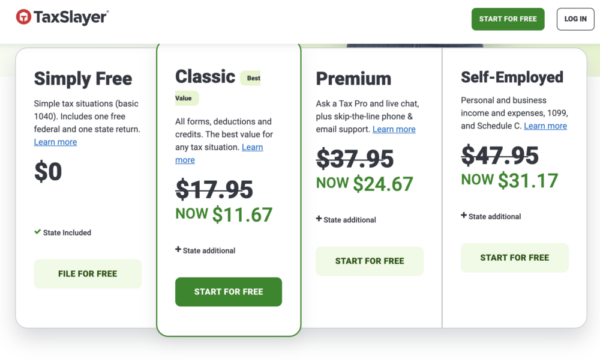

TaxSlayer (35% OFF with this link)

When I worked for a Big 4 Accounting firm, I got to work with my friend Nate, who is awesome — an accountant’s accountant. I put a lot of stock in his recommendations and he has used TaxSlayer for years. He said, “It’s super user-friendly for the basic return,” but cautions that it may not be dynamic enough for more serious issues (e.g. carryover losses). If you have a basic return and want to file taxes online for free, it’s great.

What’s unique about TaxSlayer?

Many services include a free FEDERAL return and charge you for the STATE return. For simple returns, TaxSlayer has a FREE FEDERAL return AND includes one FREE STATE return (any additional states have a relatively small fee compared to TurboTax).

Free Tax Prep for Lower-Income Individuals:

VITA

Next, if you’re lower-income (usually, earning ~$58,000 or less), you may qualify for free tax preparation through the Volunteer Income Tax Assistance (VITA) program. I volunteered for this organization while I was in college. It’s a great program where volunteers are trained to look for credits specific to those with lower income, such as the Earned Income Credit. Lookup a nearby VITA site here.

Want Your Return Prepared by a Local Tax Professional?

Lastly, do you have a complicated tax situation this year and feel like you’re in over your head? Are you looking to establish a relationship with a provider you can rely on for years to come? Use the IRS Website to find an authorized e-file provider near you. These providers range from small CPA groups (like my dad) to larger firms (with price tags to match). Or ask a friend in your area who they’d recommend.

That’s my breakdown of the best ways to file taxes online for free!

Let me know in the supportive @MoneyFitMoms Community! We’re on Instagram, TikTok, Facebook, YouTube, and Pinterest.

Get yearly reminders for filing taxes! 🙌

Getting yearly reminders about filing your taxes is part of the FREE Money Fit Challenge!